On March 27, 2025, US President Donald Trump announced a 25% tariff on all imported cars and auto parts, effective April 3. This new tariff aims to revitalize the US manufacturing industry, reduce the US budget deficit, and strengthen American jobs. While the move is positioned to boost domestic production, the global impact will be far-reaching, especially for automotive firms worldwide and key suppliers like India.

Key Features of the 25% Tariff Announcement

-

Effective Date: April 3, 2025

-

Tariff Rate: 25% on all imported cars and parts

-

Expected Revenue: $100 billion annually

-

Target Markets: The tariff will apply to all non-US-made cars, light trucks, and auto parts

-

Impact on Consumers: Higher car prices, fewer options, and potential job losses in the automotive sector

-

Manufacturing Shift: Aiming to push more car manufacturers to establish or expand production in the US

Trump’s assertion that the tariff will generate significant economic growth has sparked debates, with concerns about its long-term effects on both consumers and automakers. While US-based manufacturers may benefit from the policy, global suppliers and automakers will face higher production costs and market uncertainties.

The Immediate Global Impact of the Tariff

The global automotive industry, particularly countries like Mexico, Japan, South Korea, and the European Union, is heavily integrated with US vehicle manufacturing. The 25% tariff threatens to disrupt this integration by increasing costs for foreign automakers who rely on the US market for sales and parts.

Key Points on Global Trade Impact:

-

Rising Car Prices: Imported vehicles could see an average price increase of about $12,500. For American consumers, this means higher costs for both cars and auto parts.

-

Supply Chain Disruptions: US automakers rely heavily on auto parts sourced from Mexico, Canada, and Asia. The tariff could lead to delays and higher manufacturing costs.

-

Automakers’ Responses: Companies may either absorb the costs, pass them on to consumers, or reconsider their manufacturing strategies, potentially leading to long-term restructuring.

India’s Automotive Sector: Companies Facing the Brunt of the Tariff

Though India does not directly export large volumes of fully assembled vehicles to the US, several Indian companies will still feel the ramifications due to their roles as suppliers of auto components or their reliance on global supply chains.

Tata Motors: Indirect Impact Through Jaguar Land Rover (JLR)

-

JLR’s Exposure to the US: Tata Motors owns Jaguar Land Rover, which is a significant player in the US market. In FY24, the US accounted for 22% of JLR's global sales.

-

Manufacturing Base: JLR vehicles sold in the US are primarily manufactured in the UK and other international plants, which will now be subject to the newly imposed 25% tariff.

-

Impact on Pricing and Demand: As a result, the price of JLR vehicles in the US may increase, potentially affecting their sales volume and market share.

Eicher Motors: Royal Enfield Faces Challenges in the US

-

US as a Key Market for Royal Enfield: Eicher Motors, which manufactures the popular Royal Enfield motorcycles, heavily relies on the US market, especially for its 650cc models.

-

Impact on Pricing and Sales: The 25% tariff could raise the cost of these motorcycles, making them less competitive in a key market.

Samvardhana Motherson: Insulated but Not Unscathed

-

Diversified Manufacturing Footprint: Samvardhana Motherson, a leading Indian auto component supplier, has established production facilities in both the US and Europe. This gives the company some protection from the tariff’s direct impact.

-

Supplier to Major US Automakers: The company supplies parts to US automakers such as Tesla and Ford, meaning it will feel some effects, but the tariff will not be as devastating as for companies reliant solely on exports.

Sona Comstar: Expanding to Mitigate Risk

-

Revenue from the US and Europe: 66% of Sona Comstar’s revenue comes from the US and European markets.

-

Diversification Strategy: To mitigate risks posed by trade disruptions, Sona Comstar is expanding into China, Japan, and South Korea. These markets are expected to contribute over 50% of its revenue in the next five years, reducing its dependence on the US and Europe.

Other Affected Indian Auto Component Makers

-

Bharat Forge, Sansera Engineering Ltd, Suprajit Engineering, and Balkrishna Industries are key players in the Indian auto component sector with significant exposure to the US market.

-

These companies will feel the pressure of higher production costs and may need to rethink their pricing strategies or shift some of their focus to other regions.

India’s auto component exports were valued at $21.2 billion in FY24, contributing significantly to the global auto parts market. However, with the US being one of the largest importers of auto components, any disruption in US-India trade could have far-reaching consequences.

The Broader Industry Implications and Long-Term Uncertainty

While the Trump administration argues that the tariff will stimulate US manufacturing, industry experts are cautious about the potential economic repercussions.

-

Economic Growth vs. Consumer Costs: Economists like Mary Lovely of the Peterson Institute warn that these higher car prices could push many middle-class consumers out of the market. The result may be reduced sales of new cars and an increased reliance on older vehicles.

-

Supply Chain Overhaul: The shift in supply chains will take time, and in the short term, automakers may face increased costs, delays, and uncertainty. This could also lead to job losses before the benefits of the policy are felt.

-

Elon Musk, CEO of Tesla, pointed out that even US-based companies like Tesla will not escape the impact of the new tariffs, as they rely on global supply chains.

Market Reactions to the Tariff

-

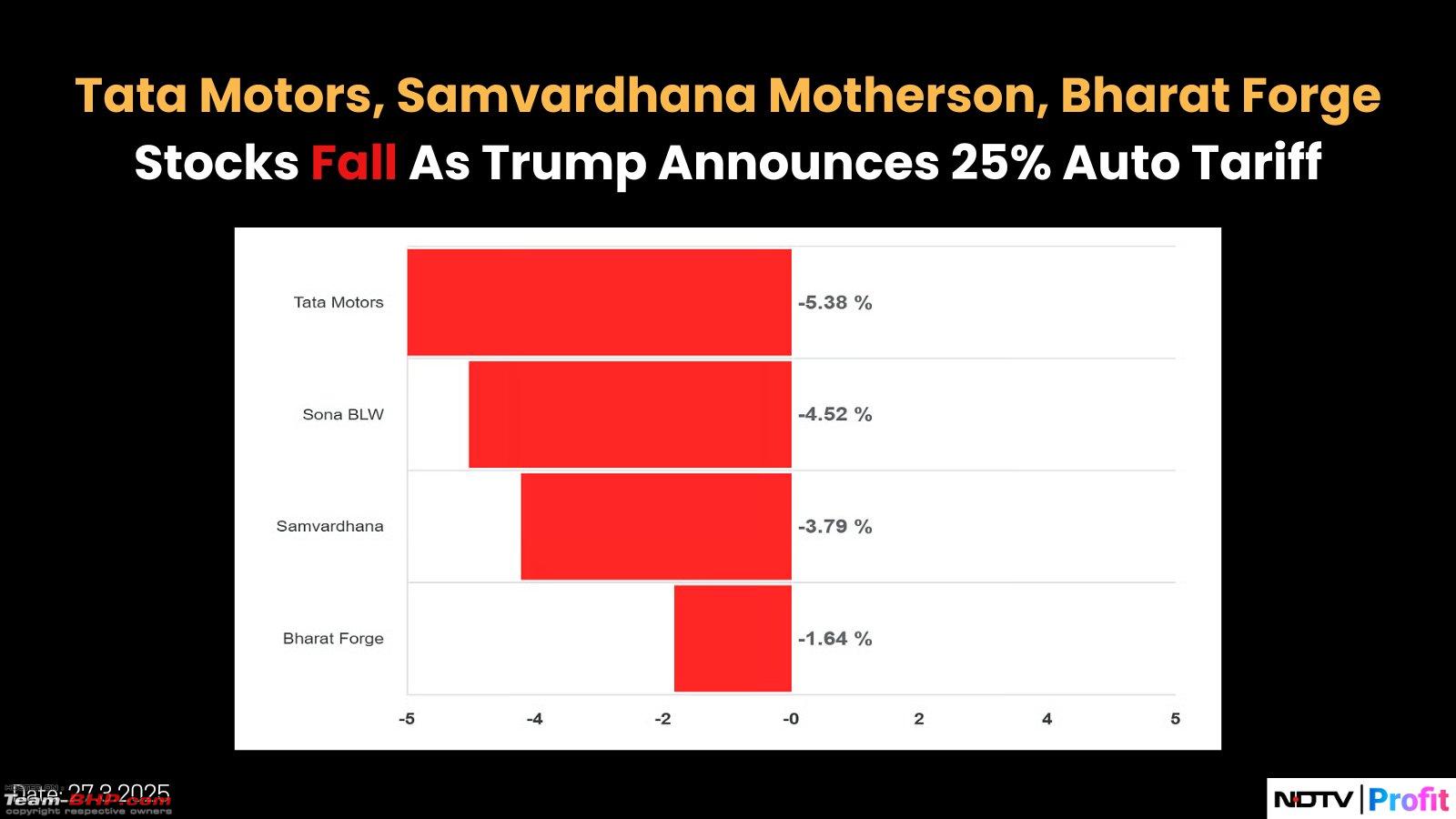

Automaker Stocks: Following Trump’s announcement, stock prices of major automakers were impacted:

-

General Motors (GM): Stock fell by nearly 3%.

-

Stellantis (owner of Jeep and Chrysler): Stock dropped by 3.6%.

-

Ford: Slight increase in stock value after the announcement.

-

Investors are wary of the long-term effects of the tariff, with concerns over profitability and potential disruptions in global supply chains.

Today, Trump introduced a 25% tariff on ALL vehicles not made in the United States. This tariff will go into effect on April 2nd. About 40% of all new cars sold in the US are imported, so this tariff is a big deal.

This is a breakdown of where cars sold in the US are made:

•… pic.twitter.com/4afYiJvtph— Sawyer Merritt (@SawyerMerritt) March 26, 2025

What’s Next for US-India Trade Relations?

The tariff announcement comes at a time when India and the US are engaged in discussions to finalize a bilateral trade agreement (BTA). The timing is critical, as India could face additional reciprocal tariffs on sectors like pharmaceuticals and agriculture.

The ongoing negotiations aim to reduce trade barriers and enhance supply chain collaboration between the two countries. India is seeking to reduce tariffs on certain US goods, hoping to secure better trade terms in return.

Potential Outcomes of the Trade Talks:

-

Bilateral Trade Agreement (BTA): Aimed at expanding trade between the two countries, targeting $500 billion in trade by 2030.

-

Tariff Adjustments: India may negotiate reductions in tariffs on US products like motorcycles and auto parts in return for favorable trade terms.

Global Backlash and Retaliation Risks

The tariff has drawn criticism from global leaders, particularly from Canada and the European Union (EU). Both have indicated that they will retaliate against US goods in response.

-

Canada: Canadian leaders have vowed to defend Canadian businesses against the new tariff.

-

EU: The EU has warned that the tariff could harm consumers and disrupt trade relations. The EU has already threatened a 50% tariff on US spirits as a countermeasure.

If these retaliatory measures escalate, they could lead to a broader trade war, with countries like the EU, China, and India imposing counter-tariffs on US products, further complicating global trade relations.

Trump’s Tax Deduction Plan for US-Made Cars

To offset the higher car prices, Trump has also proposed a new tax incentive plan, which would allow US buyers to deduct interest on auto loans from their federal income taxes. However, this deduction would only apply to vehicles manufactured in the US. This proposal aims to support US car buyers but may further disadvantage foreign-made vehicles.

A Major Shift for Global Automotive Trade

Trump’s 25% auto tariff is a significant move that will have widespread consequences, especially for countries like India, which play a crucial role in the global auto parts supply chain. While the tariff aims to bolster US manufacturing, it is likely to raise vehicle prices, reduce consumer choice, and disrupt existing supply chains. Indian companies, particularly those involved in auto parts manufacturing, will need to adapt quickly by diversifying their markets and reconsidering their production strategies.

As the global community reacts, and trade negotiations continue, the full impact of these tariffs will unfold in the coming years. India’s automotive sector must remain agile and strategic to navigate the challenges ahead and ensure continued growth in a changing global trade environment.

With inputs from agencies

Image Source: Multiple agencies

© Copyright 2025. All Rights Reserved Powered by Vygr Media.