India’s decision to impose a 30% import tariff on yellow peas from the United States has quietly emerged as a new flashpoint in already tense US-India trade relations. While the move initially escaped widespread media attention, it has now triggered political alarm in the United States, prompting two influential senators to urge President Donald Trump to personally intervene with Prime Minister Narendra Modi.

The tariff, which came into effect on November 1, 2025, is being widely interpreted as a calculated and silent response to the Trump administration’s earlier decision to impose steep duties on Indian goods. As trade negotiations between the two countries remain unresolved, pulses—or “dal,” as they are commonly known in India—have unexpectedly become a critical point of contention.

US Senators Flag ‘Unfair’ Indian Tariffs

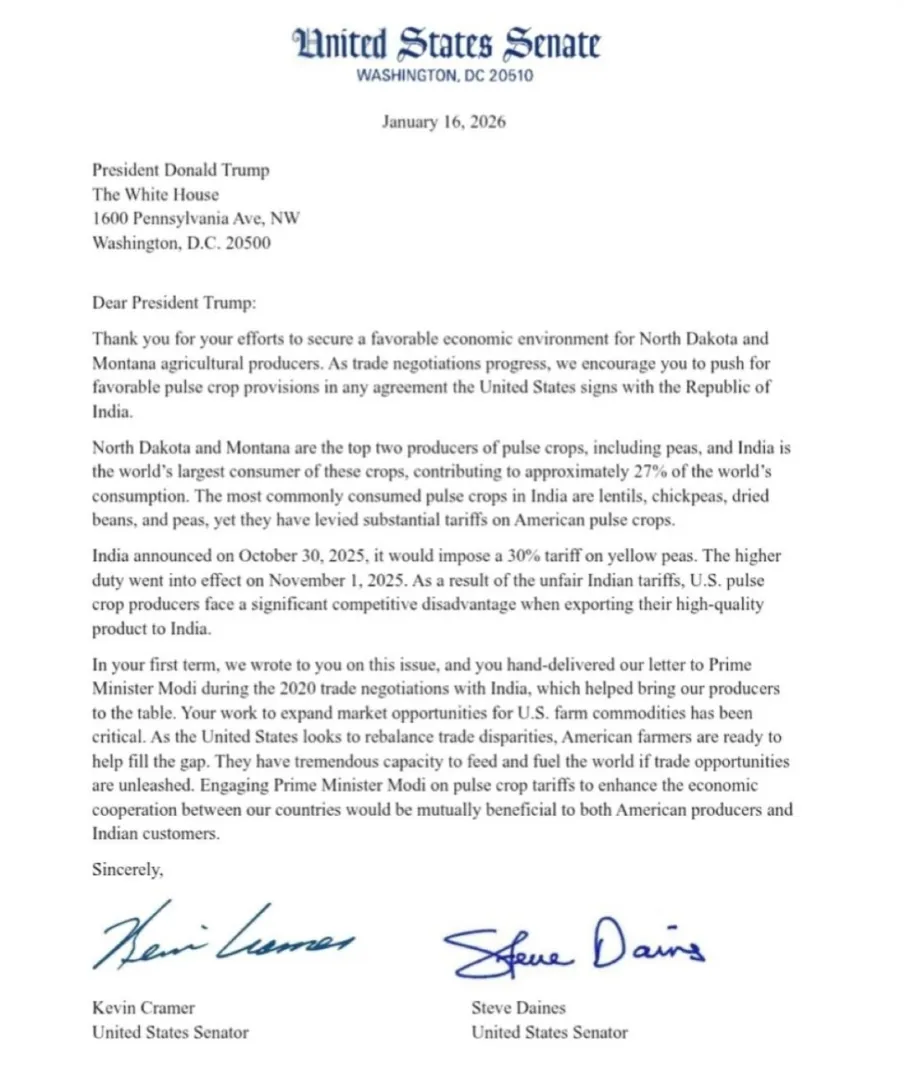

In a letter dated January 16, 2026, Senators Kevin Cramer of North Dakota and Steve Daines of Montana appealed directly to President Trump, urging him to secure better market access for American pulse farmers in any future trade agreement with India.

“India announced on October 30 that it will impose a 30% tariff on yellow peas imported from the US. The tariff went into effect on November 1,” the senators wrote. “As a result of the unfair Indian tariffs, US pulse crop producers face a significant competitive disadvantage when exporting their high-quality product to India.”

The senators specifically asked Trump to “push for favourable pulse crop provisions” in ongoing negotiations with New Delhi, warning that the tariff threatens the livelihoods of farmers in their states.

Why North Dakota and Montana Are Concerned

The issue carries particular weight for North Dakota and Montana, which are the top two producers of pulse crops in the United States. These states rely heavily on exports of lentils, peas, and other pulses, with India representing a key international market.

India, for its part, is the world’s largest consumer of pulses, accounting for more than 27% of global consumption. Lentils, chickpeas, dried beans, and peas form the backbone of the Indian diet, making access to the Indian market crucial for global exporters.

“The most commonly consumed pulse crops in India are lentils, chickpeas, dried beans and peas. Yet, they have levied substantial tariffs on American pulse crops,” the senators noted in their letter.

According to Cramer and Daines, the newly imposed 30% tariff has effectively erased any competitive advantage US farmers previously enjoyed in the Indian market.

A Quiet Retaliation to Trump’s 50% Tariffs?

Although the Indian government did not publicly frame the tariff as retaliation, analysts and policymakers increasingly view it as a direct response to the Trump administration’s aggressive trade measures earlier in 2025.

In August 2025, President Trump imposed a sweeping 50% tariff on Indian goods, citing India’s continued import of Russian oil as justification. New Delhi responded months later—without fanfare or public announcements—by raising tariffs on US yellow peas.

“That means India did retaliate to US tariffs by raising tariffs on imported pulses to 30%, which went into effect in October 2025,” geopolitical expert Navroop Singh wrote on social media. Another user summed it up succinctly: “We retaliated silently.”

The absence of official commentary or media coverage initially allowed the move to go largely unnoticed within India. However, the senators’ letter going viral has reignited domestic and international debate over India’s evolving trade strategy.

Relief in 2023, Reversal in 2025

The senators also pointed out that India had offered partial relief to US pulse exporters in 2023, temporarily easing market access. However, those gains have now been nullified by the new tariff structure.

“The recent Indian tariffs on US crops are hitting American farmers,” the lawmakers wrote, arguing that the current policy reverses progress made in earlier negotiations.

From Washington’s perspective, the situation highlights what lawmakers describe as a pattern of restrictive trade practices by India—particularly in the agricultural sector.

A Familiar Dispute From Trump’s First Term

Notably, this is not the first time the issue of pulse tariffs has strained US-India relations. Cramer and Daines reminded President Trump that they raised similar concerns during his first term in office.

Following India’s removal from the Generalised System of Preferences (GSP) in June 2019, US farmers faced higher barriers to the Indian market. The senators wrote to Trump at the time, calling India’s pulse tariffs “unfair.”

During the 2020 trade negotiations, Trump reportedly “hand-delivered” their letter to Prime Minister Modi. That period also saw Trump’s high-profile visit to India, including his participation in the “Namaste Trump” event in Ahmedabad—an event symbolising the personal rapport between the two leaders.

“It helped bring our producers to the negotiating table,” the senators recalled in their latest letter, underscoring their belief in Trump’s ability to intervene directly.

Trade Deal Still in Limbo

Despite strong diplomatic ties, the broader US-India trade agreement remains unresolved. While bilateral trade between the two nations grew by 22% year-on-year in November 2025, both sides continue to hold firm on key issues.

One of the most significant sticking points is agriculture. The Trump administration has consistently sought wider access to India’s agricultural and dairy markets—an area New Delhi considers politically and economically sensitive.

“Indian farmers are a red line,” an expert noted. “If a trade deal demands opening India’s pulse market at the cost of domestic producers, there will be no trade deal.”

India’s domestic realities make concessions in agriculture particularly challenging, especially given the political influence of farmers and the country’s long-standing emphasis on food security.

India’s Strategic Signals Beyond Tariffs

The pulse tariff is not the only move suggesting a firmer Indian stance. Recently, reports indicated that India reduced its holdings of US Treasury bonds by over $50.7 billion—a significant departure from its trend of increasing investments in recent years.

While not officially linked to trade disputes, the timing of the move has fueled speculation that India is diversifying its financial exposure amid growing geopolitical and economic uncertainty.

Taken together, these actions reflect what many observers see as India’s effort to assert strategic autonomy while navigating an increasingly transactional global trade environment.

Election Politics and Pulse Policy

India’s approach to pulse imports has also been shaped by domestic political considerations. Ahead of the 2024 Lok Sabha elections, New Delhi temporarily removed import duties on certain pulse varieties to curb food inflation, according to Bloomberg.

That flexibility, however, appears absent in dealings with Washington. As one analyst put it, Trump “lost the privilege to negotiate with India and was caught napping,” suggesting that New Delhi is now less willing to make unilateral concessions.

What Lies Ahead?

As trade talks drag on, pulses may emerge as an unlikely but potent bargaining chip in US-India relations. For American farmers in North Dakota and Montana, access to the Indian market remains critical. For India, protecting domestic producers and responding proportionately to external pressure remains a priority.

The senators’ appeal to President Trump signals rising political pressure in the US to address the issue. Whether Trump chooses to directly engage Prime Minister Modi once again—as he did in 2020—could determine whether this quiet tariff dispute escalates into a larger trade confrontation.

For now, India’s 30% tariff on US pulses stands as a subtle but firm assertion of its willingness to push back—quietly, strategically, and on its own terms.

With inputs from agencies

Image Source: Multiple agencies

© Copyright 2025. All Rights Reserved. Powered by Vygr Media.