Argentine President Javier Milei has found himself at the center of a growing controversy following his endorsement of the lesser-known cryptocurrency, $LIBRA, which resulted in significant financial losses for investors. The cryptocurrency’s rapid rise and subsequent crash have raised questions about Milei’s involvement and the potential legal ramifications for his actions.

What Is $LIBRA?

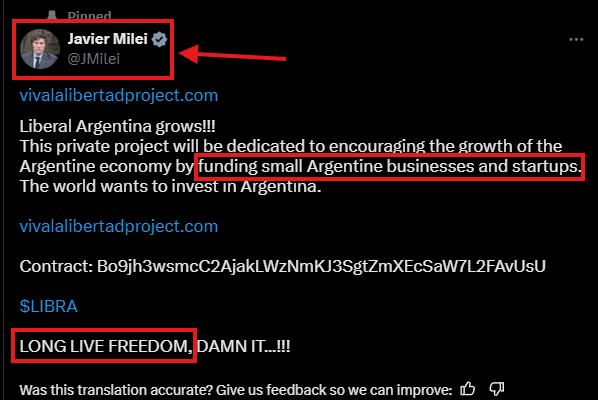

$LIBRA is a cryptocurrency developed by KIP Protocol and Hayden Davis. It was promoted as a digital asset designed to bolster Argentina's economy by supporting small businesses and startups. The coin could be accessed through a website, vivalalibertadproject.com, which referenced Milei’s well-known slogan "Viva la Libertad."

Key Features of $LIBRA:

-

Developers: KIP Protocol and Hayden Davis.

-

Website: vivalalibertadproject.com, linked to Milei’s political messaging.

-

Purpose: To stimulate economic growth and support small businesses in Argentina.

How it all started?

The controversy began when President Milei posted a tweet on his official X (formerly Twitter) account, which has 3.8 million followers, promoting $LIBRA. In his tweet, he described the cryptocurrency as a private initiative aimed at improving Argentina's economy. The post, which included a Solana contract address linked to the Libra token, generated significant attention, causing the value of the coin to skyrocket.

However, a community note quickly appeared beneath the tweet, warning users to exercise caution and suggesting that the project might be a scam. Despite this, the price of $LIBRA rose rapidly from nearly zero to a peak of $5 per token.

The Sudden Collapse of $LIBRA

In an unprecedented turn of events, the value of $LIBRA plummeted within hours. After Milei’s endorsement, insiders began cashing out, leading to a massive sell-off. Within just three hours of launch, the cryptocurrency’s market cap saw a staggering $4.4 billion wiped out.

-

Peak Market Cap: $4.5 billion.

-

Price Surge: $LIBRA spiked to $5 per token.

-

Market Collapse: Over $4.4 billion in market value vanished within hours.

Analysts' Findings:

-

The $LIBRA website was registered only hours before the coin’s launch, raising suspicions about its legitimacy.

-

82% of the coin's supply was held in a single cluster, and no details about the coin’s tokenomics were shared with the public.

-

$87.4 million was cashed out by insiders within the first three hours of the coin’s launch.

The swift implosion not only caused significant losses for retail investors but also sparked a political firestorm.

The Legal and Political Fallout

Following the disastrous collapse of $LIBRA, the incident prompted legal action and political repercussions.

Fraud Allegations and Lawsuits

In the wake of the $LIBRA debacle, Argentine lawyers filed criminal fraud charges against President Milei. The lawsuit accuses him of participating in an “illicit association to commit fraud” by endorsing the cryptocurrency. According to the plaintiffs, Milei's actions were essential to the fraud, and the promotion of $LIBRA constituted a classic "rug pull" — a term used when cryptocurrency projects abandon their investors after attracting capital.

-

Charges Filed: Criminal fraud and violation of Argentina’s Public Ethics Law.

-

Plaintiffs: Lawyer Jonatan Baldiviezo, along with Marcos Zelaya, economist Claudio Lozano, and engineer María Eva Koutsovitis.

-

Fraudulent Activity: Insiders reportedly cashed out tens of millions of dollars in the first few hours.

Milei's administration, however, denied any wrongdoing, with officials claiming that the president was unaware of the project’s details when he made the post. They also emphasized that Milei had no direct involvement in the cryptocurrency’s development.

Presidential Response

Milei’s office released a statement distancing him from the coin’s collapse, stating that he had shared the post as part of his usual practice of supporting entrepreneurial projects. After receiving backlash and further information about the project, Milei deleted the tweet and expressed regret over his endorsement.

-

Statement from Milei: "I was not aware of the details of the project, and after becoming aware of it, I decided not to continue spreading the word."

-

Investigation: The Argentine government has launched an investigation, involving the Anti-Corruption Office (OA) and creating an Investigation Task Unit (UTI) to probe the incident further.

Political Fallout and Impeachment Calls

The political fallout from the $LIBRA scandal has been significant. Opposition parties, particularly the Union for the Homeland coalition, have called for Milei’s impeachment, accusing him of abusing his position to promote a potentially fraudulent scheme. While some of Milei’s allies have dismissed these calls, the situation remains a point of contention in Argentina’s political landscape.

-

Impeachment Calls: The opposition plans to request Milei’s impeachment.

-

Government Response: Milei’s allies argue that the impeachment efforts are politically motivated.

The Bigger Picture: Meme Coins and Cryptocurrency Risks

The $LIBRA incident highlights the inherent risks associated with meme coins and the volatile nature of cryptocurrency markets. Meme coins are often driven by internet trends and cultural phenomena rather than any fundamental value, making them susceptible to wild price swings. The case also underscores the ethical and legal implications of political figures endorsing such assets, especially when there are potential financial losses for unsuspecting investors.

Key Points on Meme Coins:

-

High Volatility: Meme coins can see massive price changes within short periods.

-

Speculative Investments: Often fueled by hype, social media influence, and public figures.

-

Investor Risk: Retail investors are particularly vulnerable to losses in meme coin markets.

President Milei’s promotion of $LIBRA places him in the company of other global leaders like Donald Trump, who have also ventured into the realm of meme coin endorsements, raising concerns over the ethical implications of such endorsements by public figures.

The $LIBRA incident has placed President Javier Milei in a precarious position, both legally and politically. While he has distanced himself from the cryptocurrency and expressed regret over his endorsement, the ongoing investigation and calls for impeachment suggest that this controversy is far from over. The saga serves as a stark reminder of the risks associated with meme coins and the influence of public figures on cryptocurrency markets. It also raises critical questions about transparency, regulation, and accountability in the rapidly evolving world of digital assets.

With inputs from agencies

Image Source: Multiple agencies

© Copyright 2024. All Rights Reserved Powered by Vygr Media.