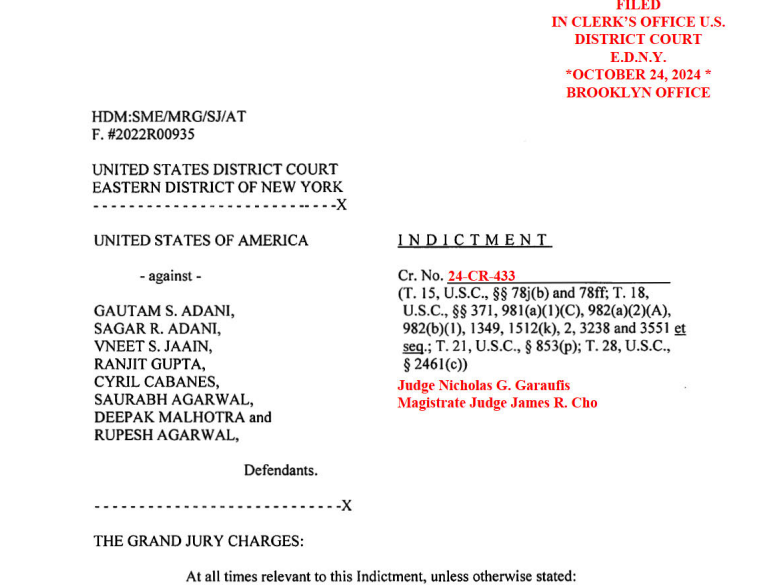

The indictment of Gautam Adani in the United States marks a pivotal moment in global business ethics, with allegations of fraud, bribery, and conspiracy casting a shadow over one of India's most prominent conglomerates. Filed in a Brooklyn federal court, the charges accuse Adani, alongside his nephew Sagar Adani, of orchestrating a $265 million bribery scheme to secure energy contracts in India while misleading American investors about the project's integrity. These accusations, which violate U.S. securities laws, bring renewed scrutiny to the Adani Group’s corporate governance.

Key Allegations and Legal Developments

The indictment alleges systemic corruption in securing state energy contracts in India, undermining the credibility of the Adani Group’s anti-bribery compliance claims. This development comes on the heels of prior allegations, including stock manipulation charges from Hindenburg Research. Legal proceedings in the U.S. now pose a significant challenge to the conglomerate's reputation and operations.

Divisive Social Media Discourse

Social Media Reactions: A Nation Divided

The indictment has ignited intense discussions on social media platforms, particularly under the hashtag #Adani. Opinions remain polarised:

-

Critics argue that this is a wake-up call for India to confront systemic corruption.

-

Supporters view Adani as a victim of international conspiracies against Indian enterprises.

Additional highlights from social media:

-

Meme Commentary:

A meme widely shared contrasts public reactions to fraud cases involving various businessmen, showing perceived biases and hypocrisy in responses to Gautam Adani's indictment.

Adani's plan right now 😎✌ #Adani pic.twitter.com/yLZ2iq4Qes— Veena Jain (@DrJain21) November 21, 2024

-

Media Criticism:

A tweet by Roshan Rai, an X user,criticises ANI for allegedly skipping coverage of the indictment, posting Adani's clarifications instead. The claim sparked debates about media impartiality.

-

Political Spin:

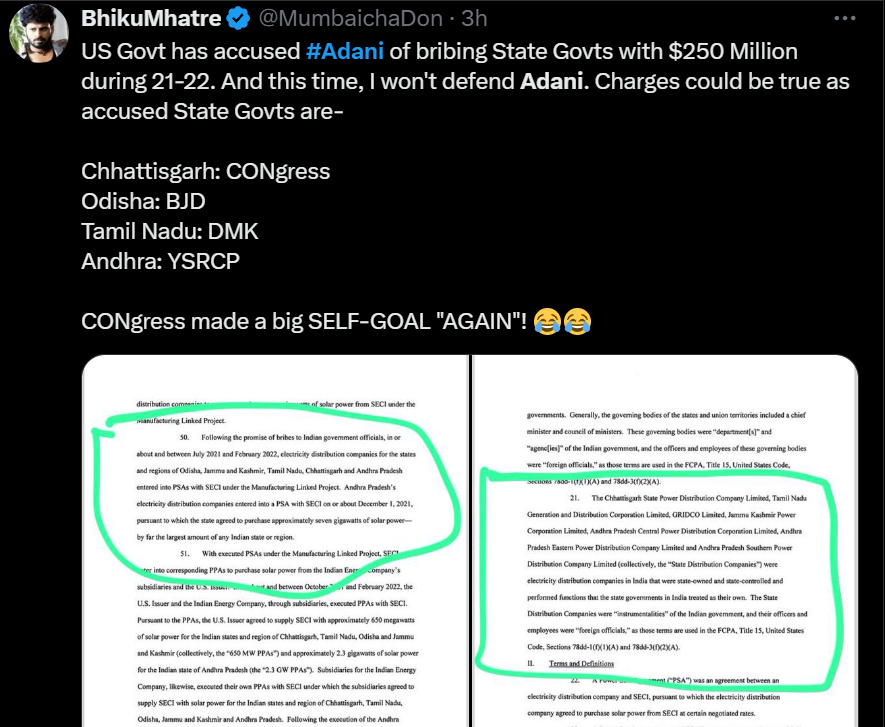

-Bhiku Mhatre, another X user, referenced details from the indictment, noting potential links to state governments run by Congress, BJD, DMK, and YSRCP. The post implied that opposition states might bear responsibility for Adani's dealings.

-

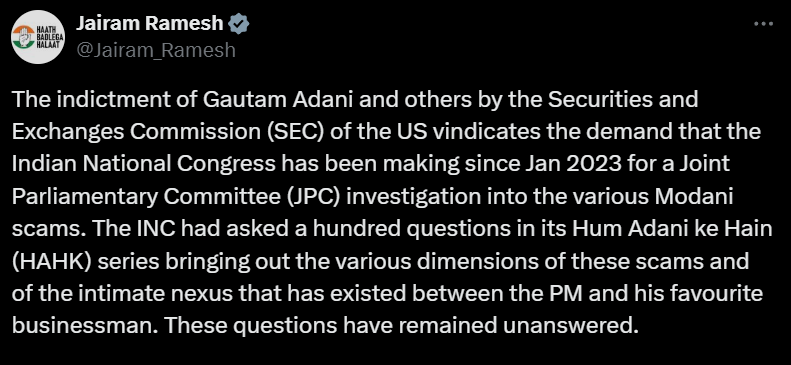

-Jairam Ramesh questioned India's regulatory frameworks in light of the allegations.

-

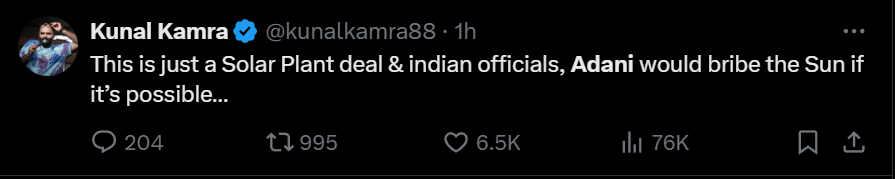

Humorous Takes:

Comedian Kunal Kamra joked, "This is just a Solar Plant deal & Indian officials; Adani would bribe the Sun if it’s possible."

-

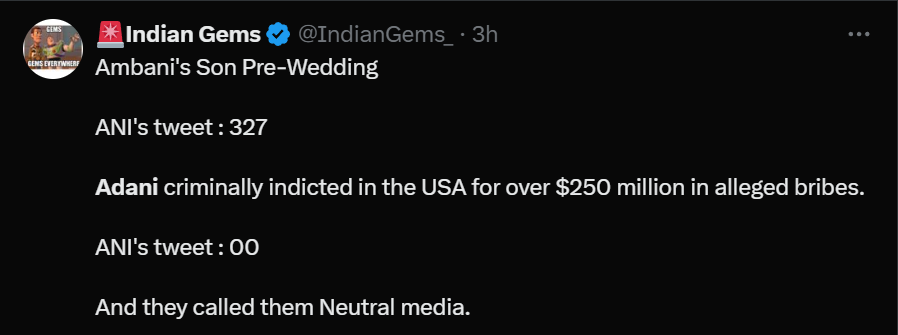

Comparison with Prior Coverage:

Another user, Indian Gems, pointed out a discrepancy between ANI's extensive coverage of Ambani family events and their silence on Adani's U.S. indictment, questioning media neutrality.

Public Sentiment and Broader Implications

Public reactions reveal a stark divide between outrage over alleged corruption and support for Adani's contributions to India's economic development. The case underscores the broader issue of systemic corruption in India, often rationalised through the cultural concept of "jugaad"—a term embodying resourcefulness that can, at times, blur ethical boundaries.

Impact on India’s Renewable Energy Policies

The allegations threaten to reshape India’s renewable energy landscape in significant ways:

1. Enhanced Scrutiny: Indian authorities may enforce stricter compliance and transparency measures for renewable energy projects.

2. Public-private partnerships: The government could reassess collaborations with private firms to ensure public interests are safeguarded.

3. Policy Reforms: Ethical guidelines and stronger whistleblower protections may emerge as part of regulatory overhauls.

For more on this read: Adani Group Pledges ₹4.05 Trillion for Green Energy at RE-Invest 2024

Consequences for Adani's Investors

The financial repercussions are already severe.

Market Impact: Adani Group stocks have plunged, eroding approximately ₹2.6 lakh crore ($30 billion) in market valuation.

Investor Confidence: Trust in the conglomerate has been shaken, complicating future fundraising efforts.

Legal Challenges: Potential penalties and sanctions may further jeopardise the group’s financial health.

For more on this read: TotalEnergies Partners with Adani Green in $444 Million Renewable Energy Joint Venture

A Call for Systemic Change

The indictment of Gautam Adani is more than a legal battle; it is a moment for introspection on systemic corruption and governance in India. Moving forward, India must address these challenges through comprehensive reforms that prioritise transparency, accountability, and ethical practices. Achieving sustainable growth requires building a foundation of trust and integrity, ensuring that economic progress is not compromised by corruption or expediency.

Inputs by Agencies

Image Source: Multiple Agencies

Ⓒ Copyright 2024. All Rights Reserved Powered by Vygr Media.