The Adani-Hindenburg saga has been a gripping financial drama that has unfolded over the past couple of years. From explosive allegations to regulatory investigations, here's a concise overview of the key events and recent updates. With recent response to SEBI's show cause notice, and naming of Kotak Bank, the market and the people have been on their toes.

The Genesis of the Adani-Hindenburg Saga

The Adani Group, one of India's largest conglomerates, has been a dominant player in sectors ranging from energy to infrastructure. Hindenburg Research, known for its investigative reports on financial malpractices, turned its focus on Adani, setting the stage for a dramatic series of events.

For more on this, click : Gautam Adani's Ranking Drops Significantly From 3rd To 38th In The Rich List

Hindenburg Research's Allegations

In January 2023, Hindenburg Research released a bombshell report accusing the Adani Group of extensive stock manipulation and accounting fraud, amounting to ₹17.8 trillion (US$218 billion). The report detailed a series of complex financial manoeuvres designed to inflate the company’s stock prices and obscure true financial conditions.

For more on this, click : Debt-Fuelled Growth: The Adani-Hindenburg Saga

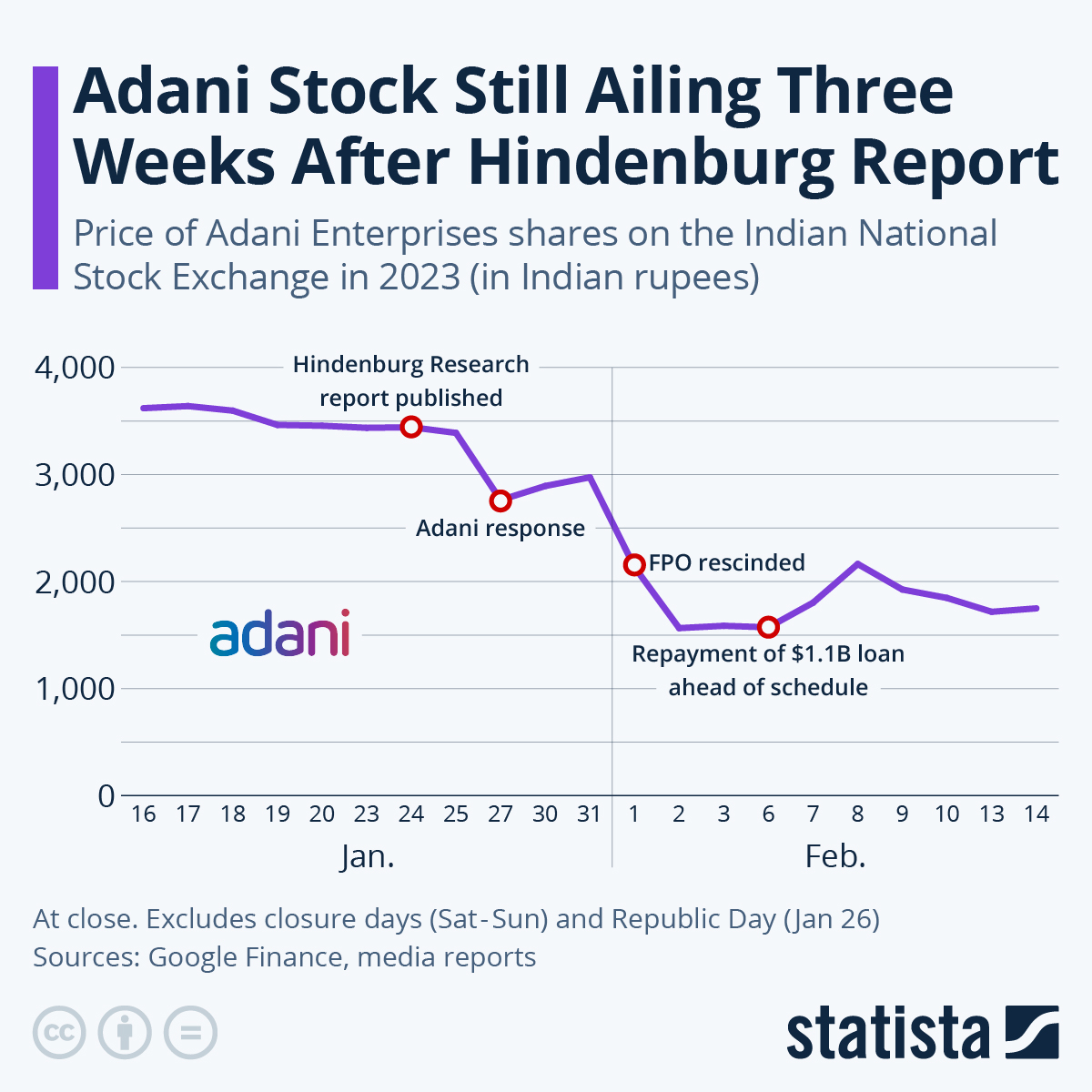

Impact on Adani Group Stocks

The immediate aftermath of the Hindenburg report saw Adani Group stocks plummet, erasing ₹1 lakh crore in market value almost overnight. This dramatic fall shook investor confidence and led to significant financial scrutiny of the group’s practices.

For more on this, click: Burning Billions: The Adani Story

Adani Group's Response

The Adani Group swiftly responded to the allegations, categorically denying any wrongdoing. The company issued multiple statements asserting that the Hindenburg report was a deliberate attempt to undermine the group’s credibility and market position. Legal actions against Hindenburg were also considered, as Adani sought to reassure investors and stakeholders.

For more on this, click: Adani Rs 20,000 Crore FPO Sails Through Despite Hindenburg

Regulatory Responses

The Securities and Exchange Board of India (SEBI) initially reacted by launching an investigation into the allegations. This was followed by the formation of several investigative committees to delve deeper into the claims made by Hindenburg and the counterclaims by Adani.

Financial Fallout

The financial repercussions of the allegations were severe. Beyond the immediate loss in market value, the long-term effects included shaken investor confidence and increased volatility in Adani Group stocks. Many investors, both domestic and international, began reassessing their positions in the group.

Cancellation of FPOs and Project Halts

In February 2023, Adani Enterprises decided to cancel its ₹20,000 crore follow-on public offer (FPO), citing market volatility as the primary reason. Additionally, the group suspended work on the ₹34,900 crore Mundra Petchem project and abandoned the ₹7,017 crore DB Power acquisition. These moves were seen as a direct consequence of the financial turmoil caused by the Hindenburg report.

GQG Partners' Investment

March 2023 brought a semblance of relief for Adani Group when GQG Partners, a global equity investment firm, injected ₹15,446 crore into four Adani Group companies. This investment was a significant vote of confidence and played a crucial role in stabilising the group’s market position amidst ongoing controversies.

For more on this, click: Adani Group Stocks Rally As US-Based GQG Partners Inject $1.8 Billion

Supreme Court's Involvement

The Supreme Court of India stepped in by forming a committee to investigate potential regulatory failures that might have allowed the alleged malpractices to occur. By May 2023, the committee reported no substantial evidence of the Adani Group violating market regulations, providing a breather for the conglomerate.

For more on this, click: Supreme Court Denies SEBI's Request For A Six-Month Extension To Complete Adani-Hindenburg Probe

Adani Group's Recovery Efforts

In response to the financial crisis, the Adani Group made substantial efforts to recover. This included full prepayment of margin-linked share-backed financing, strategic adjustments in capital expenditure plans, and successful fundraising efforts. These actions were aimed at restoring investor confidence and stabilising the group's financial health.

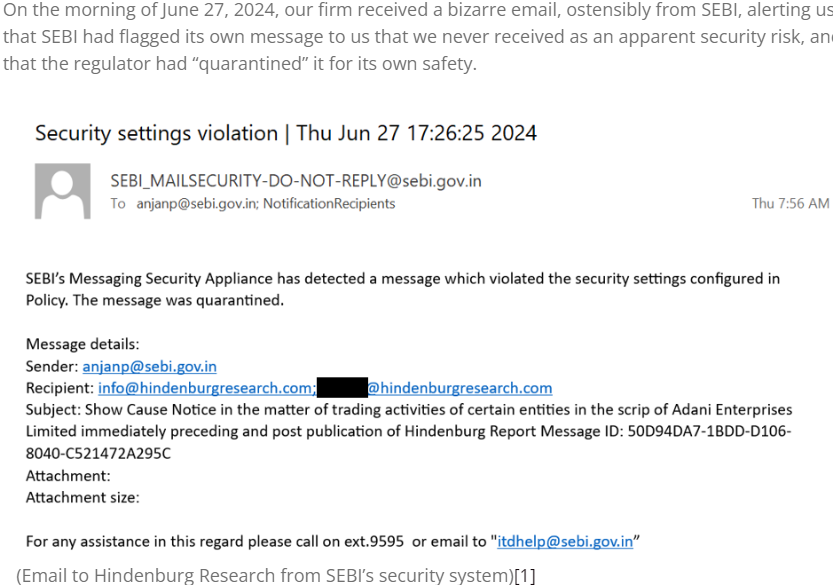

SEBI's Show Cause Notice to Hindenburg

In June 2024, SEBI issued a "show cause" notice to Hindenburg, alleging violations of Indian regulations in the context of the Adani case. This move marked a significant development, indicating SEBI’s proactive stance in addressing the issues raised by Hindenburg’s report.

Hindenburg's Counter-Allegations

In response to SEBI's notice, Hindenburg Research accused the regulatory body of aiding Adani in postponing their 2023 report. Hindenburg claimed that SEBI pressured brokers to close short positions in Adani stocks, thereby artificially influencing stock prices. These allegations have added another layer of complexity to the ongoing saga.

Kotak Bank's Alleged Role

Hindenburg's counterclaims also brought Kotak Bank into the spotlight.

Allegedly, Kotak Bank was involved in overseeing the offshore fund structure used by Hindenburg's investor partner to bet against Adani. The SEBI investigation revealed that Hindenburg colluded with Mark Kingdon and his entities, using a fund set up by Kotak Mahindra Bank to short-sell Adani Enterprises. The scheme involved sharing a draft report with Kingdon, who then set up a trading account, allowing them to build short positions in Adani Enterprise Futures.

SEBI's show cause notice highlighted the intricate details of this operation, including the legal agreements and profit-sharing arrangements. This scheme led to significant short-selling activity just before the Hindenburg report's release, resulting in substantial profits for Kingdon and Hindenburg.

After the release of the Hinderburg response on SEBI , Kotak stocks have tanked after Yash Kotak was cited in the latest report.

Ongoing Investigations

The ongoing investigations by various regulatory bodies continue to scrutinise the actions of both Adani Group and Hindenburg Research. The outcomes of these investigations are anticipated with great interest, as they will significantly impact the future operations and reputation of the Adani Group.

Media coverage and public perception

The media has played a critical role in the Adani-Hindenburg saga, providing extensive coverage of the unfolding events. Public perception has been divided, with some viewing the allegations as a major corporate scandal and others perceiving them as an attack on one of India’s leading business groups. The narrative continues to evolve as new developments emerge.

Lessons from the Saga

Investors and regulatory bodies can draw several lessons from the Adani-Hindenburg saga.

Key takeaways include:

- importance of robust regulatory frameworks

- the need for transparency in corporate practices

- critical role of investor vigilance in safeguarding financial markets.

Comparisons with Other Financial Scandals

The Adani-Hindenburg controversy can be compared to other significant financial scandals, such as the Enron collapse and the Lehman Brothers' downfall. These comparisons highlight recurring themes of corporate malfeasance, regulatory oversights, and the catastrophic impact on investors and the market.

Future Projections

Looking ahead, the Adani Group's future will likely be shaped by the outcomes of the ongoing investigations and their ability to regain and maintain investor confidence. The group’s strategic adjustments and transparency measures will be crucial in navigating the post-controversy landscape.

Conclusion

The Adani-Hindenburg saga continues to captivate investors, regulators, and the public. As investigations unfold, the group's recovery efforts and SEBI's actions remain under scrutiny. This high-stakes financial drama underscores the importance of regulatory oversight, corporate transparency, and investor vigilance. Stay tuned for further updates as this evolving story progresses.

With inputs from agencies

Image Source: Multiple agencies

© Copyright 2024. All Rights Reserved Powered by Vygr Media.