Recently, the Adani Group has clarified that neither its chairman Gautam Adani nor his nephew Sagar Adani has been charged for violating the United States Foreign Corrupt Practices Act. This clarification is in light of a recent indictment by the U.S. authorities which raised questions over their involvement in a bribery case.

Overview of the Allegations

The U.S. Justice Department has indicted Gautam Adani, Sagar Adani and another executive, Vneet Jaain in for allegedly engaging in a plot to bribe officials at Indian state-owned firms. This has reportedly involved an offer to shell out $265 million into hands of officials to lock these contracts to supply solar power electricity that could earn up to a profit of $2 billion through the next two decades.

clarification from Adani Green Energy.

In a filing with the stock exchange, Adani Green Energy Limited stated that reports that the three individuals were charged with FCPA violations are incorrect. Instead, they are charged with securities fraud and wire fraud. The counts against them include:

- Securities Fraud Conspiracy

- Wire Fraud Conspiracy

- Securities Fraud

This is clear from the filing, that there are no charges related to FCPA violations or direct bribery allegations against Gautam Adani and Sagar Adani.

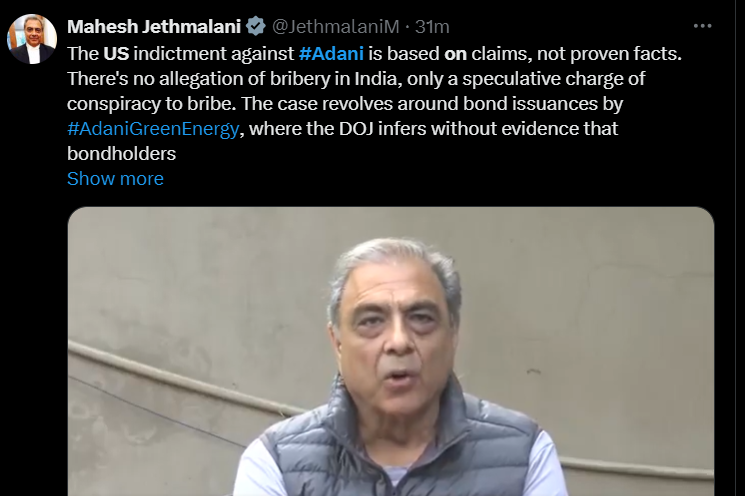

No bribery allegations in India, says Mahesh Jethmalani.

Legal Background and Response

The indictment was filed with the United States District Court for the Eastern District of New York. The Adani Group denies the allegations and has announced its intention to exercise all options that are available under law to defend itself. They stated that the indictment does not specify any fines or penalties at stake.

In addition, the civil complaint filed with this case alleges violations of parts of the Securities Act of 1933 and 1934 but does not state any amounts of civil monetary penalties against the defendants.

Effect on the Adani Group

Since the news broke on these allegations, the Adani Group has lost about $55 billion in market capitalization from its listed companies. The group reacted to the media reports over what they say is a "flawed understanding" of the indictment and assured to take up the allegations aggressively.

This is an example of the intricacies of international business operations and legal frameworks. While there are serious allegations, one must distinguish between charges under the FCPA regarding bribery and other financial misconduct allegations. The outcome of this case could have a more far-reaching impact on corporate governance and regulatory scrutiny in India and elsewhere.

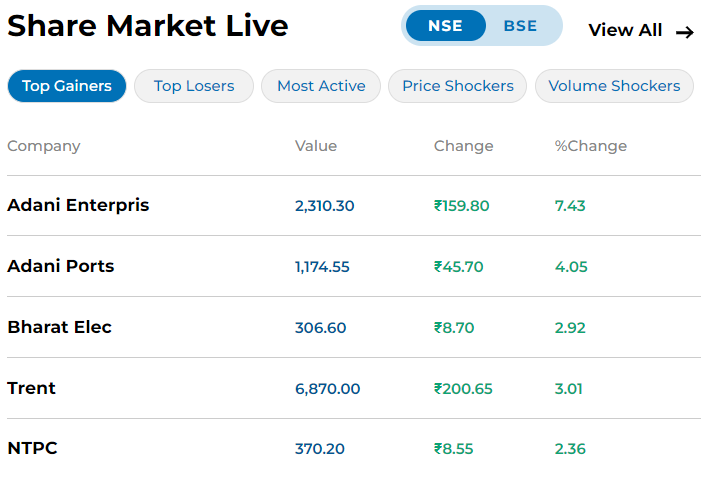

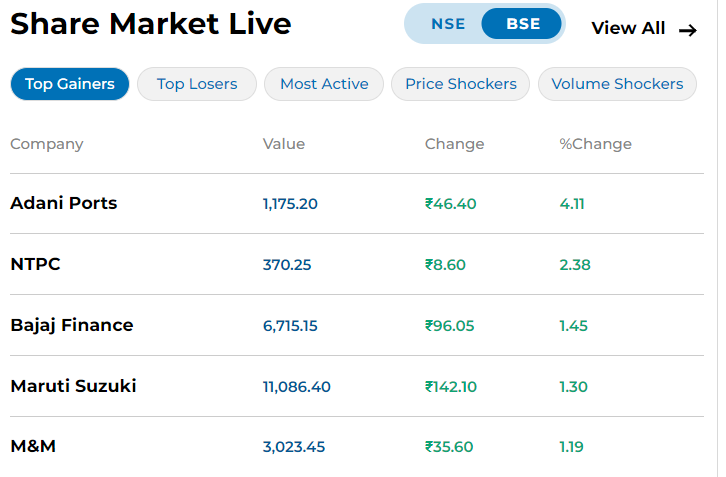

Adani Group Stock Prices Surge After Clarification

Shares of companies in the Adani Group, including Adani Green Energy, shot up to new heights after gaining up to 10% on November 21. This price surge occurred after Adani Green Energy issued an important statement regarding some very grave accusations that had been levied against Chairman Gautam Adani, his nephew Sagar Adani, and another executive named Vneet Jaain.

Stock Prices Soar

After this clarification, the stock price of Adani Green Energy rose to ₹959.1, which is the biggest one-day gain since June. Other stocks in the Adani Group rose between 2% and 5%. This positive market reaction indicates that investors were more confident after listening to the company's explanation.

A Roller Coaster Ride for Investors

Prior to this announcement, shares of the Adani Group had tumbled drastically due to the allegations. In fact, the shares lost a whopping ₹2.2 lakh crore in market value just a few days ago. The recent clarification seems to have turned things around for now, as investors are hopeful about the future of the Adani Group amidst ongoing legal challenges.

The Uncertainty of Guilt

Is Gautam Adani and his team really guilty of the charges against them? It's hard to say for sure. There are serious accusations about bribery and fraud, but so far, no clear evidence has been shown to prove these claims. Many people are curious why Adani seems to avoid serious consequences in past situations, like the Hindenburg report that said his companies were involved in stock manipulation and accounting fraud. Even with these ongoing legal troubles, the Adani Group insists that they are innocent and that the allegations are not true.

As investigations continue, we might learn more about what really happened. For now, there are still many questions about whether these claims are valid and what they might mean for Adani's business. In legal matters like this, everyone is considered innocent until proven guilty, which is an important rule we should remember.

With inputs from agencies

Image Source: Multiple agencies

© Copyright 2024. All Rights Reserved Powered by Vygr Media.