After two years of intense negotiations, Sony Group Corp has officially terminated the $10 billion mega-merger deal with Zee Entertainment Enterprises Ltd (ZEE), a move that has sent shockwaves through the media and entertainment industry. The collapse of the deal is attributed to the inability to fulfil the merger agreement, with a major point of contention being the leadership dispute.

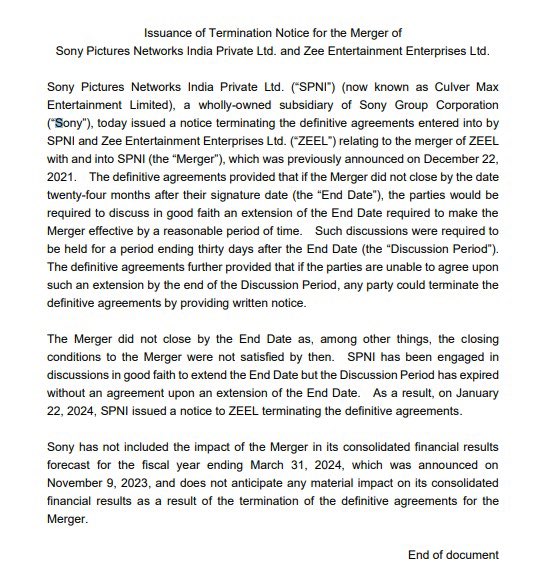

Termination Letter and Non-Compliance:

On Monday, Sony sent an official termination letter to ZEE, citing non-compliance with the merger agreement as the primary reason. The termination marks the end of a proposed merger that aimed to create the largest entertainment network in India, with Sony holding a 53% stake in the combined entity.

Stalemate Over Leadership:

The major stumbling block in the deal was the disagreement over who would lead the merged company. Talks stalled in November, with Sony expressing reservations about Punit Goenka, ZEE's CEO, leading the new entity. Despite extending the deadline by a month, the two companies couldn't reach a consensus on this crucial matter.

Investigation into Punit Goenka's Conduct:

An insider has revealed that Sony's reluctance to have Goenka as the CEO or even hold a board seat stems from an ongoing investigation into alleged fund diversion. This investigation has raised regulatory concerns for Sony, leading to a leadership dispute that ultimately derailed the entire merger.

Impact on ZEE and Sony:

The collapse of the mega-merger deal leaves both Sony and ZEE vulnerable in an industry where competition is intensifying. ZEE's market share in the Indian entertainment and broadcasting business is 18%, while Sony's market share is 6%. The termination leaves ZEE exposed to competition as rivals continue to grow, and both companies are yet to comment on the far-reaching consequences of this failed deal.

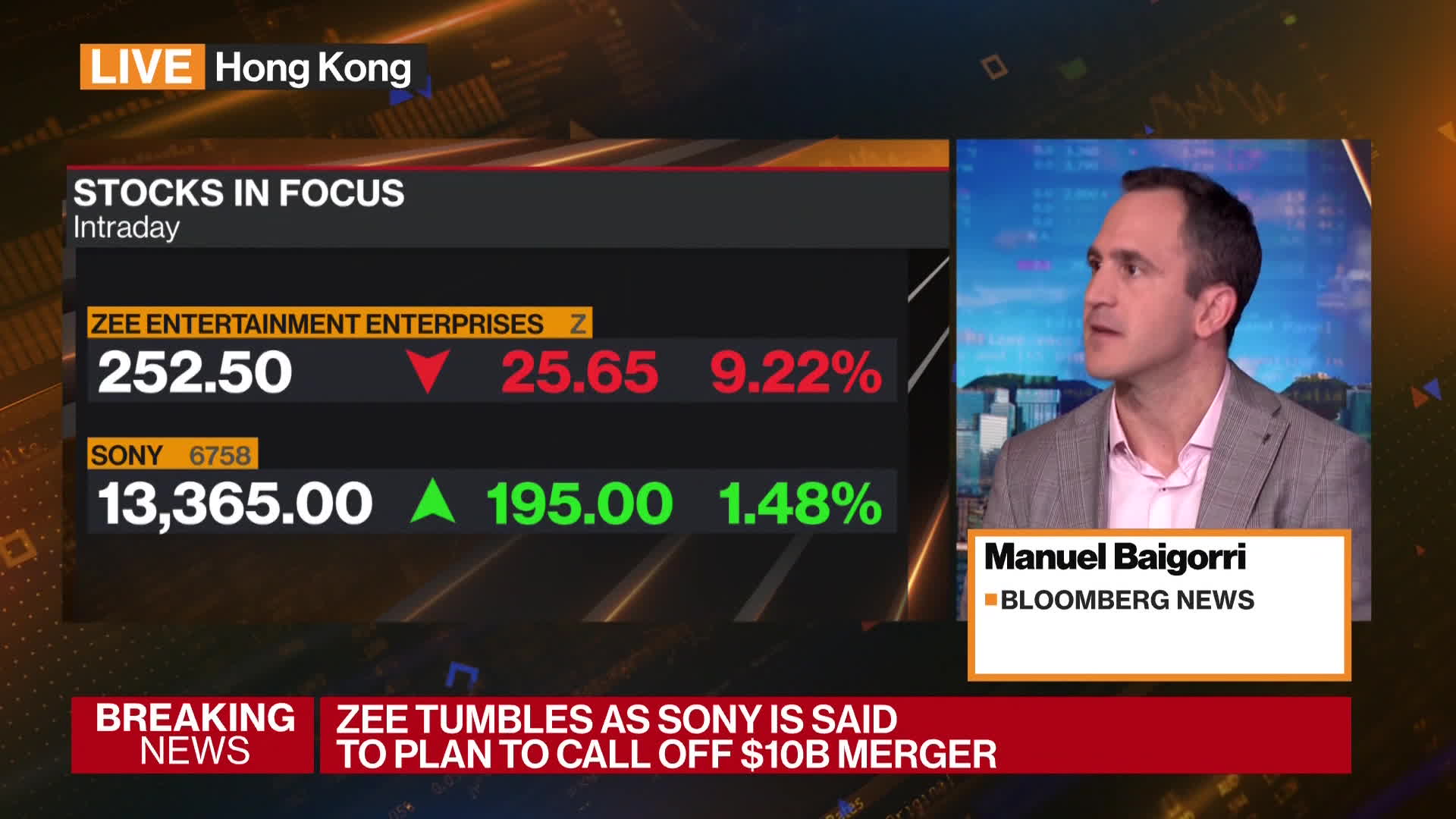

Image Source: Bloomberg

Stock Market Response

ZEE shares closed 1.59% down at ₹231.75 on the BSE on Saturday, January 20. The market capitalization of Zee currently stands at ₹22,260.04 crore. The termination comes after ZEE sought more time for the proposed merger last month.

Regulatory Challenges and Legal Battles:

The proposed merger faced numerous hurdles and delays, including legal battles with the capital markets regulator SEBI. In October 2023, the Securities Appellate Tribunal set aside an order barring Punit Goenka from holding key managerial positions, adding another layer of uncertainty to the deal. The unresolved SEBI probe remains a significant challenge, contributing to the ultimate collapse of the merger.

The following is a chronological overview spanning over two years:

-

September 21, 2021: Zee's board of directors unanimously approved the merger proposal with Sony Pictures Networks India.

-

December 21, 2021: The board, to create a media powerhouse, officially endorsed the merger proposal.

-

February 2022: Zee Entertainment faced insolvency proceedings initiated by IndusInd Bank.

-

July 29, 2022: The NSE and BSE stock exchanges approved the Zee-Sony merger.

-

October 4, 2022: The Competition Commission of India (CCI) approved the merger, incorporating voluntary structural remedies.

-

December 2022: IDBI Bank took Zee to the National Company Law Tribunal (NCLT) in pursuit of insolvency proceedings to recover Rs 149.60 crore in dues.

Zee to take legal action against Sony for withdrawal from merger

Zee Entertainment has announced its intention to pursue legal recourse against Sony Group following Sony's decision to withdraw from a $10 billion merger involving their Indian operations. The termination of the merger, initially disclosed two years ago, resulted from a failure to reach a consensus on certain deal conditions between the two companies. Zee is seeking $90 million in termination fees from Sony in connection with this matter. Following reports of Sony retracting from the Zee merger plan, Zee Entertainment Enterprises Limited (ZEEL) announced on January 22, 2024, its intention to initiate legal action against Sony Pictures Networks India (SPNI).

The collapse of the Sony-ZEE mega-merger deal underscores the complexities involved in merging major entities. The leadership stalemate and regulatory concerns have proven impossible, leaving both companies at a critical juncture. As the dust settles, attention now turns to the future prospects of ZEE and Sony in an industry that continues to undergo transformative changes.

(This is a developing story)

© Copyright 2024. All Rights Reserved Powered by Vygr Media.