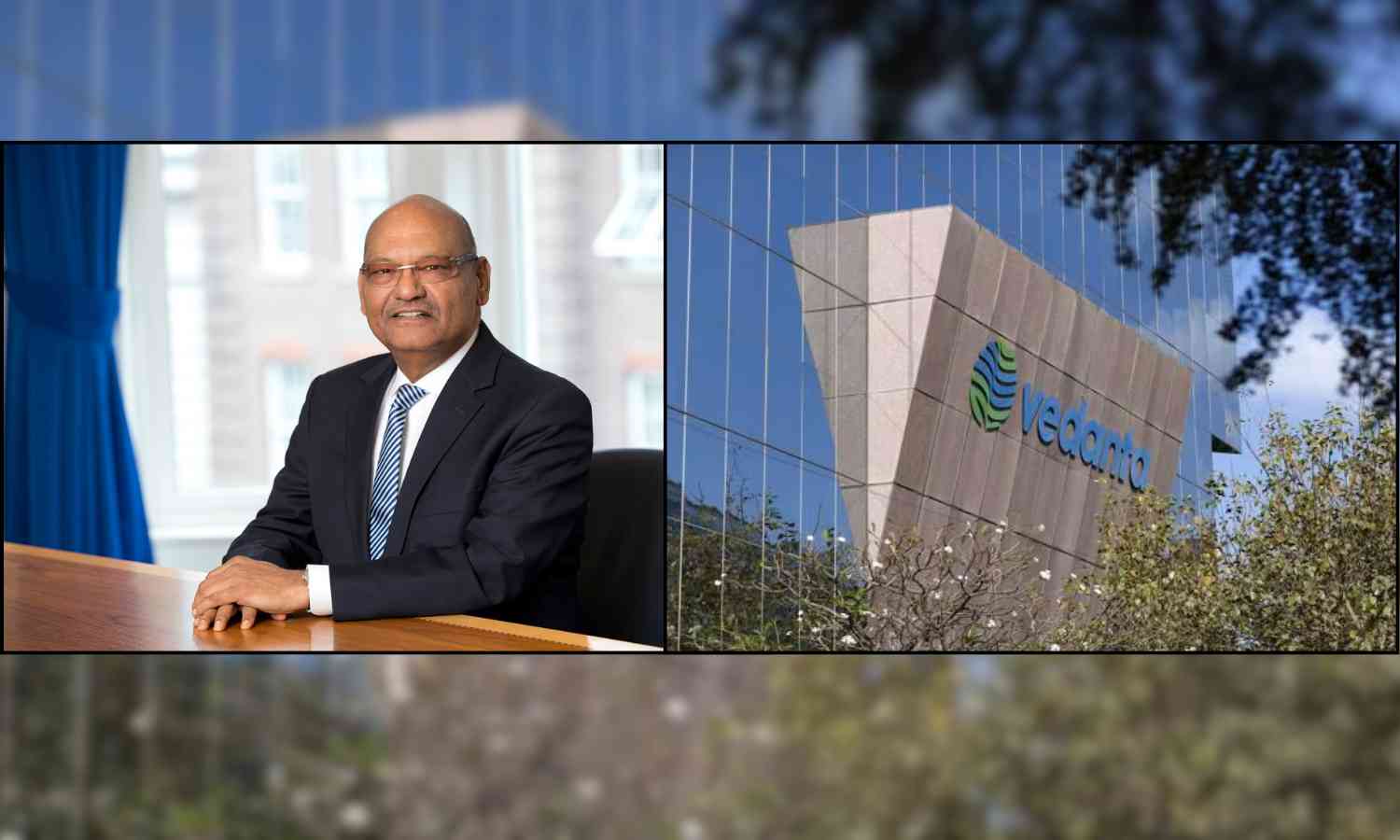

According to the group's chairman, Anil Agarwal, the debt-ridden Vedanta Ltd will complete selling off its steel assets by March 2024. The metals-to-oils conglomerate also intends to demerge its business segments into autonomous "pure play" entities to unlock value.

According to Agarwal, steel assets will be sold within this fiscal year, as said on CNBC-TV18.

Vedanta Aluminium, Vedanta Oil & Gas, Vedanta Power, Vedanta Steel and Ferrous Metals, Vedanta Base Metals, and Vedanta Limited are the new anticipated organisations, according to the company's announcement on September 29 regarding the plans to spin off.

"By demerging our business units, we believe that will unlock value and potential for faster growth in each vertical. While they all come under the larger umbrella of natural resources, each has its own market, demand and supply trends, and potential to deploy technology to raise productivity," Agarwal said last week.

Due to rating downgrades and concerns about being able to pay its financial commitments, Vedanta Resources, the parent company of Vedanta Ltd. based in the UK, has been finding it difficult to raise funds.

Vedanta is in crisis as it has been unable to raise funds, and its main concern is about $3.2 billion in bonds that are due to mature in 2024 and 2025. Along with other loan repayments, Vedanta Resources has debt commitments that include a $1 billion bond due in January, $950 million in August, and $1.2 billion in March 2025.

Vedanta Resources will honour all payments due in 2024, according to Agarwal's statement.

Ⓒ Copyright 2023. All Rights Reserved Powered by Vygr Media.