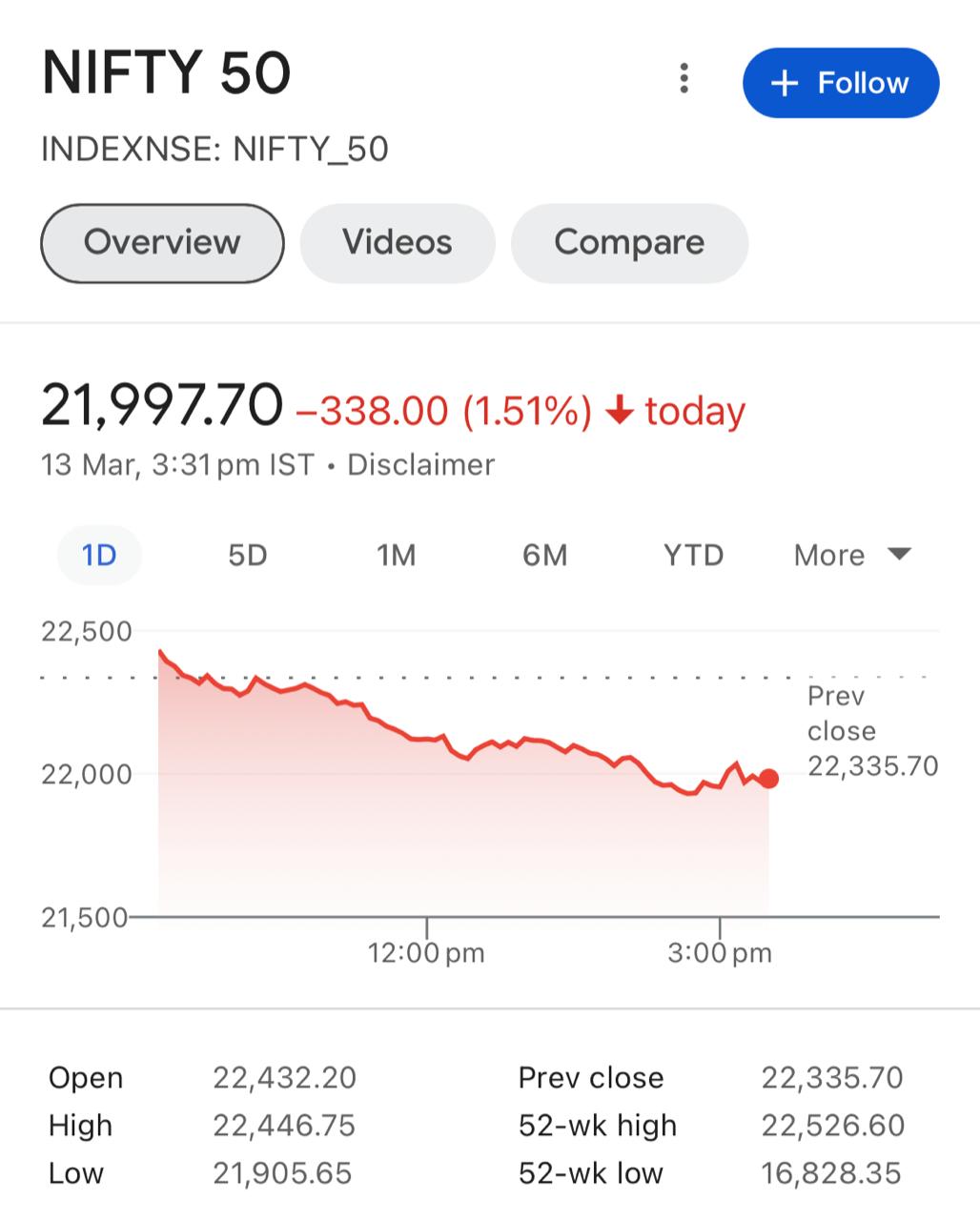

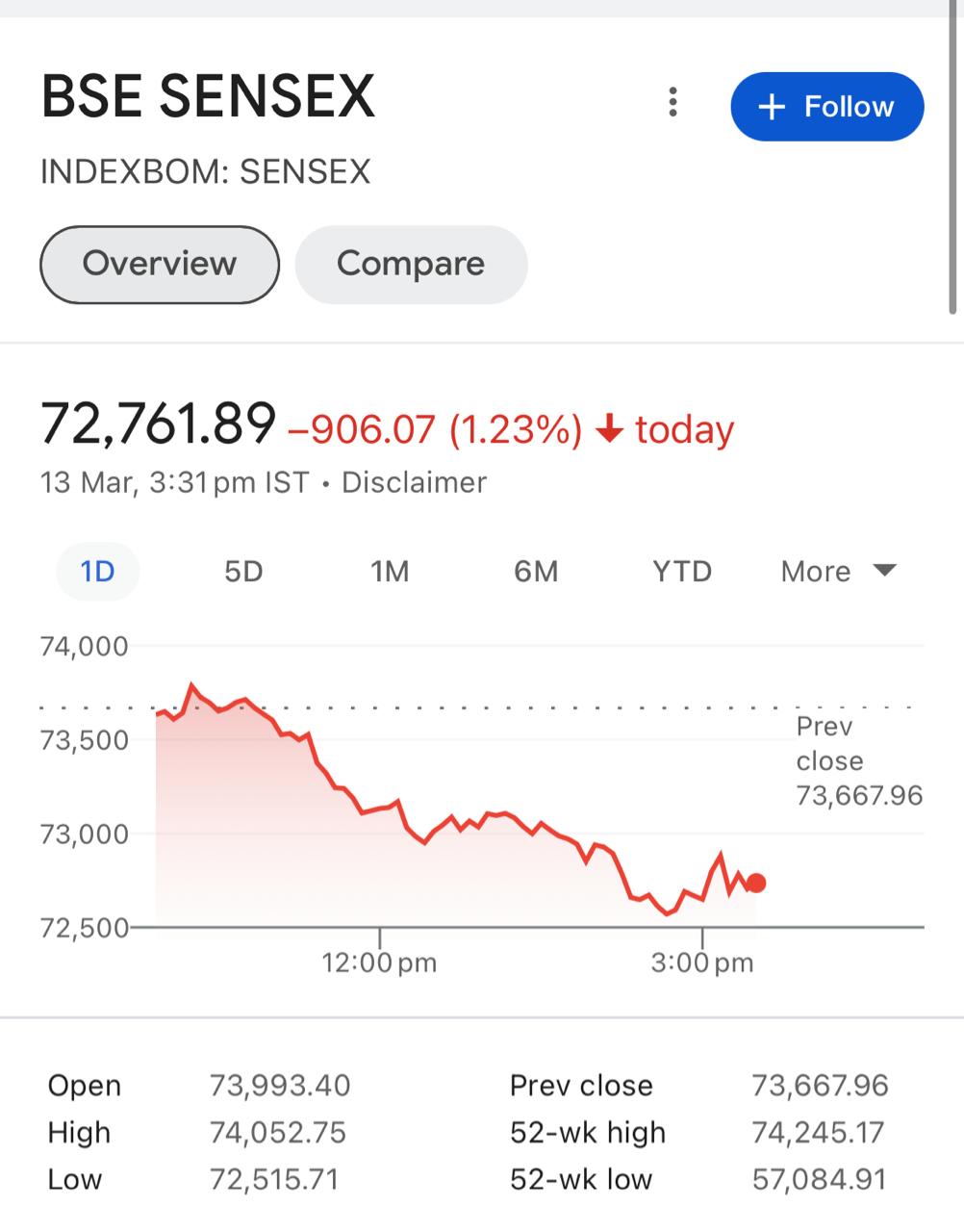

The Indian stock market saw a significant downturn on March 13, with the BSE Sensex and NSE Nifty50 closing in red at 72,761.89 and 21,997.70, respectively. The Sensex fell by 906.1 points, or 1.23%, while the Nifty50 fell by 338 points, or 1.5%.

Despite opening with modest gains of 0.43% and 0.44%, heavy selling across sectors on Dalal Street erased these early advances, leading to investors losing Rs 13.5 trillion and resulted in a significant downturn in equities.

The smallcap index took the brunt of the fall, falling 5%, its largest decline since December 2022. Midcaps trailed closely, falling 3%, and the SME stock index and microcaps both experienced sharp drops, falling about 5% each.

The market capitalization of all BSE-listed stocks has significantly decreased due to the severe market downturn; it currently stands at Rs 374 lakh crore, losing Rs 12 lakh crore in value.

Experts attribute this crash to various factors, including the stress test conducted by the Securities and Exchange Board of India (Sebi). Sebi Chairperson, Madhabi Puri Buch, had recently expressed concerns about froth in the smallcap and midcap segments, warning of disconnected valuation parameters and "irrational exuberance."

Responding to Buch's cautionary remarks, ICICI Prudential Mutual Fund took proactive measures by temporarily suspending new subscriptions via lump sum mode to smallcap and midcap funds.

In the Nifty 50, ITC, Kotak Bank, ICICI Bank, Cipla, and Bajaj Finance emerged as the leading gainers. Conversely, Power Grid Corp, Coal India, Adani Enterprises, Adani Ports, and NTPC suffered significant losses, marking them as the major losers.

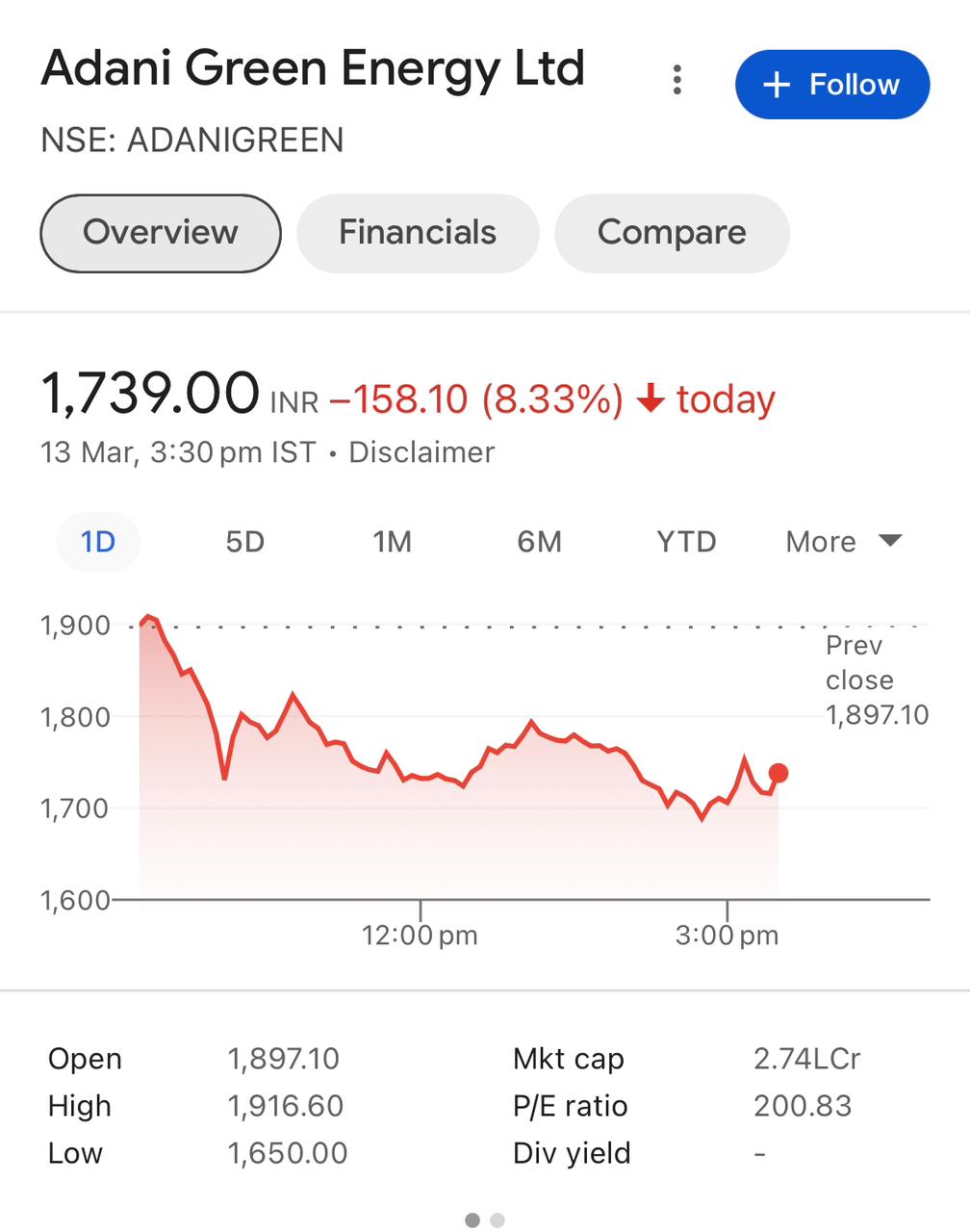

Adani Group

Adani Group suffered the brunt of a widespread sell-off on a volatile day for the Indian stock market, with a sharp decline in all of its stocks. All ten of the Adani counters saw negative trading on March 13, with Adani Green Energy suffering the most, falling 13% to an intraday low of Rs 1,650 per share. Adani Enterprises saw its stocks fall more than 6% on this particular day, marking the company's seventh straight day of losses and making it the biggest loser on the Nifty 50 index.

Adani Ports & SEZ saw a 5.3% decline in trading, indicating severe losses as well. Adani Wilmar's share price fell by 4% and Adani Total Gas's fell by over 8%. In the midst of a wider market decline, investor concerns were highlighted by the ₹90,000 crore collapse in the combined market capitalization of Adani Group stocks.

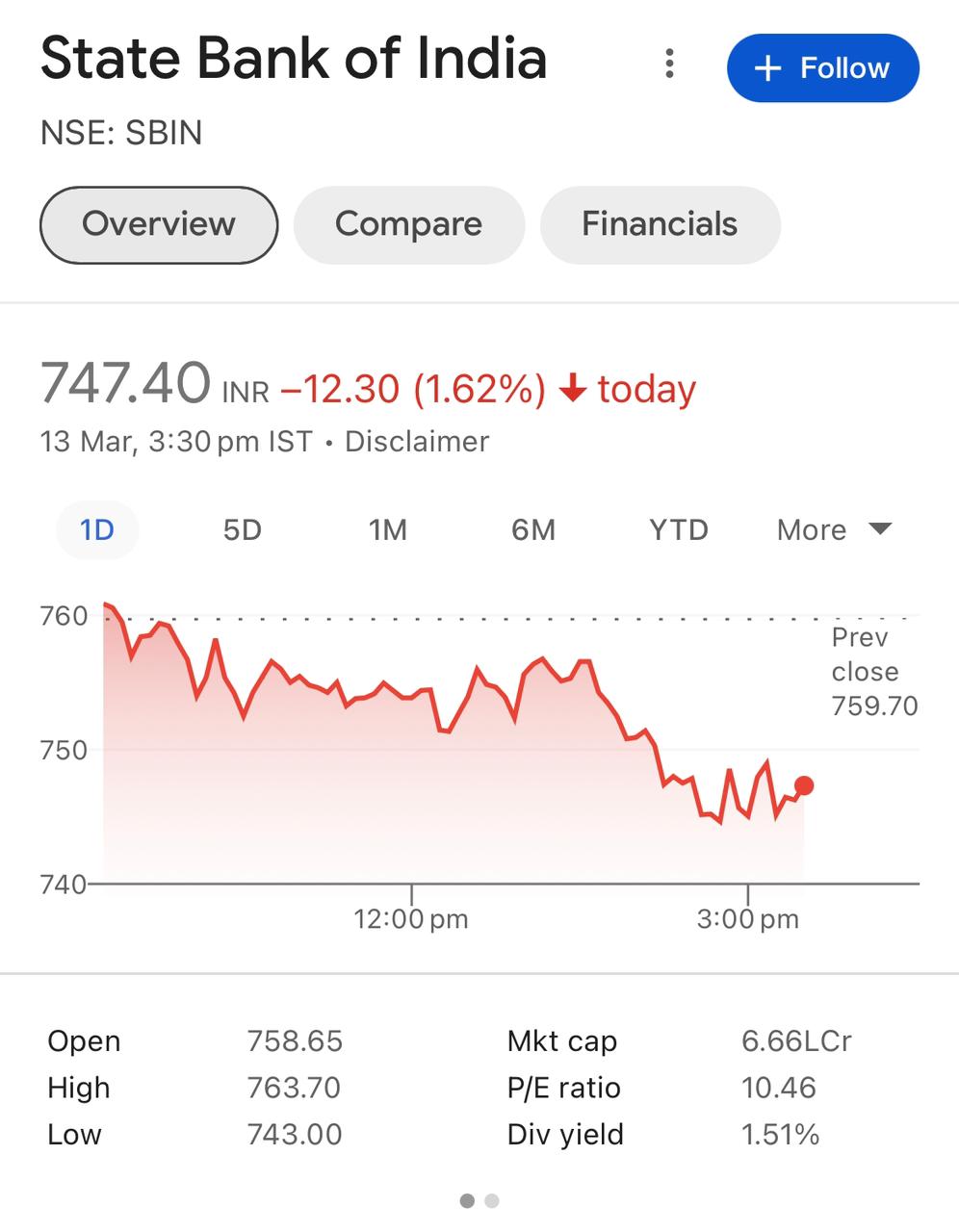

SBI

Following the filing of a compliance affidavit in the electoral bonds case, SBI's stocks dropped more than 1% to Rs 750.60. A day after providing the election commission with all the information pertaining to electoral bonds, the bank filed the affidavit. According to the bank, roughly 18,800 electoral bonds were bought and more than 20,400 bonds were redeemed between April 2019 and February 2024.

ITC

Following the announcement on Wednesday that British American Tobacco (BAT) Plc would sell roughly 3.5% of its ITC stake to institutional investors through block deals, the shares of ITC jumped 7.55% to Rs 435. Even after the deal, BAT, ITC's largest shareholder, will hold about 25.5% of the company, retaining its strategic position as the biggest domestic cigarette manufacturer.

©️ Copyright 2024. All Rights Reserved Powered by Vygr Media.