Image Source - Getty Images

Reliance Infrastructure Plans Heavy Inventories

Anil Ambani's company, Reliance Infrastructure Ltd., is about to get a huge boost in equity as its promoters are investing Rs. 1,100 crore in the business.

Meanwhile, two Mumbai-based investment houses are investing another sum of Rs 1,910 crore through an issue, reported the company filing.

Fundraising Plan Inside And Out

The Reliance Infra Board has cleared a proposal to issue Rs 6,000 crore. The company will raise both by preferential allotment of shares valued at Rs 3,014 crore and from institutional investors worth Rs 3,000 crore.

Preferential Placement of Rs 3,014 Crore

To mop up Rs 3,014 crore through preferential share placements. Reliance Infra has opted for a postal ballot to seek shareholder approval to issue 12.56 crore equity shares or convertible warrants at Rs 240 a share.

Promoters Lead with Rs 1,104 Crore Infusion

Through this preferential issuance, promoters will contribute Rs 1,104 crore.

Its company Risee Infinity Private Limited will buy 4.60 crore shares.

Mumbai-Based Investors Join In

Apart from IDFC, two other investors will also join the game. They include Fortune Financial & Equities Services and Florintree Innovations LLP. The two companies are based in Mumbai. Florintree - led by ex-Blackstone executive Mathew Cyriac -- will invest Rs 852 crore for 3.55 crore shares. The outfit owned by Nimish Shah, Fortune Financial, will invest Rs 1,058 crore, subscribing to 4.41 crore shares.

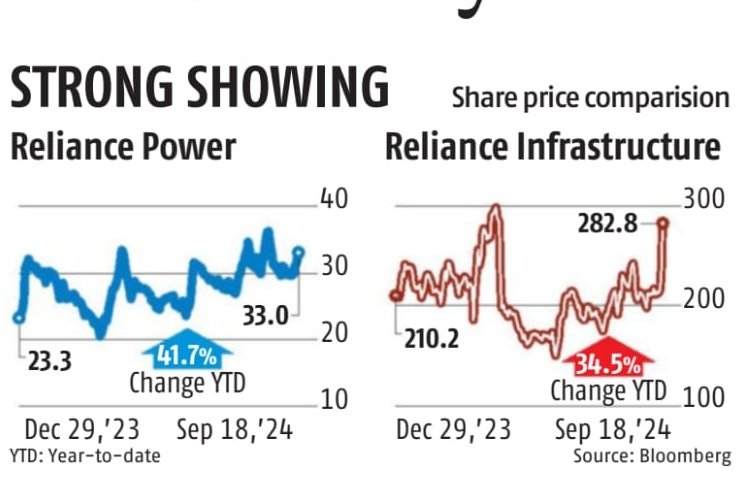

Image Source - Bloomberg

Strengthening Reliance Infra's Financials

Reliance Infra's net worth is expected to rise from Rs 9,000 crore to Rs 12,000 crore following the successful completion of preferential allotment, and its debt is anticipated to have drastically reduced to almost nil.

Voting process and use of funds

Reliance Infra gets shareholders' nod to raise Rs 30,000 crore through postal ballot. The postal ballot will be held for the period from September 20 to October 19, after which the results will be declared on October 21. All the money so raised will be used for enhancing business operations, investing in the subsidiaries as well as joint ventures besides raising all the long-term working capital and other corporate requirements.

With inputs from agencies

Image Source: Multiple agencies

© Copyright 2024. All Rights Reserved Powered by Vygr Media.