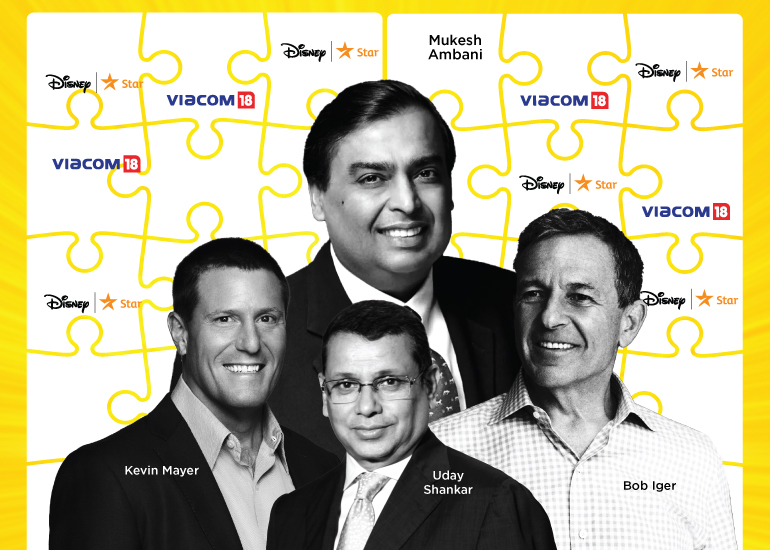

The proposed $8.5 billion merger between Reliance Industries and Walt Disney's Indian media assets has attracted significant scrutiny from the Competition Commission of India (CCI). With the potential to reshape the entertainment landscape in India, the merger is under intense examination, raising questions about market dominance and competition.

Detailed Scrutiny from CCI

The CCI has reportedly issued nearly 100 queries to both Reliance Industries and Walt Disney concerning their merger plans. According to anonymous sources cited by Reuters, these queries delve into various aspects of the merger, including the specifics of sports rights. The increased scrutiny aims to ensure that the merger does not stifle competition in the Indian media market.

_1721820520.jpeg)

The merger, which was announced in February 2024, would create a colossal entertainment entity, featuring 120 television channels and two online streaming services. Antitrust experts have highlighted that the combined entity's control over significant sports rights, particularly in the cricket segment, warrants close examination.

Arguments and Responses from Reliance and Disney

In a confidential submission to the CCI, Reliance and Disney argued that the merger would not harm competition. They emphasized that the cricket rights held by the merged entity would expire in 2027 and 2028, providing opportunities for competitors to bid for these rights in the future.

The CCI's inquiries included questions about the treatment of YouTube as a competitor. The regulator sought to understand why YouTube, which primarily deals in free and user-generated content, should be classified similarly to paid service providers like Netflix and Disney. Both Reliance and Disney responded by highlighting YouTube's paid content offerings, extensive reach, and licensing arrangements.

Market Impact and Regulatory Concerns

Data from Media Partners Asia revealed that YouTube dominated the online video market in India in 2023, holding an 88% market share. In contrast, premium streaming services, which focus on long-form content, accounted for 12% of the market. The significant market share held by YouTube and the potential impact of the Reliance-Disney merger on the competitive landscape has raised additional concerns.

The digital and television rights for major cricket tournaments and the Wimbledon tennis championship, valued at billions of dollars, have further intensified the competition scrutiny. While the CCI has not yet expressed concerns about the sports rights, it is actively gathering information on the merger's implications.

Future Outlook

The sheer size of the Reliance-Disney merger has necessitated extensive regulatory review. Sources indicated that the CCI's detailed inquiries are partly due to the scale of the deal. As of now, neither Reliance nor the CCI has provided an official response to Reuters.

If approved, the merger is expected to transform India's $28 billion entertainment market. Analyst firm Jefferies has projected that the merged entity could control up to 40% of the market share in television and streaming segments. The final decision by the competition regulator will be crucial in determining the future dynamics of India's media industry.

Inputs by Agencies

Image Source: Multiple Agencies

Ⓒ Copyright 2024. All Rights Reserved Powered by Vygr Media.