Life Insurance Corporation of India (LIC), the prominent insurer in the nation, has received approval from the Reserve Bank of India (RBI) to acquire a cumulative 9.99% stake in HDFC Bank. At present, LIC holds a 5.19% stake in HDFC Bank. The RBI has granted LIC permission to enhance its shareholding in HDFC Bank by an additional 4.8%, bringing the total stake to 9.99%.

Acquisition Deadline Within a Year

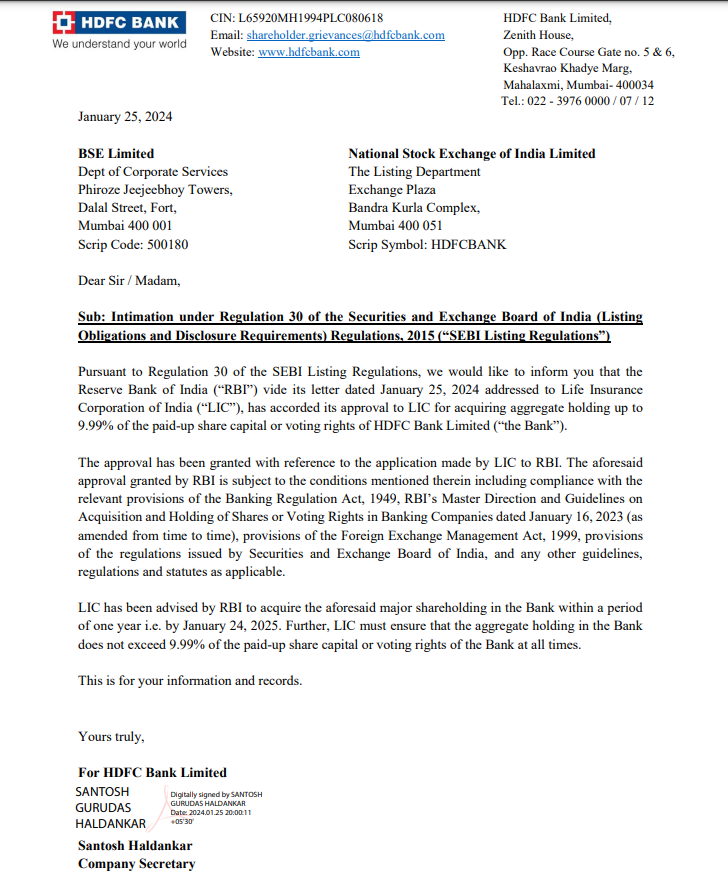

The approval for LIC's acquisition by the RBI is based on the insurer's application. LIC has been directed to conclude the acquisition within one year, ensuring completion by January 24, 2025. The central bank has stipulated that LIC's overall holding in HDFC Bank must not exceed 9.99% of the paid-up share capital or voting rights at any given point.

RBI Approval with Conditions

The RBI's green light for LIC's acquisition is subject to several conditions, as outlined in the exchange filing. Compliance with the Banking Regulation Act of 1949 and RBI's Master Direction and Guidelines on Acquisition and Holding of Shares or Voting Rights in Banking Companies dated January 16, 2023, is mandatory. Additionally, adherence to the provisions of the Foreign Exchange Management Act of 1999, regulations issued by the Securities and Exchange Board of India (SEBI), and other relevant guidelines, regulations, and statutes is required.

HDFC Bank's Performance and Outlook

On Thursday, HDFC Bank's stocks witnessed a 1.4% decline, closing at Rs. 1,435.3 on the BSE. Over the past two weeks, the stock has experienced a decline of over 15%. The bank, in its recent third-quarter results, disclosed a decrease in the net interest margin (NIM) on total assets from 4.1% a year ago to 3.4%. This decline in margin has been attributed to increased borrowing and a lower-yielding loan book since its merger with HDFC in July last year.

© Copyright 2024. All Rights Reserved Powered by Vygr Media.