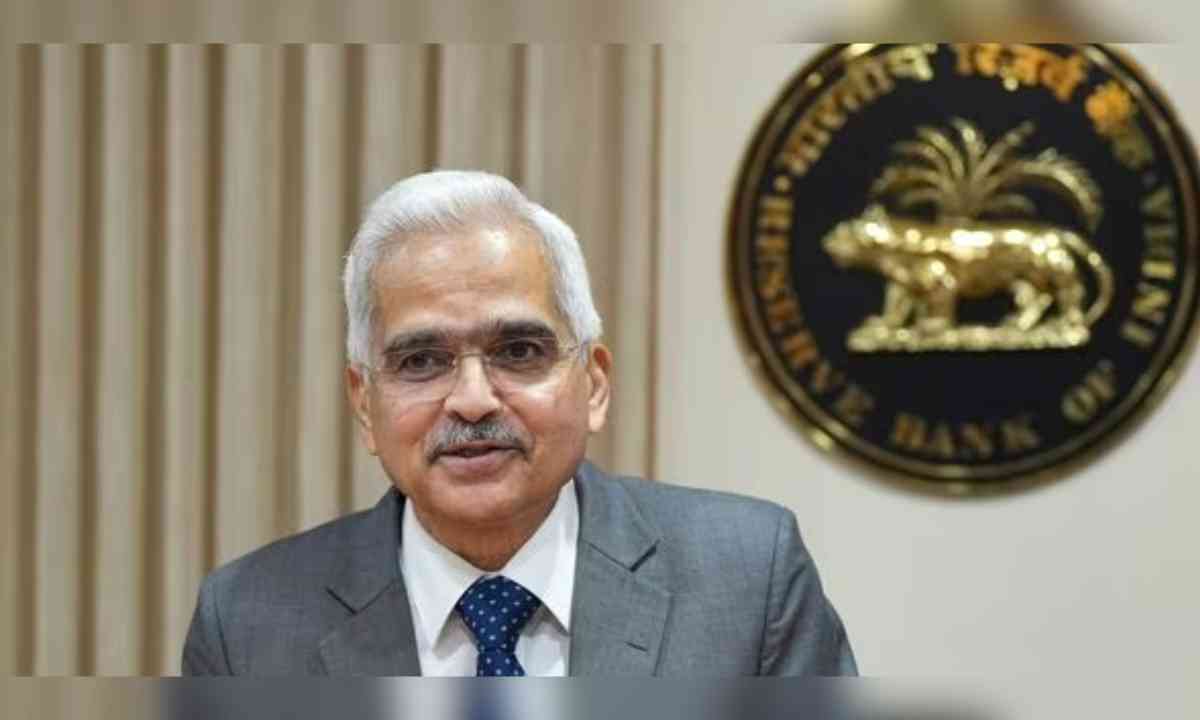

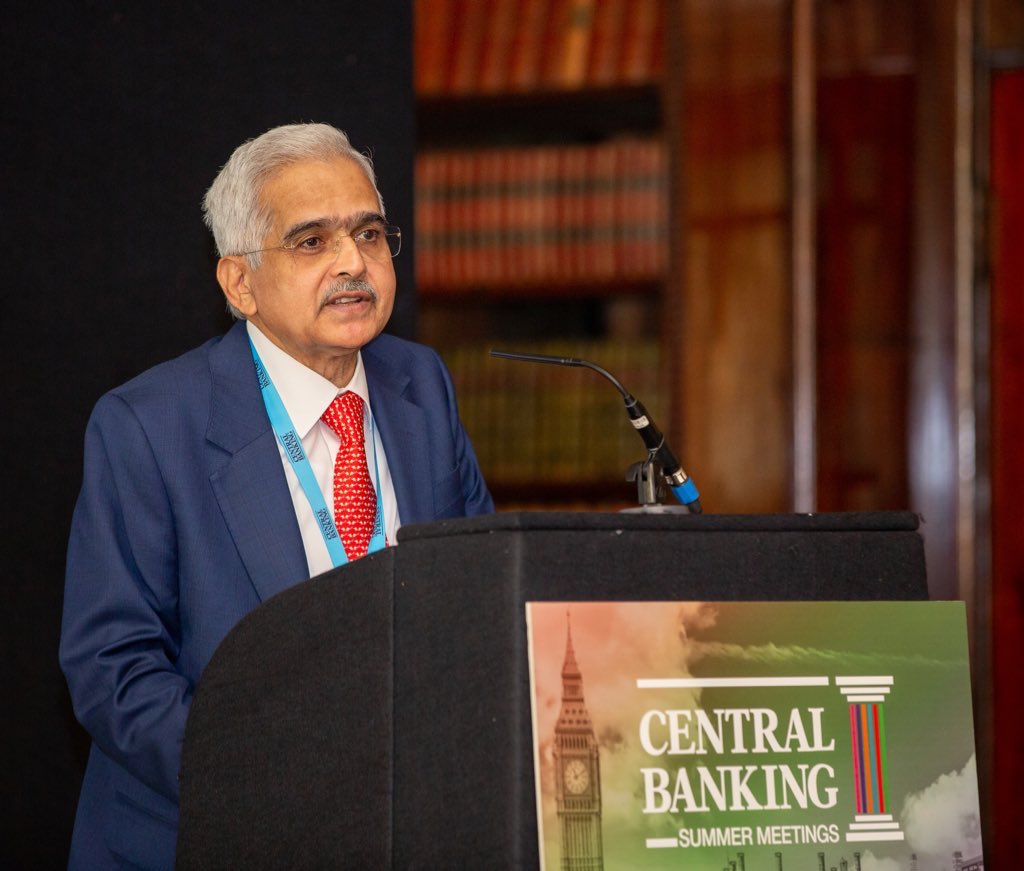

On Thursday, the Reserve Bank of India (RBI) opted to sustain the current policy rate for the third consecutive time, demonstrating its sustained focus on managing inflation. Following a sequence of six consecutive rate hikes that cumulated to 250 basis points since May 2022, the upward trajectory in rates was put on hold in April.RBI Governor Shaktikanta Das, while unveiling the bi-monthly monetary policy, announced the unanimous decision of the Monetary Policy Committee (MPC) to maintain the rate at 6.5 per cent.

He emphasized the MPC's continued vigilance over inflation and its unwavering dedication to aligning inflation with the targeted levels. Maintaining the prevailing interest rate, Governor Das remarked that the headline inflation continued to exceed the RBI's 4 per cent target. The meeting of the Monetary Policy Committee (MPC) occurred as consumer price-based (CPI) inflation for certain food items like tomatoes, wheat, and rice saw notable price surges in recent weeks. The government has entrusted the RBI with the responsibility of ensuring that CPI inflation remains within a range of 2 per cent on either side of the 4 per cent target. In early June, the monetary policy committee of the central bank reached a unanimous decision to maintain the repo rate at 6.5 per cent, aligning with the predictions of most analysts. The RBI had also opted for a repo rate pause in its April meeting.

© Copyright 2023. All Rights Reserved Powered by Vygr Media.