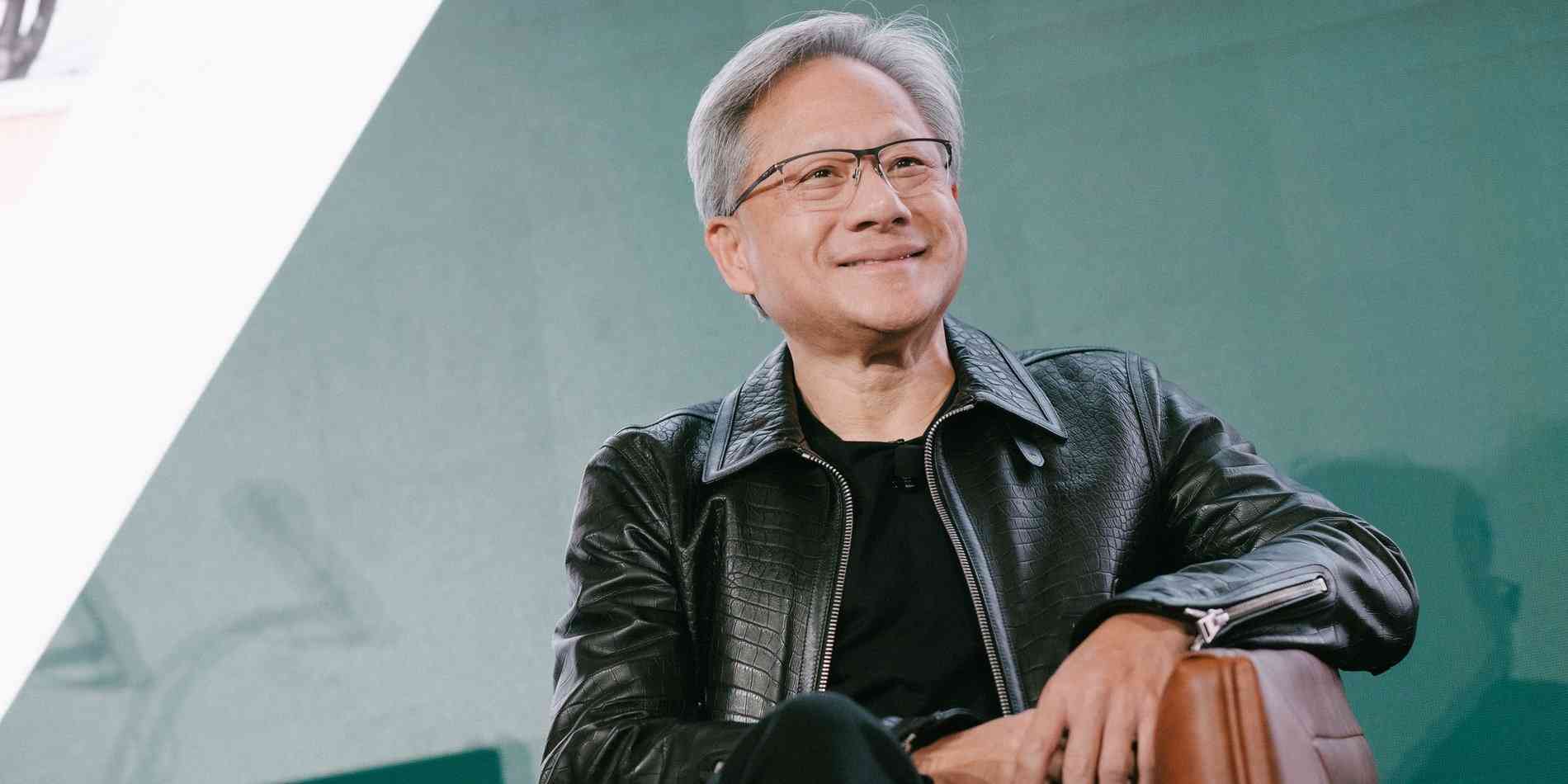

Nvidia CEO Jensen Huang has been executing substantial stock sales, offloading approximately $14 million worth of shares on a near-daily basis over the past several months. This pattern has garnered significant attention from investors and analysts.

Huang's stock sales are conducted under a 10b5-1 plan, a pre-arranged trading strategy that allows company insiders to sell a predetermined number of shares at regular intervals. This approach is designed to prevent any potential accusations of insider trading by scheduling sales in advance, irrespective of any material non-public information the insider might possess at the time of sale.

Despite these regular sales, Huang continues to hold a significant stake in Nvidia. Prior to initiating these sales, he owned more than 93 million shares, representing approximately 3.79% of the company. Even after the recent sell-offs, he retains a substantial number of shares, maintaining a strong alignment with the company's performance.

The magnitude and frequency of Huang's stock sales have led to questions among investors regarding his confidence in Nvidia's future prospects. Some are concerned about the potential implications of these sales, especially given the company's recent strong performance in the market. However, it's important to note that such sales are often part of personal financial planning and do not necessarily reflect a lack of confidence in the company's trajectory. These developments have also sparked discussions about Nvidia's corporate governance practices, particularly concerning succession planning. Experts suggest that increased transparency in succession planning is crucial for maintaining investor confidence and ensuring the company's long-term stability. Proactive communication about leadership development and future planning can help mitigate concerns arising from significant insider stock sales.

Why Is Huang Selling?

There are several possible reasons behind Huang’s steady liquidation of shares:

1. Diversification of Personal Wealth – Like many executives, Huang may be spreading his investments across different asset classes rather than having too much exposure to a single stock.

2. Tax Optimization – Regular stock sales help manage tax liabilities efficiently, rather than triggering massive capital gains taxes with a single large sale.

3. Philanthropy and Estate Planning – Some executives use stock sales to fund charitable contributions or prepare for estate transfers.

Despite these rational explanations, large insider sales sometimes cause investor concern, especially if they coincide with high stock valuations or upcoming company challenges.

Nvidia has been at the center of the AI and semiconductor boom, with its stock price soaring over the past year. The company’s dominance in graphics processing units (GPUs) and AI accelerators has made it a favorite among investors, helping it briefly surpass Apple in market capitalization. As of early 2025, Nvidia remains the undisputed leader in AI chip technology, outpacing rivals like AMD and Intel. Analysts continue to project strong earnings growth, fueled by:

- Expanding AI applications in data centers, autonomous vehicles, and edge computing.

- Partnerships with tech giants like Microsoft, Google, and Tesla.

- Increased demand for high-performance computing chips.

© Copyright 2024. All Rights Reserved Powered by Vygr Media.