Global financial markets experienced a dramatic turnaround on Tuesday, August 6, 2024, rebounding sharply from Monday's steep sell-off. Led by a surge in Asian markets, particularly Japan, investors displayed renewed optimism, pushing major indices higher. While concerns over economic conditions persist, the swift recovery has caught many by surprise.

Asia Leads the Rally

Asian markets spearheaded the global rebound:

♦ Japan's Nikkei 225 surged a remarkable 8.5%, recouping a significant portion of Monday's historic drop.

♦ South Korea's Kospi rallied nearly 5%.

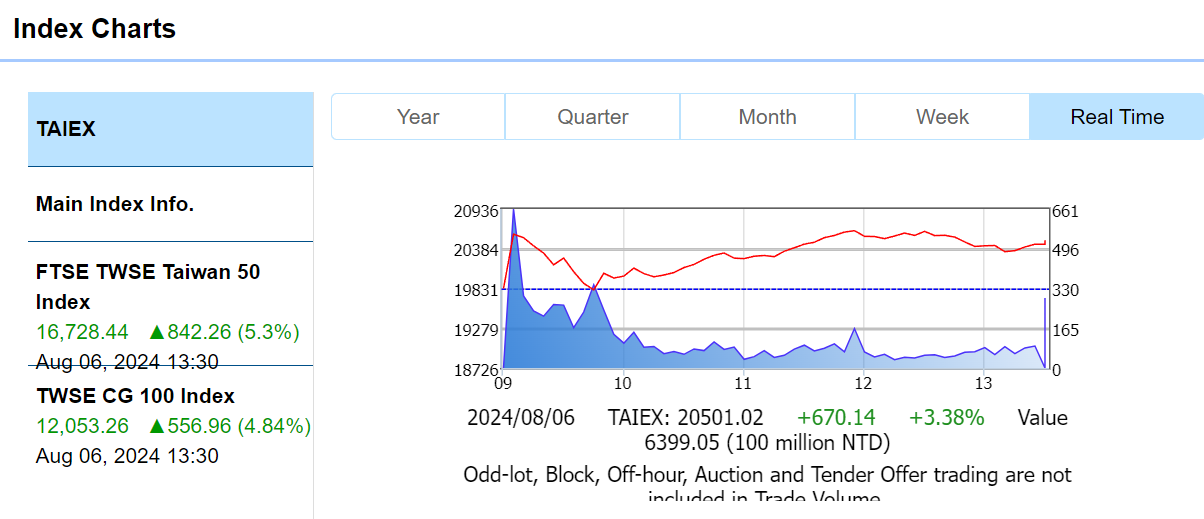

♦ Taiwan's main index rose about 4%.

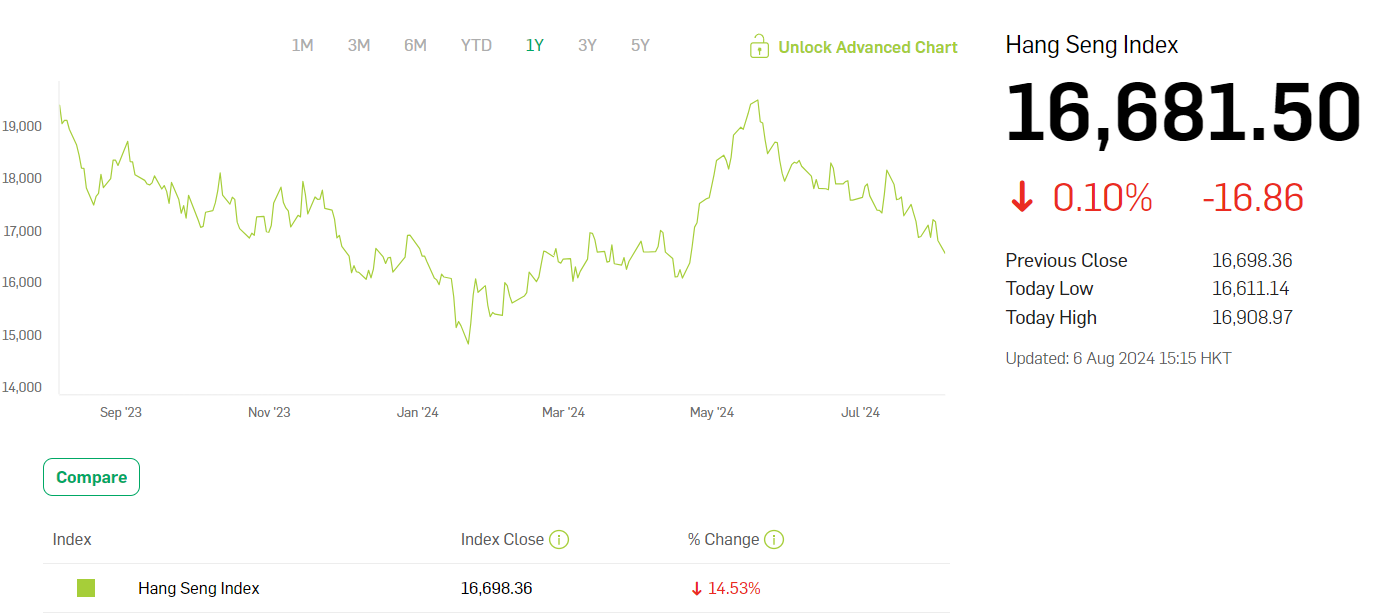

♦ Hong Kong's Hang Seng and China's Shanghai Composite both gained around 1%.

Several factors fueled the Asian rally:

- Technical rebound after Monday's decline.

- Speculation about potential aggressive rate cuts by the US Federal Reserve.

- Weakening of the Japanese Yen.

US Market Recovers

US stock futures indicated a strong opening, suggesting a partial recovery:

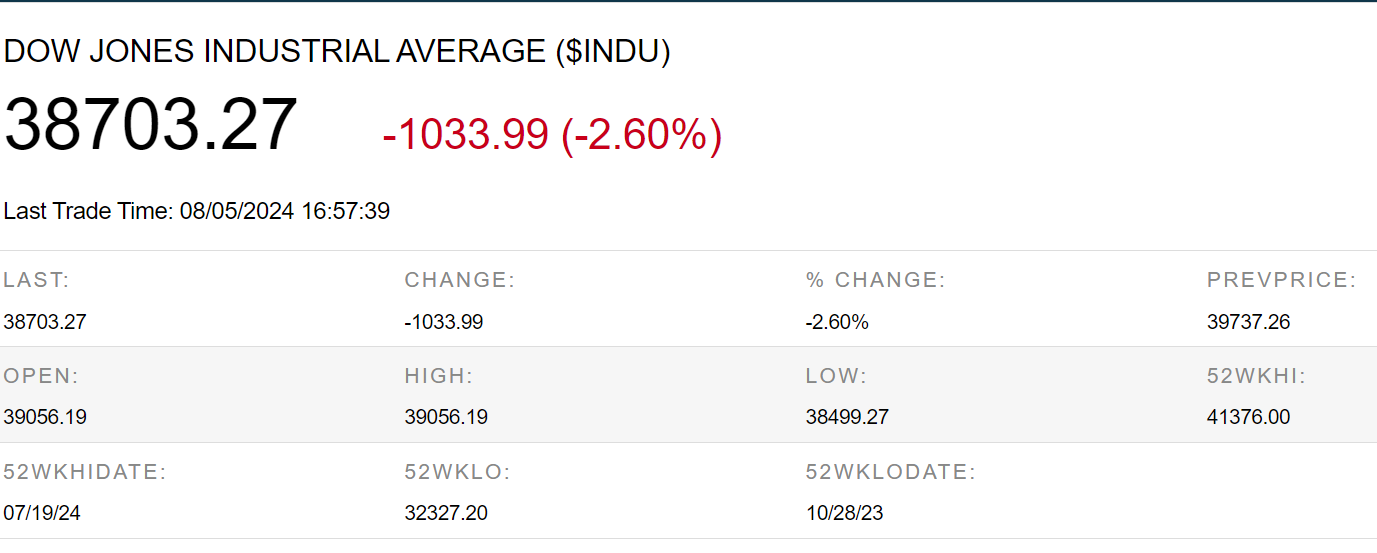

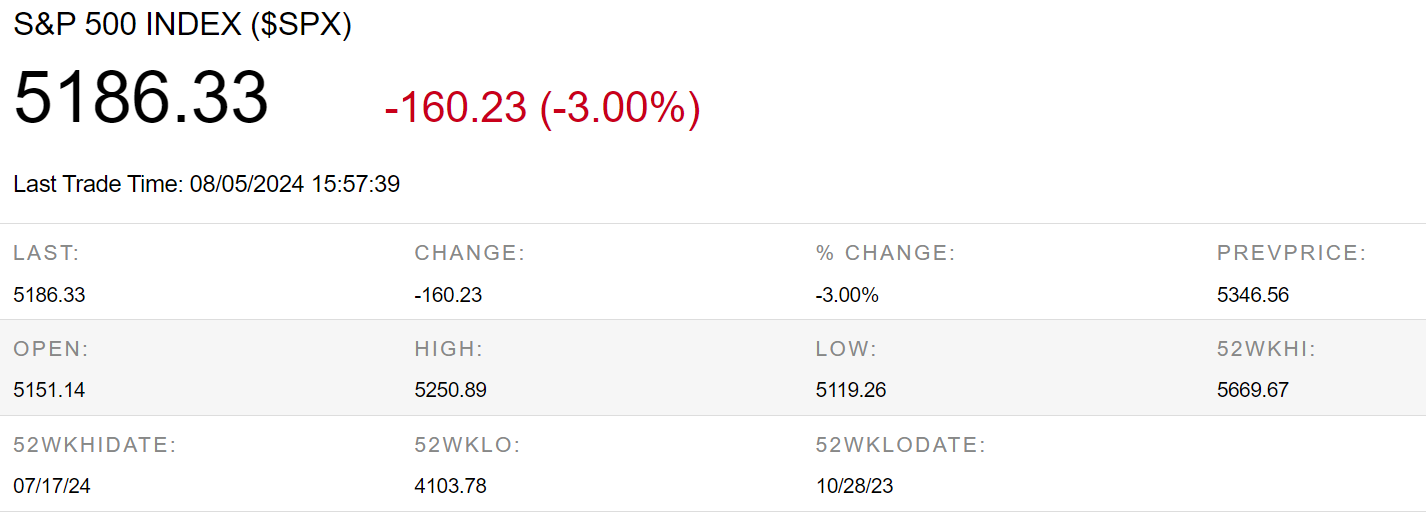

♦ Dow Jones futures up about 2%.

♦ S&P 500 and Nasdaq futures gained around 2%.

This followed a brutal Monday session:

- S&P 500 fell 3%, its biggest daily drop since September 2022.

For more on yesterday's stock market news, click: Global Stocks Collapsed: Recession Worries, Middle East Crisis Fuel Panic

Factors influencing the US market:

- Fed officials downplayed recession fears, easing investor anxiety.

- Speculation about potential rate cuts by the Fed.

Indian Markets Join the Rebound

Indian stock markets mirrored the global trend:

♦ BSE Sensex surged 1,000 points at the opening bell.

♦ Nifty 50 climbed above the 24,300 mark.

- Leading gainers included Tata Motors and Adani Ports (up to 4%).

Factors driving the Indian rebound:

- Positive cues from global markets.

- Strong performance of GIFT Nifty futures.

- Continued support from Domestic Institutional Investors (DIIs).

Factors Driving the Rally

- Technical rebound: After Monday's sharp declines, many markets were oversold.

- Rate cut speculation: Anticipation of aggressive rate cuts by the Fed boosted investor sentiment.

- Yen depreciation: The weakening of the Japanese Yen benefited Japanese exporters and Yen carry traders.

- Domestic institutional support: In the Indian market, DIIs played a crucial role.

Outlook and Cautious Optimism

The market rebound is significant, but experts advise caution. The recovery is seen as a technical bounce, and investors should monitor global developments.

sustainability of the rally depends on:

- Further comments from central banks.

- Upcoming economic data releases.

- Geopolitical events.

Investors should maintain a balanced approach and consider potential volatility. A clearer picture of the market's direction will emerge in the coming weeks.

With inputs from agencies

Image Source: Multiple agencies

© Copyright 2024. All Rights Reserved Powered by Vygr Media.