Global financial markets experienced a severe downturn on Monday, August 5, 2024, marking one of the most significant sell-offs since the COVID-19 pandemic. The confluence of US recession fears, geopolitical tensions, and shifts in monetary policy across major economies has created a perfect storm for investors, leading to widespread losses across asset classes.

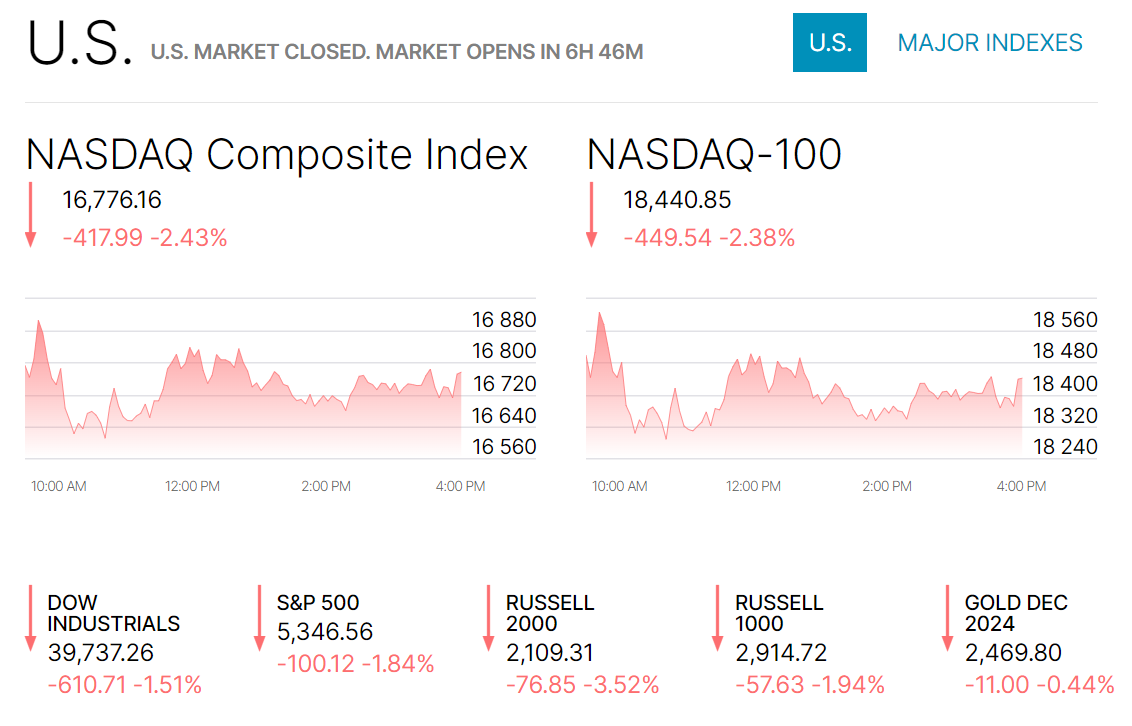

US Market Chaos

♦ The US stock market's plunge began on Friday and continued into Monday, with all major indices experiencing substantial losses.

♦ The Dow Jones Industrial Average fell nearly 1,000 points at its intraday low on Friday, closing down over 2%.

♦ The S&P 500 slid 3% over Thursday and Friday, breaking below key technical support levels.

♦ The Nasdaq Composite dropped nearly 5% over two days, officially entering correction territory (defined as a 10% drop from recent highs).

Key factors contributing to the US market decline include:

1. Weak economic data: Jobless claims reached a one-year high, while manufacturing data came in well below estimates.

2. Disappointing earnings: Tech giants Amazon and Intel both missed expectations and provided weak guidance, sparking concerns about the broader tech sector's health.

3. July jobs report: The economy added 61,000 fewer jobs than expected, and unemployment unexpectedly spiked to 4.3%.

The sell-off has prompted a significant shift in Federal Reserve rate expectations. The CME FedWatch tool now shows a 75% probability of a 50-basis-point rate cut in September, up from just 12% a week ago. This dramatic change reflects growing concerns about the economy's health and the potential for a policy mistake by the Fed.

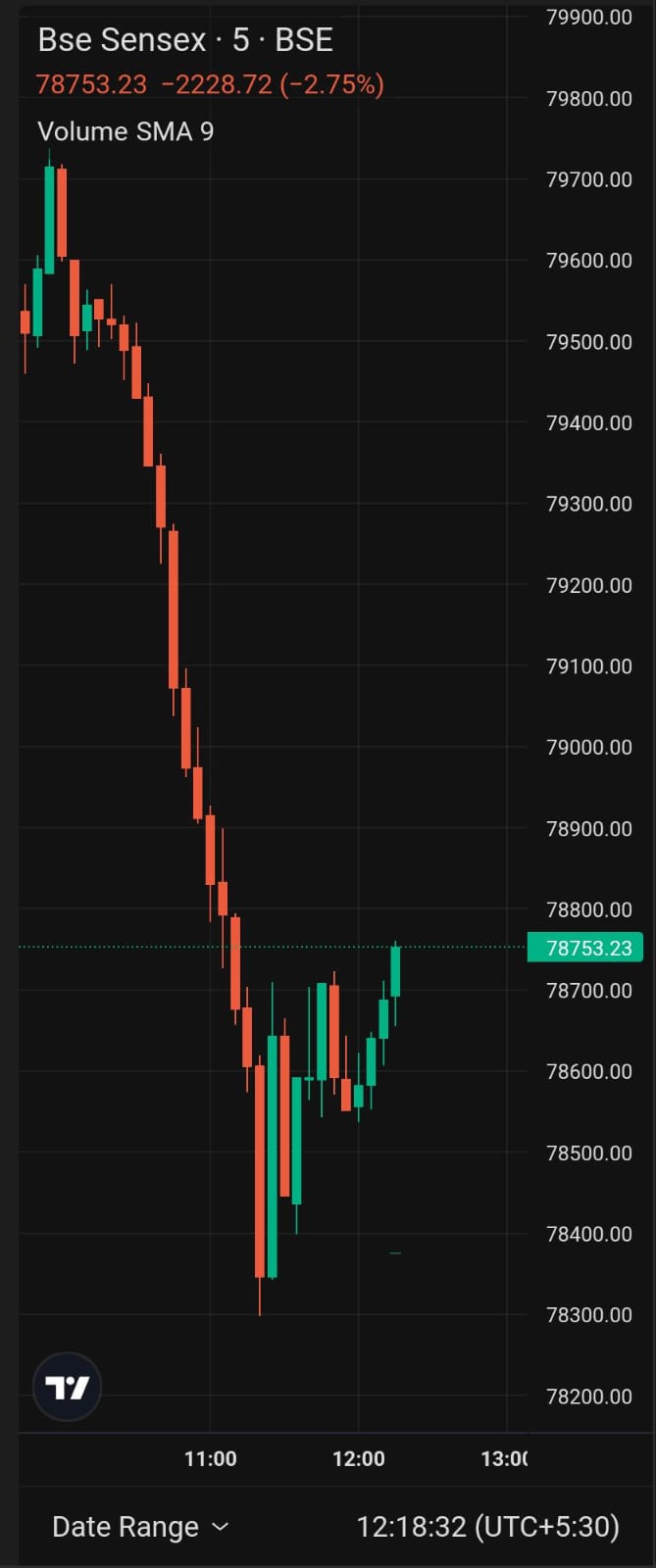

Indian markets tumble

♦ Indian stock markets mirrored the global sell-off, with benchmark indices experiencing their worst single-day fall in months.

♦ The BSE Sensex plummeted to 78,781, down over 3% from its previous close.

♦ The Nifty 50 dropped to 24,050, also falling by approximately 3%.

♦ Midcap and small-cap indices were hit even harder, declining by nearly 4% each.

The widespread sell-off affected all sectors, with particularly severe impacts on:

1. Banking: Concerns about loan growth and asset quality in a potentially recessionary environment.

2. IT: Worries about reduced tech spending in the US, a key market for Indian IT firms.

3. Metals: Global growth concerns weigh on commodity prices.

The India VIX, often called the fear index, spiked by over 20%, reaching levels not seen since the early days of the COVID-19 pandemic. This surge indicates heightened market anxiety and expectations of increased volatility in the near term.

Foreign institutional investors (FIIs) were net sellers, exacerbating the downward pressure on Indian equities. The rupee also weakened against the dollar, touching multi-month lows.

Global Market Turmoil

The sell-off was truly global in nature, affecting markets across Asia, Europe, and the Americas.

Asia:

♦Japan's Nikkei 225 index experienced its worst single-day loss since 1987, with a drop of over 10%. The yen surged against the dollar, reaching its strongest level since January, closing at 31,316.62 points.

♦ Taiwan's benchmark plummeted 7.9%, entering bear market territory.

♦ The South Korean KOSPI fell over 5%, its largest drop since March 2020.

♦ Hong Kong's Hang Seng index declined by 4.2%, while China's Shanghai Composite lost 3.1%.

Europe:

♦ The pan-European STOXX 600 index opened down over 2% and continued to decline throughout the day.

♦ Germany's DAX, France's CAC 40, and the UK's FTSE 100 all fell by more than 2.5%.

♦ European bank stocks were particularly hard hit, with the Euro STOXX Banks index down over 4%.

Americas:

♦ In addition to US market declines, Canadian and Latin American markets also saw significant losses.

♦ Brazil's Bovespa index fell by over 3%, while Mexico's IPC declined by 2.5%.

Commodities and Currencies:

♦ Oil prices initially spiked due to Middle East tensions but later retreated due to global growth concerns.

♦ Gold prices rose as investors sought safe-haven assets.

♦ The US Dollar Index initially strengthened but then weakened as expectations for Fed rate cuts increased.

US Recession Fears:

The unexpected jump in the US unemployment rate to 4.3% triggered the Sahm Rule recession indicator, significantly increasing recession probability estimates. Here's a more detailed breakdown:

• Job Market Concerns: The economy added only 114,000 jobs in July, far below the 215,000 monthly average of last year. This sharp slowdown in job creation has raised alarms about the labour market's health.

• Unemployment Rate Spike: The unemployment rate jumped from 4.1% in June to 4.3% in July, the highest level since October 2021. This rapid increase is often associated with the early stages of a recession.

• Sahm Rule Indicator: This recession predictor, created by economist Claudia Sahm, has been triggered. It signals a recession when the three-month moving average of the unemployment rate rises by 0.5 percentage points or more relative to its low during the previous 12 months.

• Broader Economic Indicators: Alongside weak job data, other economic indicators have disappointed:

- The ISM Manufacturing PMI fell to 46.4 in July, remaining in contraction territory (below 50) for the ninth consecutive month.

- Consumer confidence, as measured by the Conference Board, dropped to 95.7 in July from 98.4 in June, indicating growing pessimism among households.

• Yield Curve Inversion: The yield curve (10-year Treasury yield minus 2-year Treasury yield) has been inverted for an extended period, historically a reliable recession predictor.

• Revised GDP Forecasts: Several major banks, including Goldman Sachs and JP Morgan, have revised their GDP growth forecasts downward for the second half of 2024 and early 2025.

• The Federal Reserve Dilemma: The weak economic data has put the Fed in a difficult position. Markets are now pricing in a high probability of rate cuts, with expectations for a 50 basis point cut in September rising to 75%, up from just 12% a week ago. This rapid shift in expectations is itself contributing to market volatility.

2. Middle East Tensions: The ongoing conflict between Israel and Hamas has escalated, with Iran threatening retaliation for the reported assassination of key Hamas and Hezbollah leaders. This has raised fears of a wider regional conflict, potentially disrupting oil supplies and global trade.

For more news on the ongoing middle east conflict, visit - Vygr news

3. Valuation Concerns: Many analysts have been warning about stretched valuations, particularly in the tech sector. The forward P/E ratio for the S&P 500 was around 20, well above its 10-year average of 17, suggesting that stocks were priced for perfection and vulnerable to negative surprises.

4. Bank of Japan Policy Change and Yen Carry Trade Unwinding:

The Bank of Japan's recent policy shifts have had far-reaching implications for global markets:

• Interest Rate Hike: The BOJ raised benchmark interest rates to "around 0.25%" from the earlier range of 0% to 0.1%, marking the highest level since 2008. This move signalled a potential end to Japan's ultra-loose monetary policy era.

• Yield Curve Control (YCC) Adjustment: The BOJ allowed more flexibility in its YCC policy, permitting 10-year government bond yields to fluctuate in a wider band. This has led to increased volatility in the Japanese government bond market.

• Yen Appreciation: The Japanese Yen has seen a significant appreciation of nearly 10% against the US Dollar over the last three weeks. On August 5, 2024, the yen strengthened to 145.11 per dollar, its highest level since mid-January.

• Carry Trade Unwinding: The yen's rapid appreciation has triggered a massive unwinding of the yen carry trade. This popular strategy, where investors borrow in low-yielding yen to invest in higher-yielding assets elsewhere, is being rapidly reversed, causing ripple effects across global markets.

• Government Intervention: The Japanese government confirmed a $36.8 billion Yen intervention after the currency had declined to a 38-year low against the US Dollar. This was the second intervention since late May, which was the first intervention since October 2022.

• Global Market Impact: The unwinding of yen carry trades has led to selling pressure across various asset classes, particularly in emerging markets and high-yield investments. This has contributed to the global market sell-off.

• Future Policy Expectations: Market participants are now speculating about further policy normalisation from the BOJ, which could have continued implications for global liquidity and asset prices.

• Historical Context: Financial markets historian Russell Napier noted that this event has given investors a glimpse of the potential impact that changes in Japanese monetary policy can have on US and global financial markets.

5. Tepid Q1 Results: The earnings season has been mixed, with several high-profile misses. For the S&P 500, Q2 earnings growth is tracking at -5.2% year-over-year, marking the third consecutive quarter of earnings decline.

6. Technical Factors: The breach of key technical levels, including the 50-day and 200-day moving averages for major indices, has triggered algorithmic selling and stop-loss orders, exacerbating the market decline.

7. Global Economic Slowdown: Beyond the US, there are concerns about economic growth in China, Europe, and emerging markets. China's property sector woes and Europe's manufacturing contraction are particular areas of concern.

8. Monetary Policy Uncertainty: The market is grappling with the possibility that central banks, particularly the Fed, may have overtightened monetary policy. This has led to increased volatility in interest rate expectations.

Market Outlook and Expert Opinions

→ Market experts and strategists are divided on the near-term outlook.

→ Some, like Morgan Stanley's Mike Wilson, believe this could be the start of a more significant correction, potentially reaching 10–20% for major indices.

→ Others, such as JPMorgan's Marko Kolanovic, see this as a buying opportunity, especially in sectors that have been oversold.

The consensus view is that volatility will remain elevated in the near term as markets digest economic data and geopolitical developments.

Key areas to watch include:

1. Upcoming economic indicators, particularly inflation data and consumer spending reports.

2. Federal Reserve communications and policy decisions.

3. Developments in the Middle East conflict.

4. China's economic policies and their impact on global growth.

Implications for Investors

The current market environment presents both risks and opportunities for investors:

1. Diversification is crucial, with a focus on uncorrelated assets and safe-haven investments like gold and high-quality bonds.

2. Value stocks and defensive sectors may outperform growth and cyclical sectors in the near term.

3. Dollar-cost averaging strategies may be beneficial for long-term investors looking to take advantage of market dips.

4. Options strategies, such as protective puts or covered calls, may help manage downside risk.

5. Emerging market investments may face additional volatility due to currency fluctuations and global growth concerns.

Looking Ahead

As markets navigate this period of uncertainty, key events and data points to monitor include:

1. The next Federal Reserve meeting and policy statement.

2. Q3 earnings reports, which will provide insight into how companies are managing in the current economic environment.

3. geopolitical developments, particularly in the Middle East and US-China relations.

4. Fiscal policy decisions in major economies could provide support if economic conditions deteriorate further.

Investors are advised to stay informed, maintain a long-term perspective, and consult with financial advisors to ensure their investment strategies align with their risk tolerance and financial goals in these challenging market conditions.

With inputs from agencies

Image Source: Multiple agencies

© Copyright 2024. All Rights Reserved Powered by Vygr Media.