In the ever-changing landscape of the business world, fortunes can shift in the blink of an eye. Such is the case for Byju Raveendran, the founder, and CEO of troubled edtech giant Byju's.

Once heralded as a titan in the realm of edtech, Byju Raveendran, the visionary founder and CEO of Byju's, has now witnessed his fortunes dissolve into oblivion. From a staggering net worth of Rs 17,545 crore ($2.1 billion), Raveendran's net worth has evaporated to an absolute zero, as per the latest Forbes Billionaire Index 2024. Just a few times back, he was riding high at a peak of $22 billion and was a prominent fixture on various prestigious 'world's richest' lists.

A meteoric rise and sudden fall of Byju's

It was a meteoric rise to fame for Byju's, the ed-tech startup that became India's most valuable unicorn in just a few short years. Launched in 2011, Byju's quickly gained a reputation for its innovative learning app, which transformed the educational landscape for students of all ages. From primary school students to MBA aspirants, Byju's was hailed as a game-changer in the field of online education.

But as the saying goes, "easy come, easy go". The same can be said for Byju's, as the company's fortunes took a drastic turn for the worse in recent times. Financial discrepancies and mounting controversies began to surface, casting a dark shadow over the once-shining star of India's startup ecosystem.

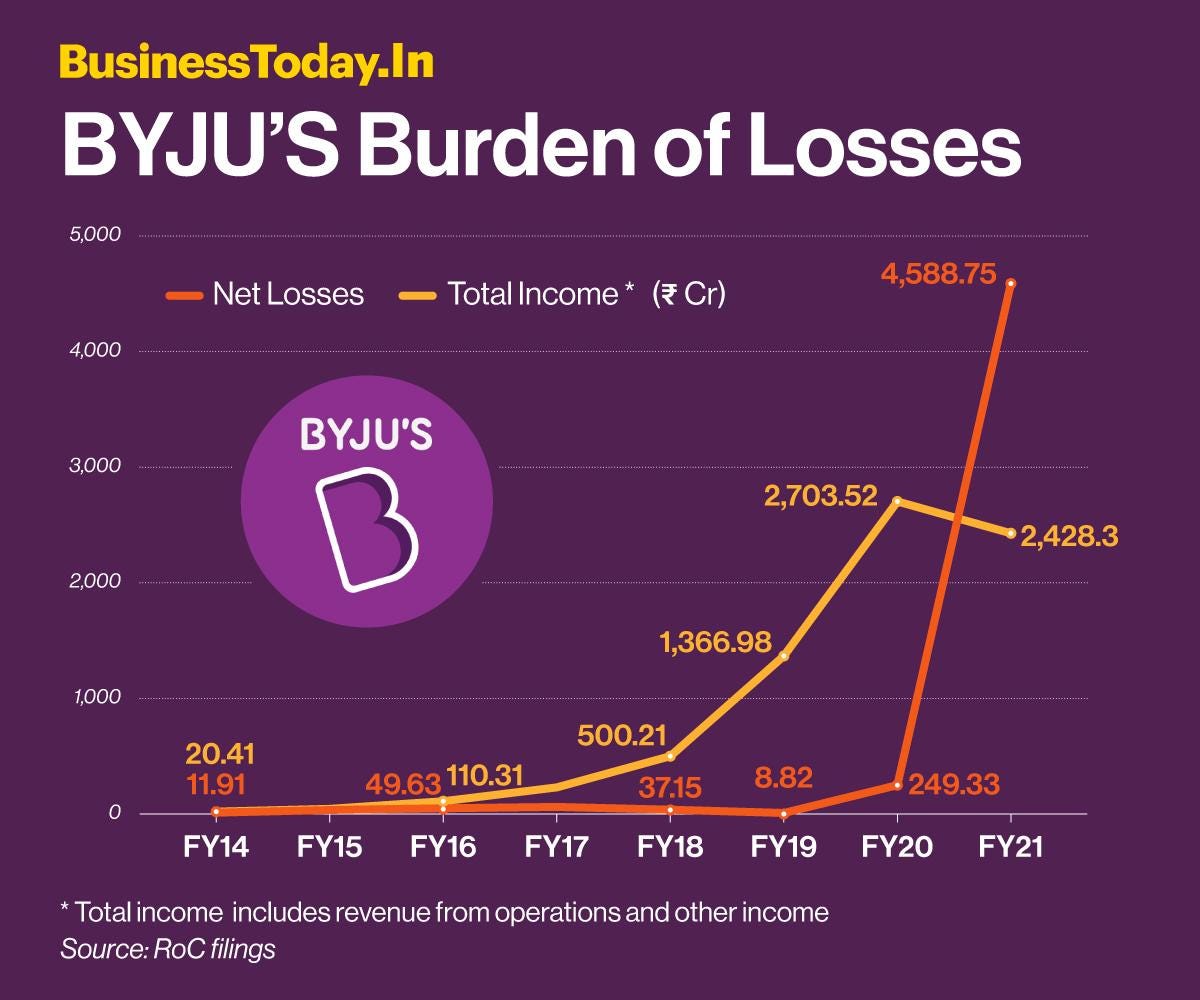

The cracks in Byju's facade became too glaring to ignore when the company's long-delayed financial results for the fiscal year ending March 2022 revealed a staggering net loss exceeding $1 billion. This dismal outcome prompted major investor BlackRock to slash Byju's valuation from $22 billion to a mere $1 billion, marking a significant decline in the company's worth.

To add insult to injury, Byju Raveendran, the mastermind behind Byju's success story, was ousted as CEO by disgruntled shareholders, including Prosus NV and Peak XV Partners. The company also initiated a series of layoffs as part of its restructuring efforts, signaling further troubles for the beleaguered startup.

The woes for Byju's did not stop there, as the company's foreign investments came under scrutiny from the Enforcement Directorate (ED) for alleged violations of the Foreign Exchange Management Act (FEMA) amounting to over Rs 9,362 crore. The ED even went as far as issuing a lookout circular against Byju's founder, adding another layer of complexity to the company's already tumultuous situation.

What Forbes said on Byju Raveendran?

"Only four people from last year's list dropped off this time, including former edtech star Byju Raveendran, whose firm Byju's was enveloped in multiple crises and its valuation was marked down by BlackRock to $1 billion, a fraction of its peak $22 billion valuation in 2022.", said Forbes.

Catalysts of Decline:

-

Financial Struggles and Investor Fears:

- Byju's revealed a massive net loss of over $1 billion for the fiscal year ending March 2022.

- Major investor BlackRock slashed Byju's valuation to just $1 billion, signaling significant financial concerns.

-

Leadership Turmoil and Regulatory Pressure:

- Shareholders ousted CEO Raveendran amidst worries about the company's direction.

- Byju's faced scrutiny from regulatory bodies, including the Enforcement Directorate, over alleged violations.

-

Downsizing Efforts and Employee Layoffs:

- Byju's initiated a restructuring plan in October 2023 to streamline operations and cut costs.

- Over 500 employees were laid off, and delayed salary payments led to further departures.

-

Financial Instability and Management Changes:

- Publication of delayed financial results exposed Byju's financial distress.

- BlackRock drastically reduced Byju's valuation to $1 billion, reflecting the severity of the situation.

-

Regulatory Scrutiny and Company Restructuring:

- Byju's parent company, Think & Learn, faced show-cause notices for alleged violations.

- A restructuring effort aimed at improving operations and cash flow exacerbated challenges, leading to investor concerns.

Billionaire Exodus: A Global Overview

China Takes the Biggest Hit

-

China experiences the most significant drop-offs in billionaire status due to economic challenges.

- Factors include slower economic growth, property market issues, declining foreign investment, and geopolitical tensions.

- 133 billionaires, including those from Hong Kong and Macau, fell off the list.

Key Figures Losing Ground

- Tang Binsen, founder of Chi Forest sparkling water company.

- Hui Ka Yan, chair of Evergrande Group.

- Wang Wenyin, whose shares in Amer International Group were frozen, causing a significant decrease in net worth.

Global Contrasts

- The United States, with the most billionaires, only saw eight individuals drop from the list.

- Japan followed with six, and Russia with five.

Sectoral Impact

- 49 individuals from the manufacturing sector lost billionaire status.

- Notable figures include Yang Jianliang of Shangji Automation and Pyotr Kondrashev, a Russian fertilizer producer-turned-investor.

- Healthcare saw 21 members leaving the list, mainly Chinese pharmaceutical moguls and medical device makers.

- Twenty tech billionaires, including Laurent Junique of TDCX and Jiang Long of Goertek Inc., also fell off the list.

Losses and Passings

- 32 billionaires passed away in the past year, including former Prime Minister of Italy Silvio Berlusconi, former President of Chile Sebastián Piñera, and Intel cofounder Gordon Moore.

- Other notable figures who lost billionaire status include Osman Kibar of BioSplice Therapeutics, Gary Lauder of Estée Lauder, and Luc Tack of Tessenderlo.

Despite reaching a new high in the number of billionaires, challenges in various sectors and regions resulted in significant shifts in rankings and net worth.

Notable Individuals Who Lost Billionaire Status

The past year witnessed the downfall of several prominent figures from the billionaire ranks. Here's a rundown of some high-profile individuals who experienced a significant decline in net worth as of March 8, 2024:

-

Wang Wenyin

- Net Worth: Less than $800 million (down from $19 billion)

- Source of Wealth: Real estate

- Citizenship: China

- Details: A Chinese court enforced a three-year freeze on Wang's stake in metals giant Amer Holding due to contractual disputes, resulting in his removal from the billionaires list.

-

Rene Benko

- Net Worth: $0 (down from $6 billion)

- Source of Wealth: Real estate, retail

- Citizenship: Austria

- Details: Benko lost his billionaire status after his real estate firm Signa Holding filed for insolvency amidst debt, with key subsidiaries also undergoing insolvency proceedings.

-

Hui Ka Yan

- Net Worth: About $700 million (down from $3 billion)

- Source of Wealth: Real estate

- Citizenship: China

- Details: Hui's property development company Evergrande Group encountered fines and liquidation, precipitating a significant decline in his net worth.

-

Osman Kibar

- Net Worth: About $750 million (down from $1.7 billion)

- Source of Wealth: Biotech

- Citizenship: U.S.

- Details: The value of Kibar's biotech business witnessed a substantial decrease, adversely affecting his net worth.

-

Gary Lauder

- Net Worth: About $960 million (down from $1.3 billion)

- Source of Wealth: Estée Lauder

- Citizenship: U.S.

- Details: A decline in Estée Lauder's share price impacted the fortunes of the Lauder family, including Gary Lauder.

-

Luc Tack

- Net Worth: Less than $900 million (down from $1.2 billion)

- Source of Wealth: Textile, chemicals

- Citizenship: Belgium

- Details: Tack's company faced challenges amid decreasing demand, resulting in a decline in his net worth.

-

Ryan Breslow

- Net Worth: Less than $100 million (down from $1.1 billion)

- Source of Wealth: E-commerce software

- Citizenship: U.S.

- Details: Breslow's company, Bolt, experienced a significant decrease in value, leading to his loss of billionaire status.

India's Top 10 Richest Individuals According to Forbes World's Billionaires List 2024

Forbes World's Billionaires List 2024 features India's 10 wealthiest individuals:

- Mukesh Ambani — net worth $116 billion

- Gautam Adani — net worth $84 billion

- Shiv Nadar — net worth $36.9 billion

- Savitri Jindal — net worth $33.5 billion

- Dilip Shanghvi — net worth $26.7 billion

- Cyrus Poonawalla — net worth $21.3 billion

- Kushal Pal Singh — net worth $20.9 billion

- Kumar Mangalam Birla — net worth $19.7 billion

- Radhakishan Damani — net worth $17.6 billion

- Lakshmi Mittal — net worth $16.4 billion

From riches to rags, Byju's journey serves as a cautionary tale for startups everywhere. The company's spectacular downfall serves as a stark reminder that success in the fast-paced world of startups is fleeting and can easily slip away if not carefully nurtured and protected. Byju's may have once been the poster child for India's booming ed-tech industry, but its fall from grace serves as a sobering lesson in the harsh realities of the business world.

With inputs from The Economic Times

Image source: Multiple agencies

© Copyright 2024. All Rights Reserved Powered by Vygr Media.