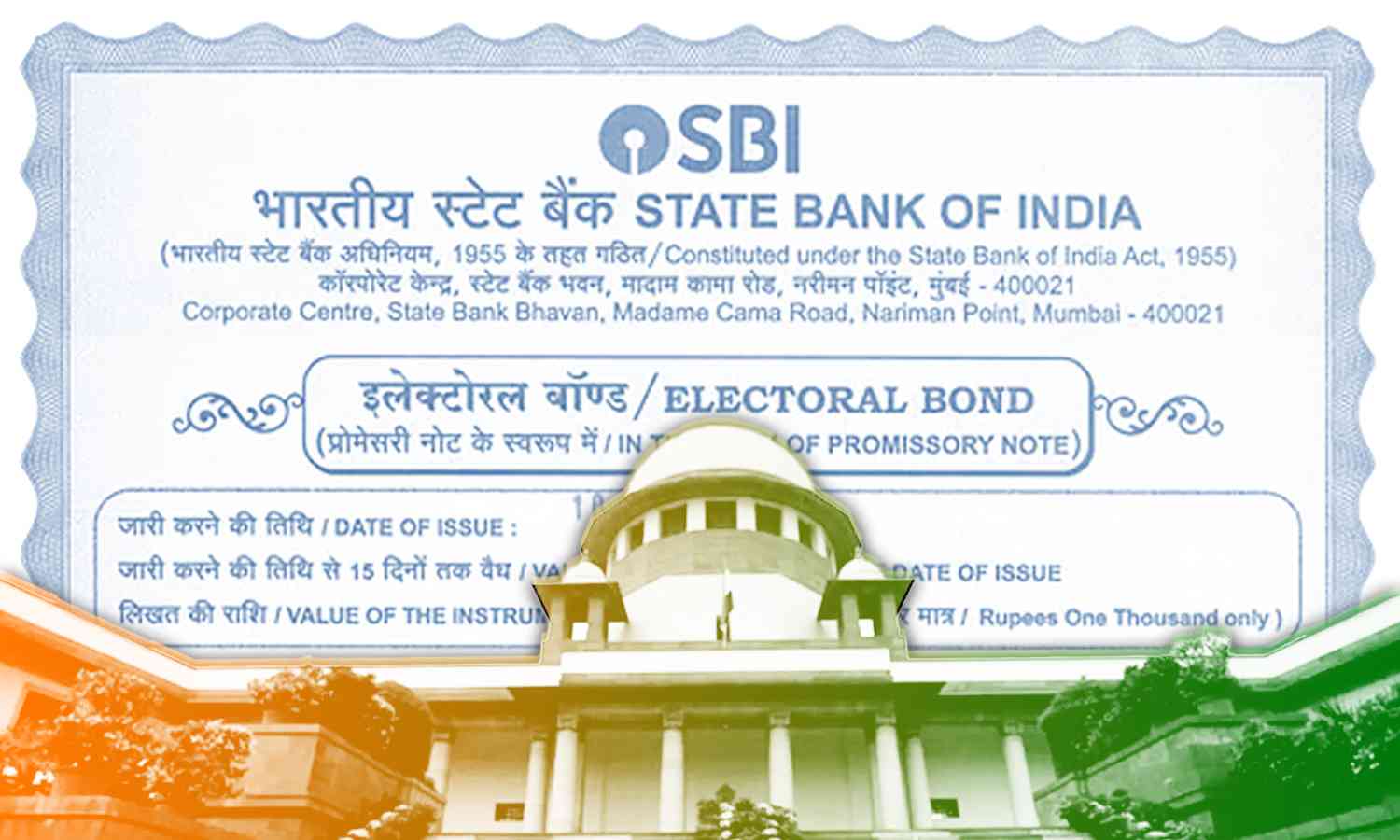

Yesterday, as households across India settled into their post-dinner routines, either engaging in spirited discussions on politics, religion, or neighbourhood gossip or winding down with their favourite prime-time television shows, a significant event unfolded. It wasn't the lavish spectacle of an Ambani wedding but rather the release of what can only be described as a monumental budget—India's Electoral Bond Data—by the Election Commission of India. This move, prompted by a directive from the Supreme Court, aimed to bring transparency to the murky world of political finance.

The Election Commission's disclosure has sparked a flurry of activity reminiscent of a detective thriller, with citizens and analysts poring over the data, uncovering intriguing details about the elusive "electoral bonds" that have captured our attention.

For more on this,read:Electoral Bonds: ECI Discloses Electoral Bond Data For Public Respecting SC Orders

Picture this: The online realm transforms into a hub of sleuths, each eager to uncover the secrets hidden within the data.

From the eye-catching contributions of prominent figures like Ms. Moneybags Mohanty (a staggering ₹45 crore!) to the enigmatic Mr. Casino (an astonishing ₹1,368 crores!), it's evident that political funding is no mere game—it's high-stakes poker played on a national scale!

But it's not just the titans of industry making waves; even fledgling (up-and-coming) companies are diving headfirst into the political arena, their bond purchases serving as a rite of passage into the business world.

BJP, topping the list at a whopping '₹11,562,00,00,000' Congress, AIADMK, BRS, Shiv Sena, TDP, YSR Congress, DMK, JDS, NCP, Trinamool Congress, JDU, RJD, AAP, and SP are among the political parties that have received funding through electoral bonds but seem pretty far behind.

Enter the courtroom drama: The release of the Electoral Bond Data has set the stage for a legal showdown, with the Supreme Court casting a critical eye and the State Bank of India caught in the crossfire.

On March 11th, SBI, asking for an extension to release the 'already under lock and key' data, poked the bear, a.k.a. the Supreme Court, which led to a public shaming and submission of the data the very next day to the Election Commission of India.

Coming to today, March 15th, The Supreme Court again had to act like the 'Patriarchal authority' of the house, with Chief Justice Chandrachud saying right at the outset of the hearing

"Who is appearing for the State Bank of India? They have not disclosed the bond numbers. It has to be disclosed by the State Bank of India,"

reminding SBI that their data is still incomplete.The court has asked the bank to explain the lapse during the next hearing on March 18. The electoral bond numbers would help establish the link between donors and political parties.

Markets Seeing Red

It should surprise no one that the markets have reacted poorly to all the speculation, especially if the supposed scandal looming in the horizon directly involves the biggest players in the sector. SBI's stocks have been grinding the lower circuits for days now, and today was no different either. It would be interesting to see if FMCG pulls the NSE out of the dip, or will the markets keep nosediving till the elections are over.

Yet amidst the chaos, there is a glimmer of hope

This data release has created transparency that is like a lighthouse piercing the night. There is hope that accountability may finally be possible as the country struggles with the disclosures. And even with all of this story's twists and turns, there's space for humour and levity—a little shared laughter in between the severity.

So let's toast to the stubborn investigators, tough attorneys, and every person who wants political financing openness. Let's remember to have silly fun with the absurdity of the money while we negotiate the intricacies of India's voting system; perhaps this will open the door to a more promising and responsible future for politics.

ⒸCopyright 2024. All Rights Reserved Powered by Vygr Media.