The Reserve Bank of India (RBI) has made significant decisions regarding Paytm Payments Bank Ltd (PPBL), extending deadlines and outlining specific business restrictions. In a recent notification, the RBI announced an extension of deadlines for certain services until March 15, 2024, shifting from the initial deadline of February 29, 2024.

Image Source: Equitypandit

PPBL Business Restrictions Where Deadline Extended Till March 15

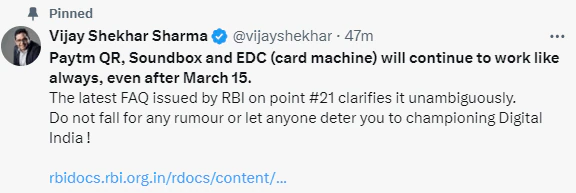

The RBI directive specifies that after March 15, 2024, no further deposits, credit transactions, or top-ups will be permitted in customer accounts, prepaid instruments, wallets, FASTags, National Common Mobility Cards, etc. This extension provides a window for users to manage their funds and transactions until the new deadline.

Additionally, banking services such as fund transfers (including AEPS, IMPS, etc.), BBPOU, and UPI facilities will cease to be provided by PPBL after March 15, 2024. Customers are advised to plan their financial activities accordingly to avoid any inconvenience.

Image Source: The Economic Times

PPBL Business Restrictions Where Deadline Is Same As February 29

Certain services will maintain the original deadline of February 29, 2024. Customers will still be able to withdraw or utilize balances from their accounts, including savings bank accounts, current accounts, prepaid instruments, FASTags, National Common Mobility Cards, etc., without any restrictions, up to their available balance.

The Nodal Accounts of One97 Communications Ltd and Paytm Payments Services Ltd maintained by PPBL are to be terminated no later than February 29, 2024. Furthermore, all pipeline transactions in nodal accounts initiated on or before February 29, 2024, must be settled by March 15, 2024, with no further transactions permitted thereafter.

The RBI emphasizes facilitating seamless withdrawals for customers, ensuring minimal inconvenience. Withdrawals up to the available balance should be facilitated from all accounts and wallets, except those frozen or lien marked by Law Enforcement or judicial authorities.

Moreover, the bank is directed to ensure a smooth withdrawal process for customer deposits parked with partner banks under the automatic 'sweep-in sweep-out' facility.

This decision by the RBI follows its previous directive on January 31, 2024, which barred PPBL from accepting deposits or top-ups in any customer accounts, wallets, FASTags, and other instruments after February 29, 2024.

The extension of deadlines and clarification of business restrictions by the RBI provide clarity for PPBL customers to navigate their financial transactions effectively. Customers should stay updated with further communications from PPBL and the RBI to ensure a seamless transition.

You can check out the complete FAQs: RBI extends Paytm Payments Bank deadline, releases customer FAQs

You may want to read:

Paytm Crackdown: How Walmart And Google Are Seizing The Opportunity?

RBI Bars Paytm Payments Bank's Transactions After Feb 29. What Does It Mean For Customers?

© Copyright 2024. All Rights Reserved Powered by Vygr Media.