The Indian stock market faced turbulence as Hindenburg Research intensified its allegations against SEBI chief Madhabi Puri Buch and the Adani Group. The US-based short-seller's fresh claims of conflicts of interest have sparked a political storm and market volatility, putting India's financial regulatory framework under scrutiny.

Hindenburg's Allegations

Hindenburg Research claims that whistleblower documents reveal that Buch and her husband had stakes in offshore entities implicated in the Adani money-syphoning scandal. These entities allegedly facilitated questionable financial activities by Vinod Adani, brother of Gautam Adani. The firm argues that this involvement creates a significant conflict of interest, given Buch's role as SEBI chief responsible for investigating the Adani Group.

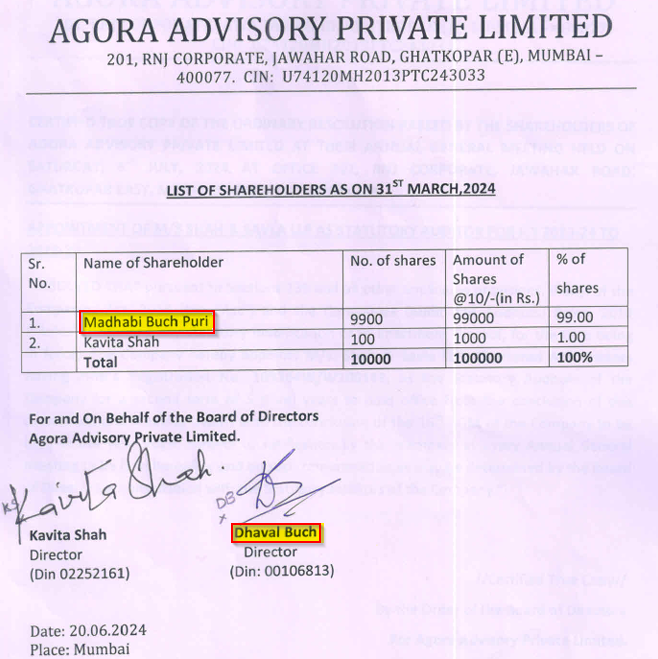

Hindenburg also accused Buch of maintaining active consulting firms while serving as SEBI chief. It questioned the transparency of Buch's consulting companies, which she set up during her time in Singapore. One of these companies, Agora Advisory Limited (India), remains 99 percent owned by Buch and generates revenue while she oversees investigations into the Adani Group.

Response from the Buchs

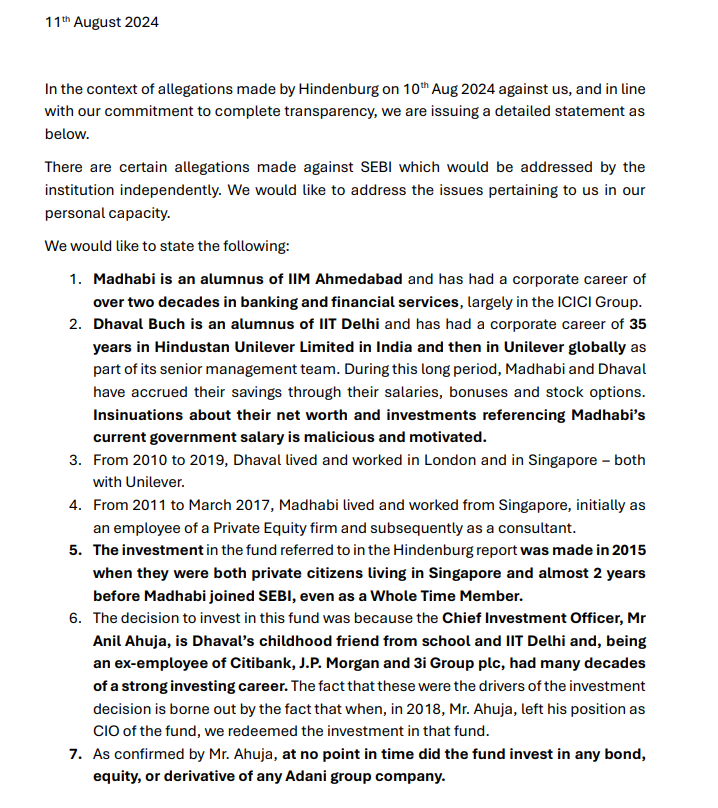

In a detailed statement, Madhabi Puri Buch and her husband categorically denied the allegations, labelling them as "baseless" and "without merit." Buch emphasised her commitment to transparency and integrity, outlining that the fund in question never invested in Adani securities. She clarified that the fund was managed by a childhood friend of her husband, who was then an Adani director, but that they held only a minor stake and had no influence over investment decisions.

Additionally, Buch provided a comprehensive disclosure of her consulting activities. She confirmed that all her consultancy operations were fully declared to SEBI and were conducted in a manner that avoided any conflict of interest. Buch also reiterated that she had recused herself from any investigation that might present a potential conflict.

Political Reactions

The report has ignited a political storm, with opposition leaders demanding thorough investigations. Rahul Gandhi, Leader of the Opposition in the Lok Sabha, called for a Joint Parliamentary Committee (JPC) inquiry. He expressed concerns over the integrity of SEBI and the potential risks to the Indian stock market, emphasising the need for accountability if investors' money is at stake.

Congress president Mallikarjun Kharge echoed these sentiments, stressing the importance of protecting small and medium investors. Other political figures, including Sitaram Yechury of the CPI (M) and D. Raja of the CPI, also called for a JPC probe.

The integrity of SEBI, the securities regulator entrusted with safeguarding the wealth of small retail investors, has been gravely compromised by the allegations against its Chairperson.

Honest investors across the country have pressing questions for the government:

- Why… pic.twitter.com/vZlEl8Qb4b — Rahul Gandhi (@RahulGandhi) August 11, 2024

SEBI's Defence

SEBI defended its handling of the Adani-Hindenburg matter, stating that 23 out of 24 investigations are complete, with the final one nearing closure. The regulator attributed the lengthy process to cumbersome enforcement procedures. SEBI also initiated proceedings against Hindenburg Research, accusing the firm of misleading disclosures for profit through short selling.

SEBI Statement on Hindenburg Research’s Report: August 10, 2024

SEBI noted the report published by Hindenburg Research and advised investors to remain calm and exercise due diligence. SEBI highlighted that the report mentions Hindenburg Research’s short positions in the securities covered, implying a potential conflict of interest.

SEBI clarified its actions regarding the Adani Group, noting that it had completed 22 out of 24 investigations, with one more investigation completed in March 2024 and the last nearing completion. The regulator issued over 1,100 letters and emails, more than 100 summonses, and examined around 12,000 pages of documents during the investigation. SEBI emphasised that enforcement proceedings are quasi-judicial and follow due process, including show cause notices and hearings before any public orders are issued.

Regarding the show cause notice to Hindenburg Research issued on June 27, 2024, SEBI asserted that it followed due process of law. The show cause notice alleged securities law violations by Hindenburg Research, and the proceedings are ongoing in compliance with legal principles.

SEBI also addressed allegations about the SEBI (REIT) Regulations 2014, stating that amendments to these regulations follow a robust consultation process involving industry feedback, advisory committees, and public input. SEBI reiterated its commitment to transparency and the integrity of India’s capital markets.

Stock Market Overview: August 12, 2024

Morning Session Performance

The Indian stock market experienced significant fluctuations in the morning session. The S&P BSE Sensex opened lower, dropping 409.24 points to 79,296.67. Similarly, the Nifty50 began the day in negative territory at 24,320.05, down by 47.45 points. Major sectoral indices, including Nifty Metal, PSU Bank, and Energy, were in the red, with Nifty Metal falling over 1.4%.

Detailed Adani Group Stock Performance

The Adani Group stocks experienced a tumultuous trading session. Adani Enterprises saw a drop of 4.45%, closing at Rs 2,327.25, while Adani Ports and SEZ declined by 5.23% to Rs 676.55. Adani Green Energy plummeted 5.41% to Rs 854.80. Adani Transmission also faced a significant dip, ending the day at Rs 2,356.45, down 4.91%. Adani Wilmar wasn't spared either, falling 3.84% to Rs 450.75.

The decline in Adani stocks followed a pattern of volatility observed since Hindenburg Research's initial report. The company's market capitalization has been significantly impacted, raising concerns among investors about the group's stability and future prospects.

For more on the Adani-Hinderburg: Adani-Hindenburg-Sebi Saga: A Timeline and Recent Events

Top Gainers and Losers

Despite the overall market downturn, some stocks performed well. Asian Paints, Tata Motors, Tech Mahindra, Bharti Airtel, Maruti Suzuki India, HDFC Bank, Sun Pharma, and Infosys emerged as top gainers in the S&P BSE Sensex. On the other hand, Adani Ports led the list of losers, followed by NTPC, Power Grid, State Bank of India, ICICI Bank, HCL Tech, Nestle India, TCS, Hindustan Unilever, and Titan.

Mid-Market Recovery

By midday, the Sensex and Nifty managed to pare some of their early losses. The Sensex recovered approximately 700 points from its intraday low, while the Nifty breached the 24,400 mark. Broader indices such as the Nifty Smallcap 100 and Midcap 100 showed mixed performance, with the Smallcap index turning slightly positive.

Sectoral Performance

All major sectoral indices remained in the red, reflecting the broader market sentiment. The Nifty Metal, PSU Bank, and Energy indices saw significant declines. However, the Nifty IT index showed some resilience, with a slight positive movement (source).

Key Stocks to Watch:

Sensex, Nifty recover from early lows; Sensex up 286 points at 79,992; JSW Steel, Grasim shine on Nifty#Share #sharemarket #sharemarketindia #Nifty #market #nifty50 #MarketUpdate #Trending #BreakingNews #LatestNews #Adani pic.twitter.com/G2ueGcSC4f — VYGR | News App (@Vygrofficial) August 12, 2024

Conclusion

As the controversy unfolds, the Indian stock market remains on edge, with Adani Group stocks bearing the brunt of investor concerns. The allegations against SEBI's chief have added a new dimension to the ongoing Adani-Hindenburg saga, raising questions about regulatory oversight and market integrity. With political pressure mounting for a thorough investigation, the coming days are crucial for restoring investor confidence and maintaining the stability of India's financial markets.

Inputs by Agencies

Image Source: Multiple Agencies

Ⓒ Copyright 2024. All Rights Reserved Powered by Vygr Media.

-

Ola Electric: The stock hit a 20% upper circuit for the second consecutive day, crossing the Rs 100 mark.

-

Jubilant FoodWorks: Surging 8% to hit a two-year high following strong Q1 results.

-

Inox Wind: The stock rose by 9% as brokerages raised their targets, expecting strong execution.

-

NBCC: Won orders worth Rs 720 crore, boosting investor sentiment.