One more addition to Byju's crisis!

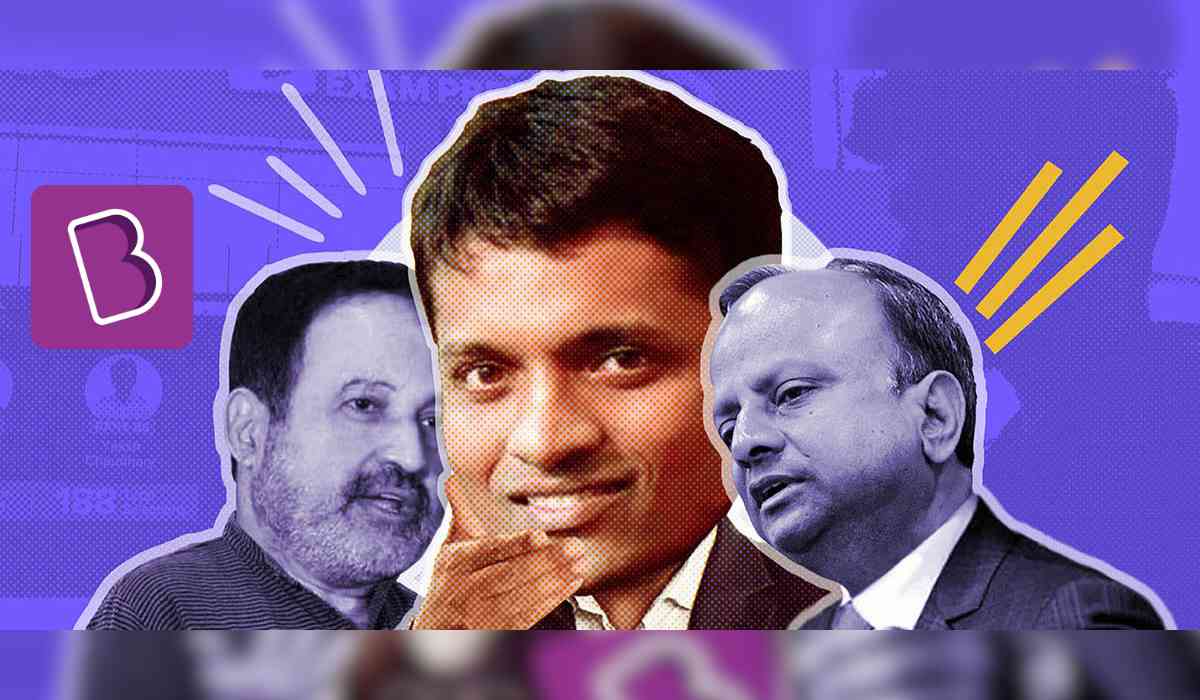

Former State Bank of India chief Rajnish Kumar and former Infosys chief financial officer TV Mohandas Pai have opted not to renew their contracts with the troubled edtech company Byju’s. Their one-year tenure on the advisory panel concludes on June 30, after which they will exit their roles.

Reasons for Exiting

As per reports, Kumar and Pai have informed Byju’s founder, Byju Raveendran, of their decision. Their departure follows a series of high-profile board exits and ongoing financial difficulties that have embroiled the company in legal disputes. According to an unnamed executive cited in the report, the primary reason for their departure is the numerous lawsuits the company faces in both India and the US from creditors and key shareholders, who are demanding Raveendran's removal due to alleged mismanagement.

Advisory Panel's Role and Challenges

The advisory panel, which included Kumar and Pai, was created to reassure investors concerned about Byju’s future amidst its escalating legal challenges. The panel's main objectives were to push for transparency in Byju’s financial disclosures, assist Raveendran in restructuring the team, and improve communication with shareholders. Despite initial progress, the company soon found itself entangled in various legal issues, complicating the advisory board's efforts. Additionally, the panel worked on expanding the board and altering the board committee's composition to better navigate these challenges.

BYJU'S Statement

Byju Raveendran acknowledged that while their plans faced delays due to legal challenges, he expressed gratitude for the invaluable support and guidance from Rajnish Kumar and Mohandas Pai. Despite setbacks caused by litigations from certain foreign investors, Raveendran emphasized his reliance on the ongoing counsel provided by Kumar and Pai in navigating the company's rebuilding phase, which he personally leads.

In a joint statement released on Sunday, Kumar and Pai concurred "Based on our discussions with the founders, it was mutually decided that the tenure of the advisory council should not be extended. Though the formal engagement concludes, the founders and the company can always approach us for any advice. We wish the founders and the company the very best for the future.” However, their involvement has reportedly been on a fixed-term basis.

BYJU'S Challenges

-

Initial Valuation Decline:

-

Byju’s, once hailed as a leading startup with a remarkable valuation of $22 billion in 2022, faced a substantial devaluation to $1 billion by Blackrock, a significant investor in the company.

-

-

Investor Reactions:

-

Sequoia Capital, now known as Peak XV Partners, followed suit by depreciating its investment in Byju’s.

-

-

Board Resignations:

-

The departure of key figures from Byju’s board, including GV Ravishankar of Peak XV Partners, Vivian Wu of Chan Zuckerberg Initiative, and Russell Dreisenstock of Prosus, was attributed to concerns over inadequate corporate governance practices.

-

-

Auditor Resignation:

-

Deloitte, the statutory auditor of Byju’s, resigned citing delays in the provision of necessary company details.

-

-

Leadership Changes and Layoffs:

-

Byju’s witnessed significant organizational shifts as its chief executive, Arjun Mohan, stepped down alongside the layoff of thousands of employees and delayed salary payments.

-

-

Legal Challenges:

-

The company faced multiple insolvency proceedings before the National Company Law Tribunal, exacerbating its challenges.

-

-

Capital Restrictions:

-

Despite the approval of a $200-million rights issue by Byju’s shareholders, the company’s access to these funds remains restricted pending the conclusion of ongoing court hearings

-

With the exit of seasoned executives Kumar and Pai, Byju’s finds itself at a critical juncture, grappling with lawsuits and governance issues, signaling a challenging road ahead as it strives to rebuild and chart a course towards stability and recovery.

You may also like to read: Byju Raveendran Among Billionaires Who Plummeted To Bankruptcy

With inputs from agencies

Image Source: Multiple agencies

© Copyright 2024. All Rights Reserved Powered by Vygr Media.