-

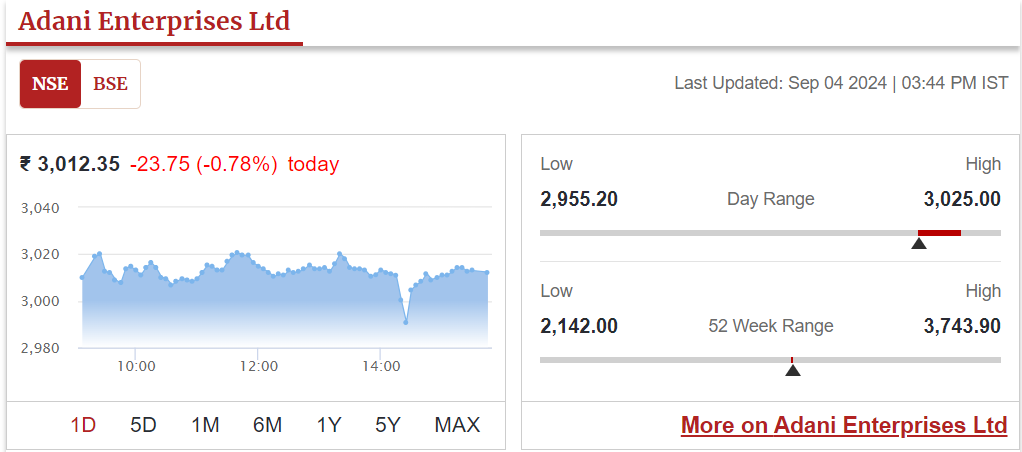

₹800 Crore Bond Issue: Adani Enterprises aims to raise up to ₹800 crore through its first bond issuance targeted at individual investors.

-

Investor Segmentation: The issuance allocates 60% for high-net-worth and retail investors, 30% for non-institutional investors like corporates, and 10% for institutional buyers.

-

Recovery Test Post-Hindenburg: The bond sale tests investor confidence in Adani’s recovery after the Hindenburg report in January 2023 caused a sharp decline in the group’s shares and bonds.

-

Diverse Fundraising Efforts: Adani has resumed its growth strategy, including potential fresh fundraising through share sales after overcoming previous challenges.

-

Bond Features: The bonds have tenures of two, three, and five years, offering yields between 9.25% and 9.90%.

-

Use of Funds: At least 75% of the proceeds will be used to repay or prepay existing debt, with the rest earmarked for general corporate purposes.

Image Source - Business Today

Adani Enterprises Ltd., the flagship company of Gautam Adani's conglomerate, has opened its first bond issuance targeted at individual investors. The sale of bonds started on Wednesday and is an attempt to give the funding sources of the diversified group a broader base after the turbulent times that the company saw last year.

Details of the Bond and Allocation

The company will raise proceeds of up to ₹800 crore or about $95.3 million through the issue. Sixty percent of the amount is reserved for high-net-worth and retail investors, according to the prospectus. Thirty percent will be allocated for non-institutional investors, including corporations; 10% be assigned to institutional buyers.

Test of Investor Confidence

These bond sales form part of Adani's plan to raise money through different channels. A successful deal would indicate investors are confident in the group's prospects for recovery after January 2023 allegations of corporate misconduct by the Hindenburg Research report. Those claims led to a significant decline in the shares and bonds of Adani, although the group denied it had committed any wrongdoing.

Image Source - Business Standard

Past Fundraising and Future Plans

Adani Enterprises had earlier planned a ₹1,000 crore public bond sale in January last year shelved after the Hindenburg allegations. The group has restarted its growth trajectory since then starting to pursue new fundraising avenues likely including share sales for its flagship unit after recently selling shares in its power utility. Last month, the group said it has enough cash to cover debt payments for more than 30 months in what has been seen as an attempt to ameliorate concern about its liquidity risks.

Bond Features and Use of Proceeds

The bonds being offered are of tenures of two, three, and five years and yield between 9.25% and 9.90%. The company would use at least 75% of funds raised in prepaying or repaying its debt and balance for general corporate purposes.

Inputs by Agencies

Image Source: Multiple Agencies

Ⓒ Copyright 2024. All Rights Reserved Powered by Vygr Media.