As India gears up for a cleaner and greener future, the electric vehicle (EV) industry is at the heart of this transformation. With the Indian government targeting 30% vehicle electrification by 2030, and policies like the Electric Mobility Promotion Scheme (EMPS) propelling industry growth, electric vehicle stocks are rapidly emerging as a lucrative opportunity for both seasoned and new investors.

What Are EV Stocks?

EV stocks in India represent companies that are involved in the manufacture of electric vehicles or the production of essential components such as batteries, charging stations, cables, and EV software. These firms are instrumental in reshaping the future of mobility and offer substantial opportunities for growth-oriented investments.

Why Invest in Electric Vehicle Stocks?

India's EV industry is being driven by a combination of environmental goals, technological advancements, and economic incentives. Here are the major benefits of investing in EV stocks:

-

Exposure to a Growing Market: BloombergNEF predicts that EVs will comprise 31% of global passenger vehicle sales by 2030.

-

Diversification: Investment can be spread across diverse industries such as renewable energy, battery manufacturing, and smart mobility.

-

Potential for High Returns: As the demand for EVs increases, related companies may witness a substantial rise in their stock value.

-

Environmental Benefits: Lower emissions and reduced reliance on fossil fuels align with global sustainability goals.

-

Favourable Government Policies: Incentives and subsidies are bolstering growth across EV-related sectors.

Segments of the EV Sector in India

The EV market can be categorised into several interdependent segments:

1. Electric Vehicle Producers

These companies design, manufacture, and sell electric vehicles across categories like two-wheelers, four-wheelers, and commercial vehicles.

2. Battery Manufacturers

These firms develop and supply energy storage solutions essential for EVs. Their innovations determine range, charging speed, and performance.

3. Vehicle Components and EV Software

Includes manufacturers of EV components such as motors, cables, electronic control units, and software for energy management and connectivity.

4. EV Charging Infrastructure

Focused on building a robust network of EV charging stations across urban centres and highways to enable seamless long-distance travel.

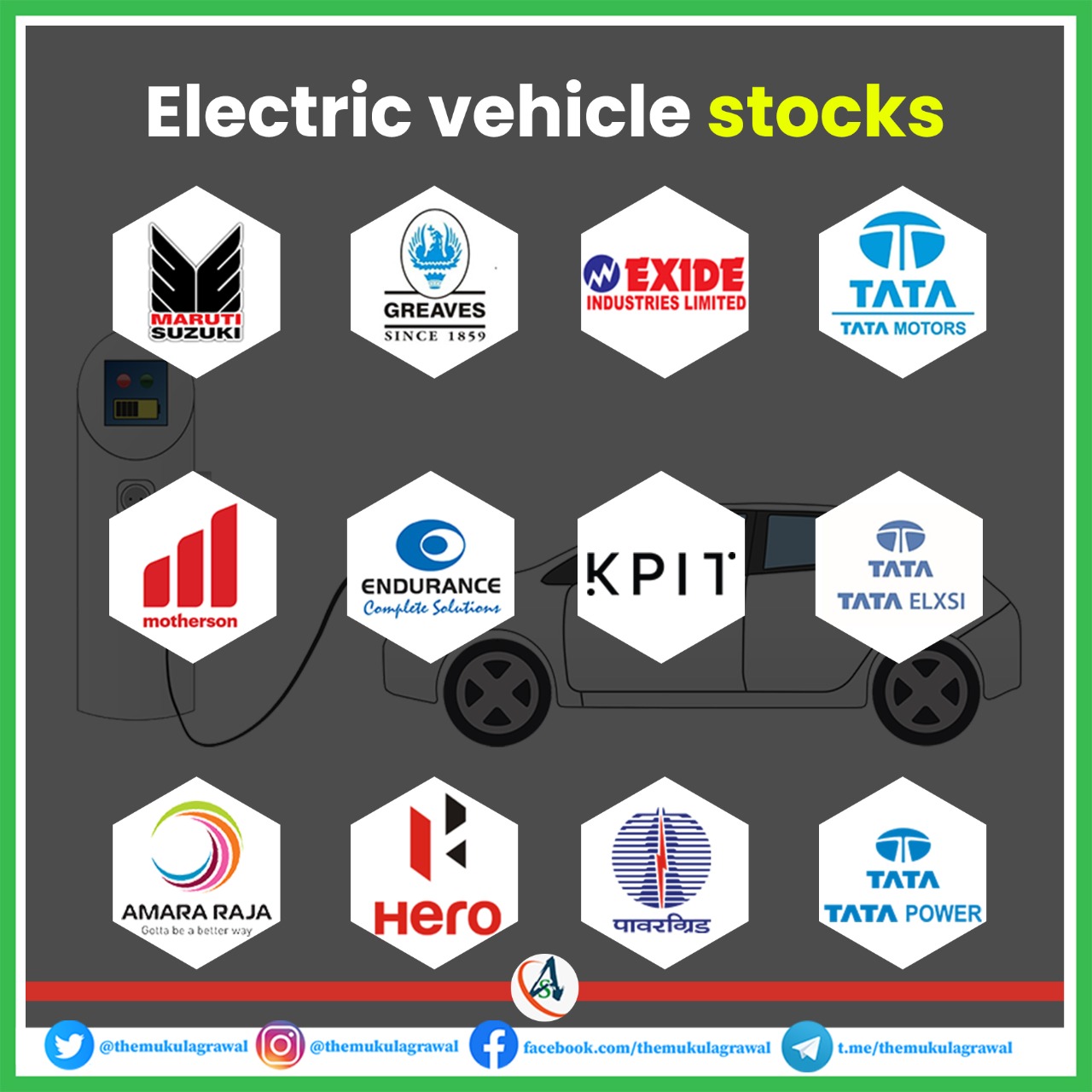

Top Electric Vehicle Stocks in India (2025)

Below is a detailed list of India's top EV-related companies, categorized by their core area of expertise:

Electric Vehicle Manufacturers

-

Tata Motors Ltd – Four Wheelers

-

Mahindra and Mahindra Ltd – Four Wheelers

-

Maruti Suzuki India Ltd – Four Wheelers

-

Ashok Leyland Ltd – Trucks & Buses

-

Hero MotoCorp Ltd – Two Wheelers

-

Olectra Greentech – Electric Buses

-

JBM Auto Ltd – Auto Parts and EV Manufacturer

Battery and Energy Storage

-

Amara Raja Energy & Mobility Ltd

-

Exide Industries Ltd

-

HBL Engineering

EV Components, Electronics & Software

-

Bosch

-

UNO Minda

-

Minda Corporation

-

Samvardhana Motherson International

-

Sona BLW Precision Forgings

-

Endurance Technologies

-

Gabriel India

-

Fiem Industries

-

Lumax Industries

-

Motherson Sumi Wiring India Ltd – Cables

-

Servotech Power Systems Ltd – Electrical Components

-

Tata Chemicals Ltd – Diversified Chemicals

-

Graphite India Ltd – Electrical Components

-

HEG – Graphite Electrodes

-

Himadri Speciality Chemical Ltd – Commodity Chemicals

Industrial & Engineering

-

Bharat Electronics

-

Bharat Forge

-

Greaves Cotton Ltd – Industrial Machinery

-

Ramkrishna Forgings

Technology & Consulting

-

KPIT Technologies Ltd – IT Services & EV Software

Metals & Mining

-

Hindalco Industries Ltd

-

Vedanta Ltd

-

Hindustan Copper Ltd

EV Infrastructure & Charging

-

Exicom Tele-Systems – Charging Infrastructure

-

Rattan India Enterprises

Features of Top EV Companies in India

When evaluating the best EV stock in India, consider the following key traits:

-

Strong Financials: Consistent profitability and positive cash flow.

-

Market Leadership: Strong brand presence and established customer base.

-

Experienced Management: Visionary leadership with domain expertise.

-

Diverse EV Range: Product offerings across multiple vehicle categories.

-

Technological Leadership: Innovation in battery tech, powertrains, and software.

-

Robust Supply Chain: Scalable and agile production capabilities.

-

Environmental Responsibility: Use of renewable energy and eco-friendly practices.

-

Wide Customer Reach: Extensive service and charging networks.

Indian Government’s Support for the EV Sector

A host of policies and incentives are fuelling the rise of EV stocks in India:

1. National Electric Mobility Mission Plan (NEMMP)

Launched in 2013 to promote electric and hybrid vehicles, the plan aims to invest ₹14,000 crore and reduce crude oil dependence by 9,500 litres.

2. FAME Scheme

The Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme is a government-backed initiative to incentivize EV manufacturing, demand, pilot projects, and charging infrastructure.

3. State EV Policies

Several states have introduced their own EV policies to promote adoption:

-

Delhi EV Policy

-

Maharashtra EV Policy

-

Tamil Nadu EV Policy

-

Andhra Pradesh EV Policy

-

Gujarat EV Policy

4. Public Charging Infrastructure

Target of setting up 69,000 public charging stations by 2025 to address range anxiety and promote EV usage across India.

5. Green Urban Transport Scheme (GUTS)

Provides financial assistance to cities for building sustainable public transport infrastructure, including EV facilities.

How to Invest in EV Stocks in India?

If you're considering adding electric vehicle shares to your portfolio, here’s a step-by-step guide:

-

Research the top EV companies listed on Indian stock exchanges.

-

Use platforms like Tickertape Stock Screener to filter companies based on over 200 investment metrics.

-

Open a Demat account via platforms like smallcase.

-

Place a Buy Order for selected EV stocks for long-term or short-term goals.

-

Consider investing in curated EV portfolios via smallcase, managed by SEBI-registered experts.

Who Should Invest in EV Stocks?

-

Long-Term Investors: Those looking for sustained capital appreciation.

-

Green Investors: Environmentally conscious investors aiming to support low-emission technologies.

-

Risk-Tolerant Individuals: EV stocks, while promising, may have short-term volatility.

-

Tech-Savvy Investors: Those who understand the EV ecosystem and want to stay ahead of the curve.

Factors to Consider Before Investing

Before diving into EV shares in India, keep these critical aspects in mind:

-

Policy Monitoring: Stay updated on government subsidies, tax incentives, and new regulations.

-

Market Potential: Analyze domestic demand, urbanization trends, and global EV adoption rates.

-

Mergers & Acquisitions: M&A activity may signal strength, expansion, or consolidation.

-

Company Fundamentals: Focus on financial stability, growth metrics, and innovation track records.

Final Thoughts

The Indian electric vehicle sector is no longer just an emerging market—it’s a powerful megatrend shaping the future of transportation. With major players like Tata Motors, Hero MotoCorp, and Exide Industries leading the charge, and a robust support system in place from the government, EV stocks in India for 2025 present a compelling opportunity.

Whether you’re an environmentally conscious investor or someone seeking high-growth sectors, the time to explore India’s electric vehicle revolution is now. A well-researched EV investment portfolio can not only drive returns but also power a cleaner, greener tomorrow.

With inputs from agencies

Image Source: Multiple agencies

© Copyright 2025. All Rights Reserved Powered by Vygr Media.