Do you remember your last trading experience? Nod if this sounds familiar: the market turned against you, your research fell short, or you hesitated long enough to miss the perfect entry point. We can feel the pain. But do you know that having Deepseek AI onboard in your trading journey can turn this scenario completely? In the rapidly evolving landscape of financial markets, traders are continually seeking innovative tools to gain a competitive edge. DeepSeek AI has emerged as a transformative force in trading, offering a suite of advantages that enhance decision-making, efficiency, and profitability.

It comes out as a trading assistant who is not influenced by clouds of emotions and never has a second thought. An ally that sifts through millions of data points in real-time, recognizing market patterns even the sharpest human minds would miss, and then executes with absolute conviction. This isn’t some distant vision, it’s the reality Deepseek AI is shaping today.

Financial markets are no longer a test of gut instinct and experience alone. They’re an arena where AI-driven strategies dominate, leaving manual traders struggling to keep up. The real question isn’t whether AI gives an edge—it’s whether you can afford to trade without it. You decide for yourself by the end of this.

Deepseek AI’s Edge in Trading: Smart Trading Over Clueless Guessing

DeepSeek AI excels in processing vast amounts of financial data, including news articles, earnings reports, and social media posts. By analyzing this information, it can detect market sentiments and trends in real-time, enabling traders to make informed decisions based on current market moods.

This capability is crucial for identifying bullish or bearish trends before they become apparent through traditional analysis methods.

The Limitations of Manual Trading: Relying on traditional methods leaves you exposed to:

Emotional Bias: Fear and greed distort decision-making, leading to avoidable losses.

Lagging Execution: Markets move in milliseconds—can you keep up?

Data Overload: With countless signals shaping the market, how much can you realistically track?

The platform automates both technical and fundamental analyses by identifying chart patterns and evaluating indicators such as moving averages, RSI, MACD, and Bollinger Bands. This automation allows traders to quickly scan multiple securities to uncover potential opportunities across various trading strategies, including swing, intraday, and positional trading.

Be honest– how many times have you second-guessed a trade, only to watch the market move exactly how you thought it would, after it was too late? Or worse, jumped in based on hype and ended up regretting it? The truth is, in today’s market, instinct alone won’t cut it. You need an edge.

Here Deepseek AI enters the frame.

DeepSeek AI assists in developing and coding trading algorithms, particularly in Python, for integration with platforms. It facilitates backtesting of strategies using historical data to assess profitability and optimize risk management parameters, such as stop-loss and take-profit levels. This support streamlines the creation of robust, data-driven trading strategies.

And before you say, "But there are so many AI tools out there, why Deepseek AI? " let’s see what Deepseek AI brings differently to the table of your trading.

Most trading algorithms rely on static strategies. They work well until market conditions change, and then they fall apart. Deepseek AI works differently. It doesn’t just follow trends; it learns, adapts, and evolves in real-time. It processes massive amounts of data—historical trends, live market feeds, even social media sentiment, and adjusts its strategies instantly. That’s something a traditional trading bot simply can’t do. For options traders, DeepSeek AI analyzes key metrics like Open Interest, Implied Volatility, and Option Greeks. This analysis aids in formulating strategies such as straddles, strangles, or iron condors, and in developing real-time trading bots for indices. By providing insights into options dynamics, DeepSeek AI enhances the precision and effectiveness of options trading.

Why Deepseek AI Over Everything Else?

Smarter Predictions – Unlike basic AI models, Deepseek AI uses both supervised and unsupervised learning. Thus, it not only recognizes known patterns but also uncovers hidden opportunities others miss.

No More Information Overload – Markets are flooded with noise—news, tweets, rumors. Deepseek AI filters out distractions and focuses on data that moves the market. Traders can leverage DeepSeek AI to create custom AI assistants or chatbots that deliver market insights, trade recommendations, and risk management advice.

Speed That Wins Trades – When milliseconds matter, Deepseek AI’s high-performance computing processes data and executes trades before the competition even reacts. These assistants can be integrated with tools like Excel or Google Sheets, automating financial data tracking and analysis, thereby reducing manual workload and increasing efficiency.

So clearly the market is getting smarter. If you’re not using Deepseek AI, someone else is, and they’re the ones profiting. One of DeepSeek AI's standout features is its cost-effectiveness. Developed with a relatively modest investment, DeepSeek AI offers advanced capabilities comparable to leading AI models but at a fraction of the cost. This affordability makes sophisticated AI tools accessible to a broader range of traders and financial institutions, democratizing access to cutting-edge technology.

AI is transforming the trading market by increasing both transaction volumes and liquidity. Due to AI’s ability to process orders much faster than humans can, as well as automatically placing them through APIs, AI is likely to boost liquidity further. If AI can place orders in real-time, it will also increase the likelihood of trades being executed without price manipulations and distortions. The practical benefits of DeepSeek AI are evidenced by its adoption among prominent financial firms. For instance, Tiger Brokers integrated DeepSeek's AI model, DeepSeek-R1, into its AI-powered chatbot, TigerGPT, enhancing market analysis and trading capabilities for its users. This integration reflects a broader trend of financial institutions embracing DeepSeek's AI solutions to transform operations and improve client services.

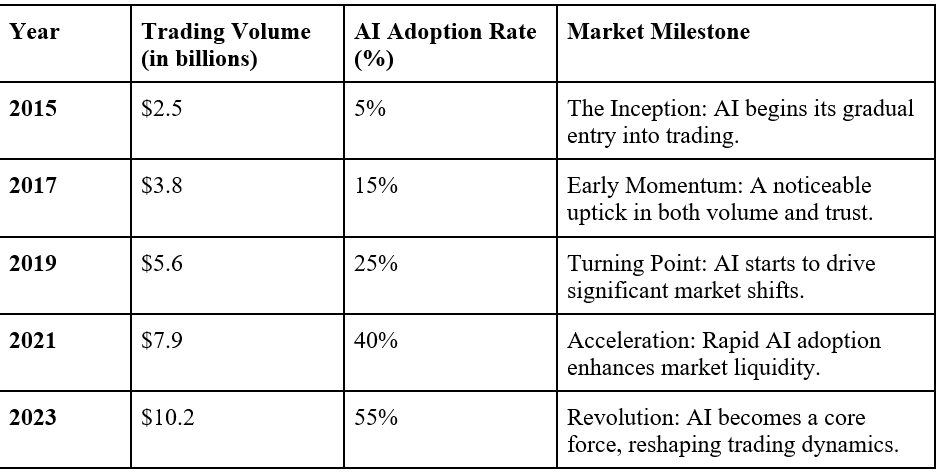

Curious to see the numbers behind the change?

Below is a data table that highlights the rising trading volumes in tandem with the growing adoption of AI technologies in financial markets.

The Tech Magic Behind DeepSeek AI In Trading

Based on real-time analytics and deep machine learning, Deepseek AI is intended to improve trading decisions by processing large volumes of data, forecasting market patterns, and carrying out trades effectively and precisely. Market movements might seem unpredictable, but there’s usually a pattern beneath the chaos. Deepseek AI taps into deep learning to analyze years of market data, helping traders spot trends they might otherwise miss.

Using conventional and recurrent neural networks (CNNs and RNNs), Deepseek AI uncovers hidden connections in price movements. It flags strange price shifts or odd trading behavior, pointing to potential risks or opportunities. Learning from past trends, it keeps getting better at forecasting market changes, giving traders an edge. Numbers are important, but news, earnings reports, and emotions of investors can really affect market changes. Deepseek AI integrates Natural Language Processing (NLP) to analyze text across various platforms, allowing traders to have a more comprehensive view of the market sentiment.

The AI scans headlines and other relevant news in order to flag events that could potentially shift the market. It analyzes Tweets, Reddit threads, and other forums to try and assess the general confidence or fear that investors are expressing. It analyzes the reports alongside the statements from the CEO to track any sentiment changes that may impact the company stock.

DeepSeek AI's emergence has intensified competition in the AI and financial sectors. Its innovative approach has challenged established players, prompting a reevaluation of AI development and deployment strategies. This competitive environment fosters innovation, leading to more advanced and cost-effective solutions for traders. In trading, timing is everything. Deepseek AI integrates high-frequency trading (HFT) algorithms, allowing it to execute trades within microseconds.

It places orders at optimal price points, reducing slippage and improving trade efficiency. Deepseek AI operates on low-latency infrastructure, ensuring trades are executed faster than human reaction times. By analyzing order book data, it identifies and capitalizes on liquidity gaps, securing better trading positions.

As uncomfortable market fluctuations happen, remember that you don’t always have to pay the price. Deepseek AI keeps your portfolio problem-free by applying intelligent risk management and fraud detection. The AI actively tracks risks and reallocates assets to maintain a balance in your investments. The system spots and deals with unordinary trading tendencies swiftly, thus helping to mitigate potential detrimental impacts on the portfolio.

Protection from losses is done in a much smarter way by Deepseek AI as it reacts to market changes to counterbalance the losses while eliminating undesirable market selloffs.

_1740281309.jpg)

What Future Holds For Deepseek AI in Trading and Is NVIDIA’s Reign at Risk Due To Deepseek AI in Trading?

For years, NVIDIA has been the kingpin of AI hardware in trading. It has been raking in billions, setting the gold standard, and practically dictating the terms of the AI arms race. But here’s the twist: What if cutting-edge AI models no longer need NVIDIA’s ultra-premium, high-margin chips? What if they can be trained just as efficiently on cheaper, more restricted alternatives? That’s a big problem for NVIDIA and investors are definitely paying attention. Could this be the first real challenge to its dominance? Or will NVIDIA find a way to stay ahead of the curve? Either way, the AI landscape just got very interesting and benefitting for traders.

Decentralized AI Being A Challenge for Wall Street?

The rise of decentralized AI models could change the story. Unlike traditional AI, which is managed by big financial companies, decentralized Deepseek AI runs on blockchain networks. This makes it open, clear, and less likely to be manipulated. Could this take power from Wall Street's elite and give regular investors better trading strategies? Some think this could create a fairer market, while others worry it might introduce new types of market manipulation. If AI-driven strategies are available to everyone, who ultimately benefits? Well, it will definitely benefit you if you could find a way to make the best match of AI and your years of trading experience.

So till now you must have figured out that it is not mindful to not have deepseek AI in your trading journey. If you are ready to come onboards, try the new tech on your palm top and see the wonder it does.

Note: This article is for informational purposes only and does not constitute financial advice. Investors should conduct their research or consult with a financial advisor before making investment decisions.

Disclaimer

Trading carries inherent financial risks, including the potential for significant losses. Historical data indicates that a substantial percentage of traders experience financial downturns. Names such as "AI Trading" mentioned on our site are fictitious and used solely for marketing purposes. Testimonials and featured media may include actors and are intended for promotional use only. Before engaging with any trading platform, we strongly advise reviewing its terms, conditions, and disclaimers. Additionally, ensure compliance with tax obligations related to capital gains in your jurisdiction, such as CFTC regulations in the US. In regions like the UK, financial regulations, including FCA Policy Statement PS20/10, impose restrictions on certain marketing practices for CFDs. Adhering to local financial laws is essential. By submitting your details, you agree to their use by third parties as outlined in our Privacy Policy and Terms and Conditions. Whether you trade independently, use automated trading software, or consult professional brokers, make informed decisions that align with your financial strategy.

Vygr News & Vygr Media Private Limited and its authors are not responsible for your actions and decisions on your trading activities.

© Copyright 2024. All Rights Reserved Powered by Vygr Media.