In a landmark ruling that could reshape the contours of American trade policy, the US Supreme Court has struck down former President Donald Trump’s sweeping global tariffs, delivering a major setback to his economic agenda. The 6-3 decision declared that Trump overstepped his legal authority by invoking emergency powers to impose broad import duties on virtually all US trading partners.

The judgment not only challenges the legality of the tariffs but also reasserts a core constitutional principle: the power to tax rests with Congress, not the executive branch. The fallout from the ruling is already reverberating through US political circles, global markets, and trade capitals — including New Delhi.

The Supreme Court’s 6-3 Verdict: A Constitutional Line Drawn

The Supreme Court ruled 6-3 that Trump’s tariffs, imposed under the 1977 International Emergency Economic Powers Act (IEEPA), were unlawful. The majority opinion found that the law — intended for genuine national emergencies — did not authorize the president to impose sweeping, across-the-board tariffs in peacetime.

The justices emphasized that the US Constitution clearly allocates taxing authority to Congress. Quoting the Framers, the Court observed that Congress alone has “access to the pockets of the people.” In other words, the executive branch has no inherent authority to levy tariffs outside of clearly defined statutory powers.

The Court underscored several key points:

-

The president asserted “extraordinary power to unilaterally impose tariffs of unlimited amount, duration, and scope.”

-

Given the breadth and constitutional context of that claim, clear congressional authorization was required.

-

The government conceded that the president has no inherent authority to impose tariffs during peacetime.

-

The administration did not defend the tariffs as an exercise of war-making powers.

-

“The United States, after all, is not at war with every nation in the world.”

-

The challenged tariffs were “unbounded in scope, amount, and duration.”

-

When Congress grants tariff authority, it does so explicitly and with constraints — which it did not do in this case.

The majority concluded that had Congress intended to grant the “distinct and extraordinary power” to impose tariffs through IEEPA, it would have said so explicitly, as it has in other tariff statutes.

Justices Divided: Unusual Alliances on the Bench

The ruling reflected an unusual alignment on the Court. Three liberal justices joined three conservatives to form the majority, upholding lower court decisions that had already deemed the tariffs illegal.

In dissent were conservative Justices Brett Kavanaugh, Clarence Thomas, and Samuel Alito, who disagreed with the majority’s interpretation of executive authority under IEEPA.

The decision reinforces the principle that even in areas traditionally seen as executive-heavy — such as foreign policy and national security — the constitutional separation of powers remains intact.

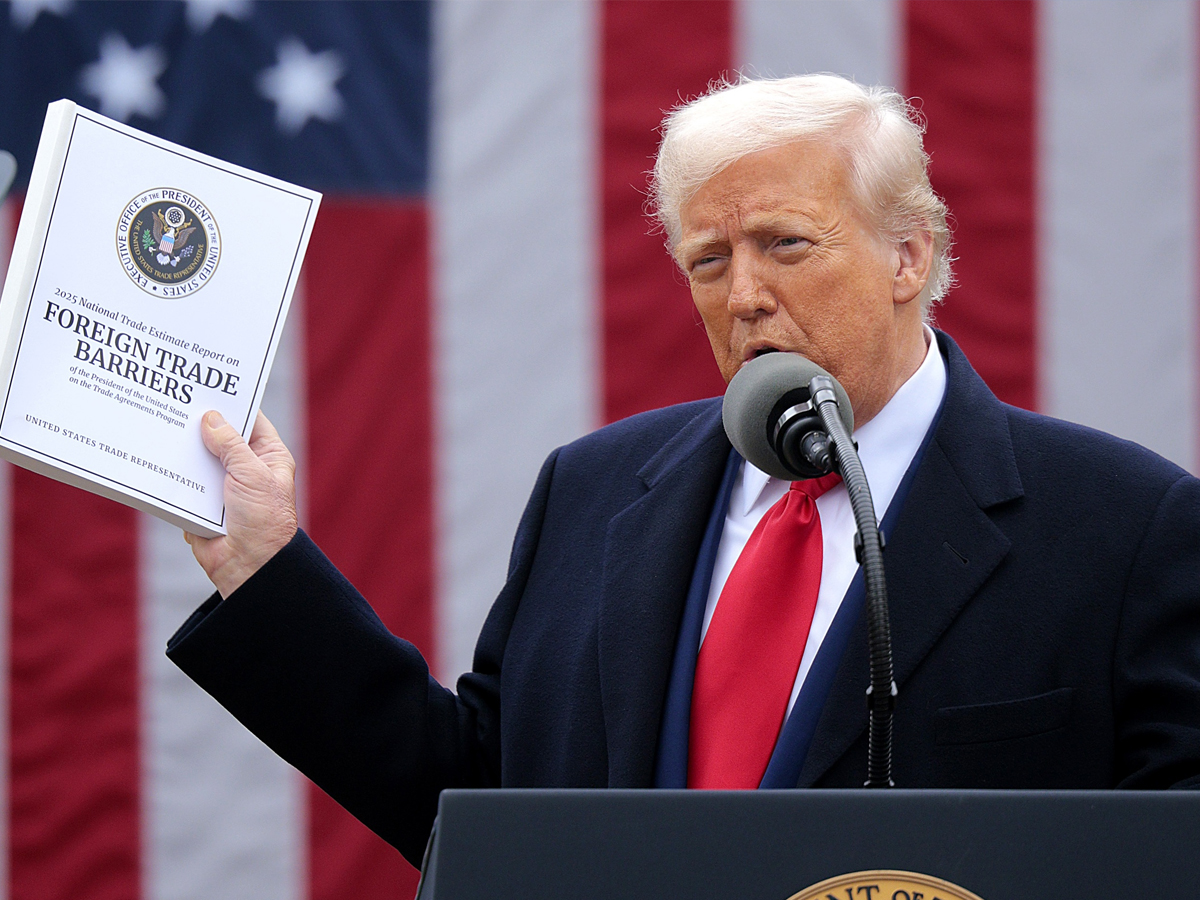

Trump’s Tariff Strategy: Emergency Powers as Economic Leverage

In April 2025, Trump announced what he described as “reciprocal” tariffs on most countries, declaring trade deficits a national emergency. He framed the move as essential to safeguarding US economic security and argued that without such measures, the country would be “defenceless and ruined.”

Tariffs were central to Trump’s economic and diplomatic strategy. Across both his terms, he used import duties as a tool to pressure trading partners, reshape supply chains, and influence negotiations.

However, critics argued that invoking IEEPA — a law designed to address extraordinary national emergencies — to impose blanket tariffs amounted to stretching the statute beyond its intended purpose. Small businesses and a coalition of US states challenged the policy in court, claiming it effectively gave the president a blank cheque to impose taxes, a power constitutionally reserved for Congress.

The Economic Stakes: $133 Billion Collected, $3 Trillion Impact Estimated

The financial consequences of the tariffs were substantial.

According to federal data, the US Treasury collected more than $133 billion from import taxes imposed under the emergency powers law as of December. These funds came directly from tariffs levied on foreign goods entering the US market.

However, economic estimates painted a broader picture. The Congressional Budget Office projected that the economic impact of Trump’s tariffs could total approximately $3 trillion over the next decade. These figures reflect not just tariff collections but the wider effects on consumer prices, business costs, supply chains, and trade flows.

Several companies have already taken legal action to seek refunds. Among them is the big-box warehouse chain Costco, which joined others in demanding repayment of duties collected under the now-invalidated tariff regime.

Trump’s Reaction: “Disgrace”

Unsurprisingly, Trump responded angrily to the ruling. During a meeting with state governors, he described the decision as a “disgrace,” framing it as an attack on his economic strategy.

The ruling marked a significant political and legal loss for the Republican leader on an issue central to his platform.

In contrast, former Vice President Mike Pence publicly welcomed the decision. Writing on social media, he stated: “American families and American businesses pay American tariffs — not foreign countries. With this decision, American families and businesses can breathe a sigh of relief.”

Pence’s comment highlighted a key economic reality: tariffs are generally paid by domestic importers, with costs often passed on to consumers.

Not the End of Tariffs: Possible Legal Workarounds

While the ruling invalidates the tariffs imposed under IEEPA, it may not be the final chapter in the trade saga.

The government could seek to reimpose tariffs through alternative statutory pathways. Trade experts note that Section 232 of US trade law allows tariffs on national security grounds, while Section 301 authorizes duties targeting unfair trade practices. However, these mechanisms require formal investigations, legal justifications, and procedural safeguards.

In other words, future tariff actions would likely face greater scrutiny and longer timelines — but they remain possible.

India Watches Closely: A Potential Quiet Advantage

Beyond Washington, the ruling has significant implications for global trade partners — particularly India.

For New Delhi, the decision is less about a specific tariff schedule and more about restoring predictability in US trade policy. The Supreme Court’s ruling reduces the risk of sudden, across-the-board “reciprocal” tariffs imposed via executive fiat.

Reduced Risk of Tariff Shocks

Indian export-heavy sectors such as engineering goods, auto components, chemicals, textiles, and gems and jewellery had been especially vulnerable to abrupt tariff announcements. The Court’s decision narrows the scope for such sudden shocks, offering immediate relief to businesses operating within global supply chains.

Trade Negotiations Return to Institutional Channels

The ruling effectively shifts US tariff policy back toward Congress-linked statutory frameworks. These involve structured investigations, defined triggers, and political oversight.

For India, this means more predictable timelines and structured engagement. Rather than reacting defensively to unilateral White House announcements, New Delhi may have greater opportunity to seek exemptions, negotiate product-specific relief, and align compliance measures in advance.

Potential Supply-Chain Opportunities

If elements of the Trump-era tariff architecture must now be rebuilt under narrower authorities, Indian manufacturers could gain incremental advantages — particularly in sectors where competitors were more heavily impacted by US duties.

Over time, firms seeking to diversify sourcing away from higher-risk jurisdictions may increasingly look to India as a stable alternative.

A Confidence Signal for Investors

Beyond trade flows, the ruling sends a broader message: even amid economic nationalism, legal constraints remain powerful in the United States.

By drawing a firm boundary around emergency tariff powers, the Supreme Court has reinforced institutional checks and balances. This could strengthen India’s pitch to global investors, offering reassurance that US market access is less vulnerable to abrupt policy swings.

A Cautious Silence from New Delhi

Publicly, the Indian government is expected to adopt a wait-and-watch approach, avoiding direct commentary while monitoring legal and political developments in the US.

Privately, however, the ruling may be viewed as a recalibration of US trade authority — one that subtly improves India’s negotiating position without requiring a single statement from South Block.

A Constitutional Reassertion with Global Implications

Ultimately, the Supreme Court’s ruling is not an endorsement of free trade. It is a constitutional clarification.

The Court has not declared tariffs unlawful per se. Instead, it has reaffirmed who holds the authority to impose them. Congress, not the president, controls the power to tax.

For Trump, the decision represents a significant rebuke and a constraint on one of his signature policy tools. For American businesses and consumers, it may bring financial relief and potential refunds. For global trading partners like India, it introduces greater predictability into an often volatile landscape.

Whether the administration pursues alternative legal pathways to reinstate tariffs remains to be seen. But for now, the Supreme Court has made one principle unmistakably clear: emergency powers cannot serve as a substitute for congressional authority.

In an era defined by economic nationalism and executive assertiveness, the judiciary has stepped in to draw a constitutional boundary — one that could shape US trade policy, global supply chains, and international negotiations for years to come.

With inputs from agencies

Image Source: Multiple agencies

© Copyright 2025. All Rights Reserved. Powered by Vygr Media.