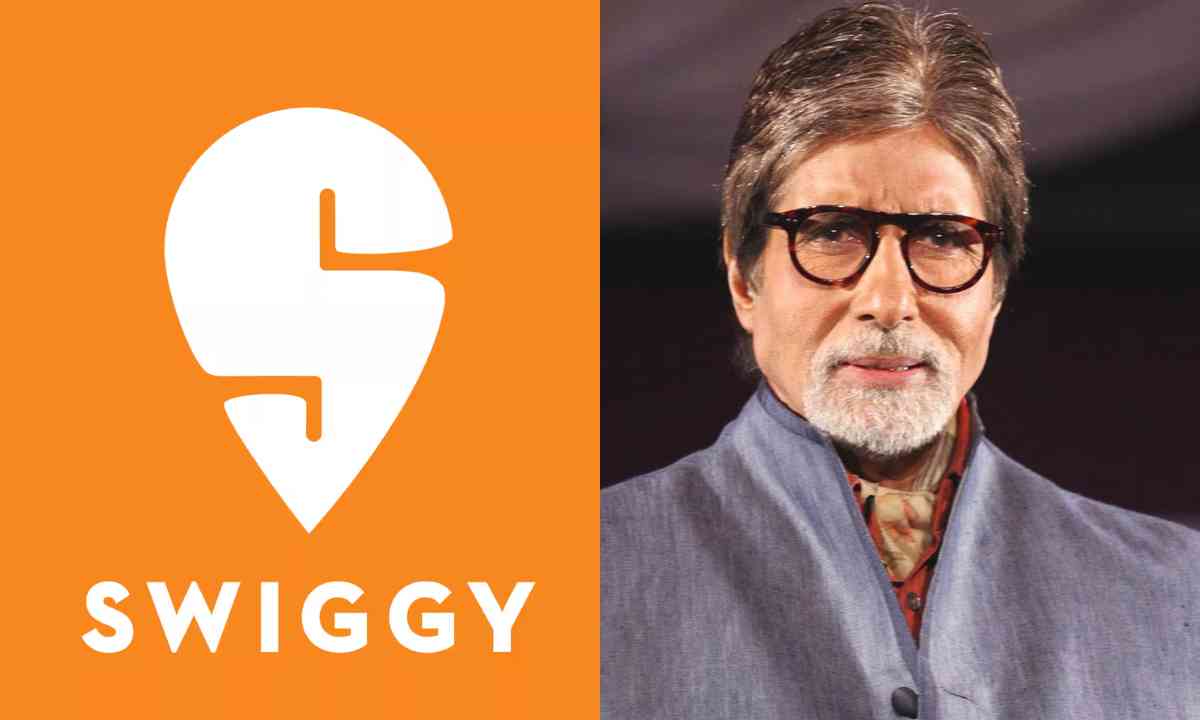

Bollywood icon Amitabh Bachchan’s family office has reportedly acquired a minor stake in Swiggy, a prominent food delivery and quick commerce company. This investment comes as Swiggy prepares for its initial public offering (IPO), which is anticipated to value the company at around $15 billion.

Investment Details

As reported by The Economic Times, Bachchan’s family office secured this stake through the purchase of shares from Swiggy’s employees and early investors. While the exact amount of the investment remains undisclosed, it is expected to be a substantial sum.

Other Notable Investments

The Economic Times report also noted that Raamdeo Agrawal, chairman of Motilal Oswal Financial Services, has acquired a stake in Swiggy. Additionally, Agrawal invested in the quick-commerce firm Zepto through its recent $665 million funding round.

Valuation and IPO Plans

These secondary share transactions have been conducted with an estimated company valuation of $10-11 billion. Swiggy, backed by SoftBank, is aiming for a valuation of approximately $15 billion in its upcoming IPO. The company plans to raise between $1 billion and $1.2 billion through this offering, which is set to be one of the largest Indian IPOs this year.

Swiggy's Market Position and Future Plans

Competing with Zomato in the online food delivery space, Swiggy has also expanded into quick commerce, offering grocery deliveries within minutes. In April, Swiggy secured shareholder approval for an IPO to raise up to $1.25 billion, with its confidential filing expected to be approved by the Indian market regulator soon. The proceeds from the IPO are intended to bolster Swiggy’s Instamart quick commerce business and expand its warehouse network.

Swiggy's latest funding round in 2022, led by Invesco, valued the company at $10.7 billion. According to Goldman Sachs, the quick delivery sector represents $5 billion of India's $11 billion online grocery market, with projections suggesting it will capture 70% of the market by 2030. While Swiggy’s food delivery segment is profitable, its Instamart business is currently facing losses. The company owns around 550 grocery warehouses across various cities in India.

Inputs by Agencies

Image Source: Multiple Agencies

Ⓒ Copyright 2024. All Rights Reserved Powered by Vygr Media.