India is poised to redefine its role in the global economy and promises a future of sustained growth and innovation. As Wall Street puts its faith in India, a new era of economic opportunity and stability emerges, solidifying India's position as the premier investment destination for the coming decade.

In a dramatic shift that resonates with the ever-evolving world of finance, investors are redirecting billions of dollars from China to India, signalling the dawn of a new era for economic opportunities. This move not only reflects changing market sentiments but also highlights India's emerging role on the global stage. Wall Street giants such as Goldman Sachs Group Inc. and Morgan Stanley are championing India as the premier investment destination for the next decade. This article explores the implications of this historic realignment and examines the factors that make India a compelling market for investors worldwide.

A Modern-Day Gold Rush: India Leading the Charge

The fervour surrounding India within the investment realm is noticeable, as evidenced by the $62 billion hedge fund Marshall Wace singling out India as its most substantial net long wager following the United States. Likewise, Vontobel Holding AG and Janus Henderson Group Plc are strategically manoeuvring to deepen their interests in India's narrative of growth. This burgeoning interest indisputably underscores India's ascension as a formidable force in the global economic arena.

Image Source: Bloomberg

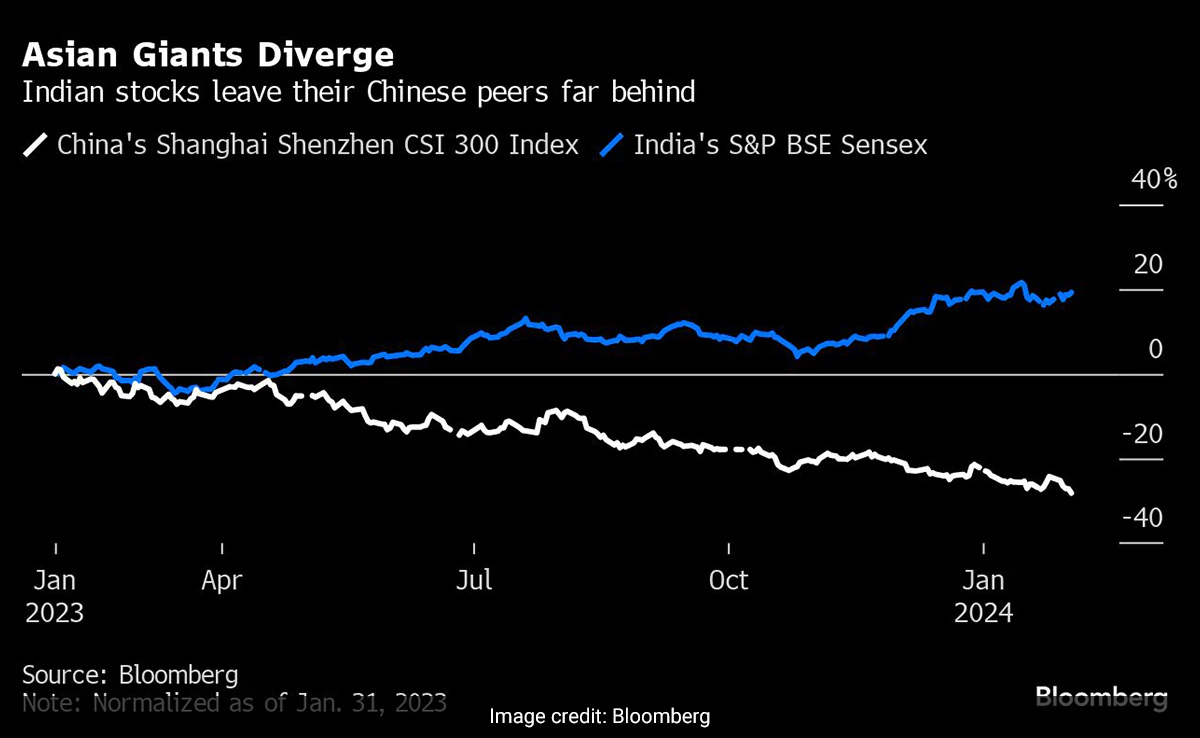

India vs. China: Divergent Trajectories

At a time when India and China's economies are taking divergent trajectories, India has been making remarkable progress under the leadership of Prime Minister Narendra Modi. With India actively expanding its infrastructure, aims to attract global capital and diversify supply chains away from Beijing. On the other hand, China faces economic challenges and a growing rift with the Western-led order. Investors are noticing this contrast and seeking long-term growth and stability in India.

Image Source: Bloomberg

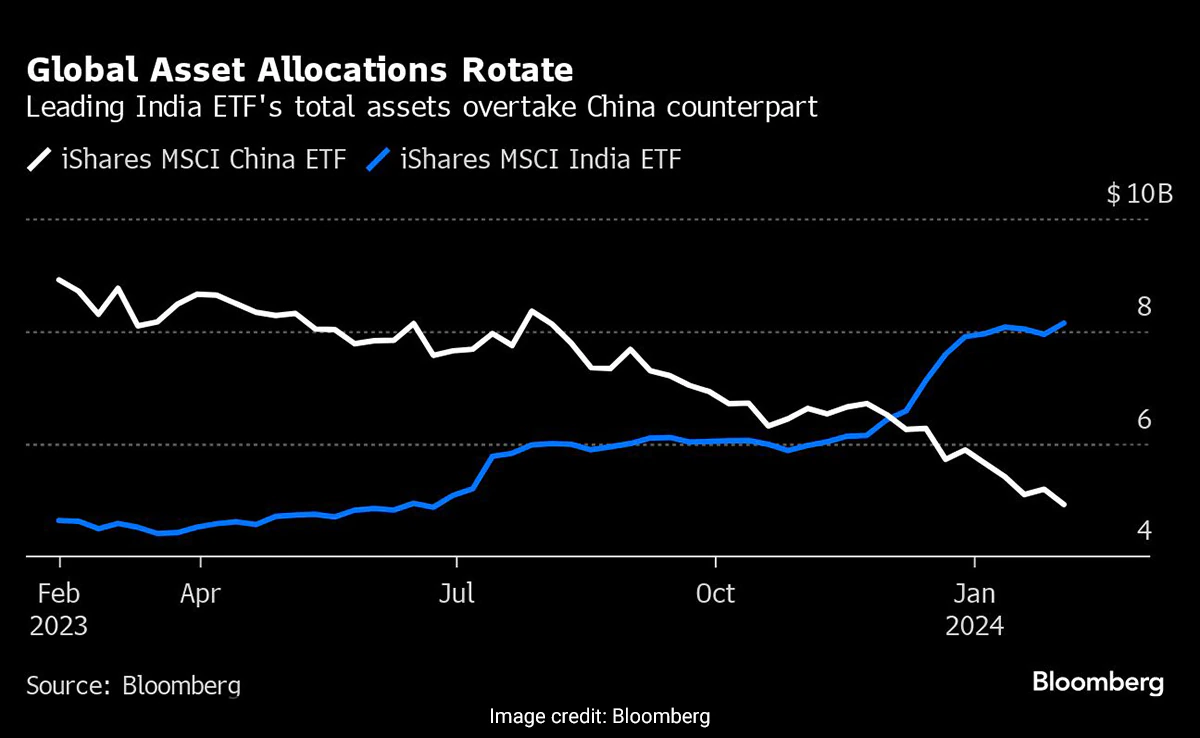

Capital Flows and Market Optimism:

The shift in capital flows is not only a powerful endorsement of India's economic prospects but also a reflection of the market's optimism. The main US exchange-traded fund investing in Indian stocks experienced record inflows in the final quarter of 2023, while China-focused funds witnessed significant outflows. This trend signifies a vote of confidence in India's market potential. Morgan Stanley even predicts that India's stock market could become the third-largest by 2030.

India's Strategic Edge:

India's strategic initiatives to position itself as a viable manufacturing alternative to China are yielding positive results. The country's efforts to upgrade infrastructure and develop a robust ecosystem of digital technologies have become attractive to both global companies and investors. With increased infrastructure spending and the push towards a digital economy, India presents new opportunities for growth and investment.

Navigating Challenges with Optimism:

While investors acknowledge the challenges such as expensive valuations and market corrections, they remain bullish on India's long-term prospects. The low per capita income combined with the government's approach of opening up financial markets creates a landscape ripe for multi-year expansion and new market opportunities. Overall, India's economic resilience, strategic foresight, and untapped potential differentiate it from other emerging markets.

A Promising Future:

India's economic ascent is a compelling narrative that intertwines resilience, strategic foresight, and untapped potential. As global investors continue to "buy into India," the nation is poised to redefine its role in the global economy, promising sustained growth and innovation. The transition from China to India represents a historic realignment in global markets, with India emerging as a beacon of economic opportunity and stability.

As Wall Street snubs China for India, it becomes evident that India's economic potential is gaining widespread recognition among global investors. With Wall Street titans actively positioning India as the premier investment destination, India's rise to prominence on the world stage is inevitable. As the country continues to prioritize infrastructure development, foster a digital economy, and attract foreign capital, India's economic future looks increasingly bright. Investors who embrace this pivotal moment stand to benefit from the nation's untapped potential and enduring growth.

(With inputs from Wall Street)

© Copyright 2024. All Rights Reserved Powered by Vygr Media.