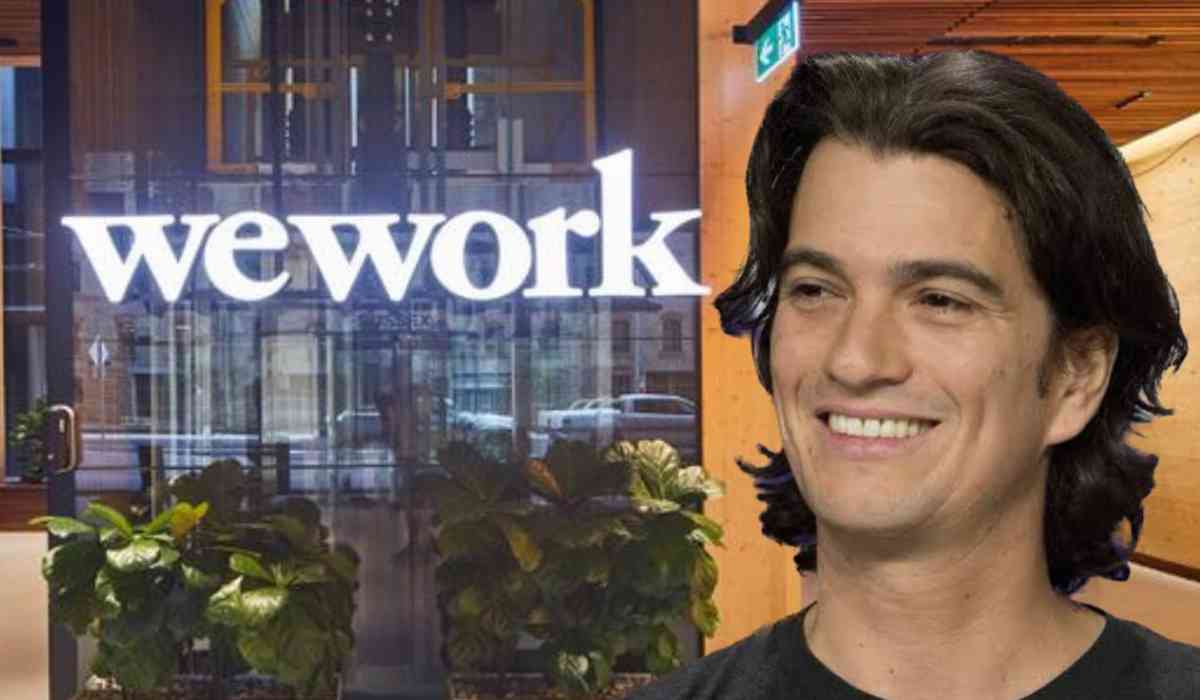

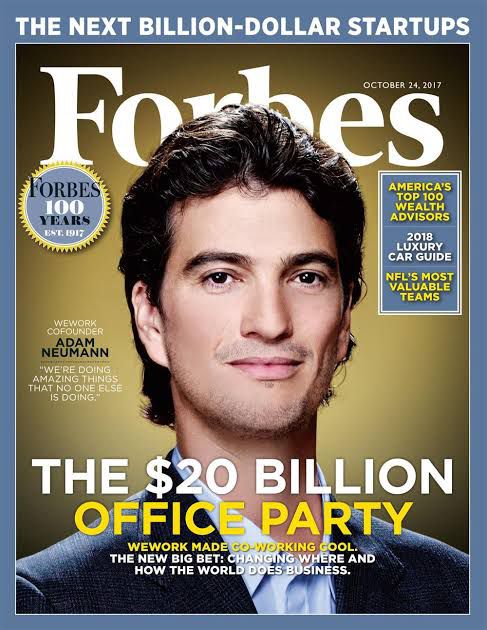

The ‘ousted’ co-founder is making a comeback with a huge bid to buy back his company! The co-founder of WeWork, Adam Neumann, who was ousted in 2019, has reportedly submitted an unsolicited bid exceeding $500 million to buy the company out of bankruptcy. as per media sources suggest that the bid may increase to $900 million pending due diligence.

Once a CEO, known for a charismatic personality and impulsive decisions, Neumann had expressed his desire to reclaim the company from which he was removed five years ago.

To read our previous article about Illustrious startup Founders - Click Here

But, here’s a twist: The newspaper reports stated that Neumann made the offer even though he wasn't sure how he would pay for it. Moreover, it might make WeWork less likely to accept his offer if combined with his employment experience there.

On Monday, Neumann, his family business Nazare, and his Andreessen Horowitz-backed real estate company Flow filed a notice of appearance in WeWork's bankruptcy docket.

Venture capital firm Andreessen Horowitz invested $350 million in Neumann's Flow in 2022, valuing the company at $1 billion even before it started operations. Flow specialises in multifamily property management, striving to foster a sense of community and ownership among tenants.

According to rumours from last month, Dan Loeb's Third Point and other investors, including Neumann, the former CEO of WeWork, were considering buying the company out of bankruptcy. According to a letter to WeWork's legal team, Neumann and his real estate firm, Flow, had been contacting WeWork since December in order to gather information for a proposal.

However, Third Point spokesman, rejecting this, said, Third Point is not participating in Neumann's bid, as per reports.

WeWork in Bankruptcy

After facing years of difficulties, WeWork filed for bankruptcy in November 2023, with its principal creditors expected to take over the business. Since then, the company has been working with bankruptcy consultants to restructure and streamline its operations.

A quick rewind, at its peak, WeWork held the distinction of being the largest private office space tenant in Manhattan, operating coworking spaces in various cities worldwide.

However, concerns about WeWork's business model and rapid expansion and of course Neumann's leadership reliability, were two main reasons that led down investor confidence in the company.

Neumann, known for his charismatic personality and sometimes impulsive decisions within the company, was ousted by the Board of Directors in September 2019. This occurred shortly after the company's initial public offering was postponed. He departed with a $1.7 billion exit package, and the company's valuation plummeted to $8 billion at that time.

WeWork’s valuation plummeted from a high of $47 billion after a failed attempt to go public in 2019, then the Covid-19 pandemic dealt another blow, and the company never fully recovered.

Although WeWork’s office locations initially emptied out, demand for flexible work proved somewhat resilient. The company eventually went public in 2021 through a combination with a special purpose acquisition company, or SPAC.

WeWork attempted to present a turnaround story, in which the boisterous co-working startup becomes a stable, successful public company, before it filed for bankruptcy. The New York-based company was losing money after the pandemic due to expensive leases. In its Chapter 11 filing from the previous year, the company reported $15 billion in assets and $19 billion in liabilities.

In a statement, WeWork emphasised that it will continue to concentrate on becoming a "financially strong and profitable company" by coming out of Chapter 11 bankruptcy protection in the second quarter.

Reacting to this ‘odd’ offer, the company said, “WeWork is an extraordinary company and it’s no surprise we receive expressions of interest from third parties on a regular basis.”

“Our board and our advisers review those approaches in the ordinary course, to ensure we always act in the best long-term interests of the company,” they added.

Overall, Neumann's bid could even complicate WeWork's bankruptcy process. In order to avoid longer-term obligations in less profitable markets, the company is and will attempt to turn down multiple lease offers as a few of WeWork's lessers have opposed those initiatives.

(Inputs from Agencies)

©️ Copyright 2024. All Rights Reserved Powered by Vygr Media.