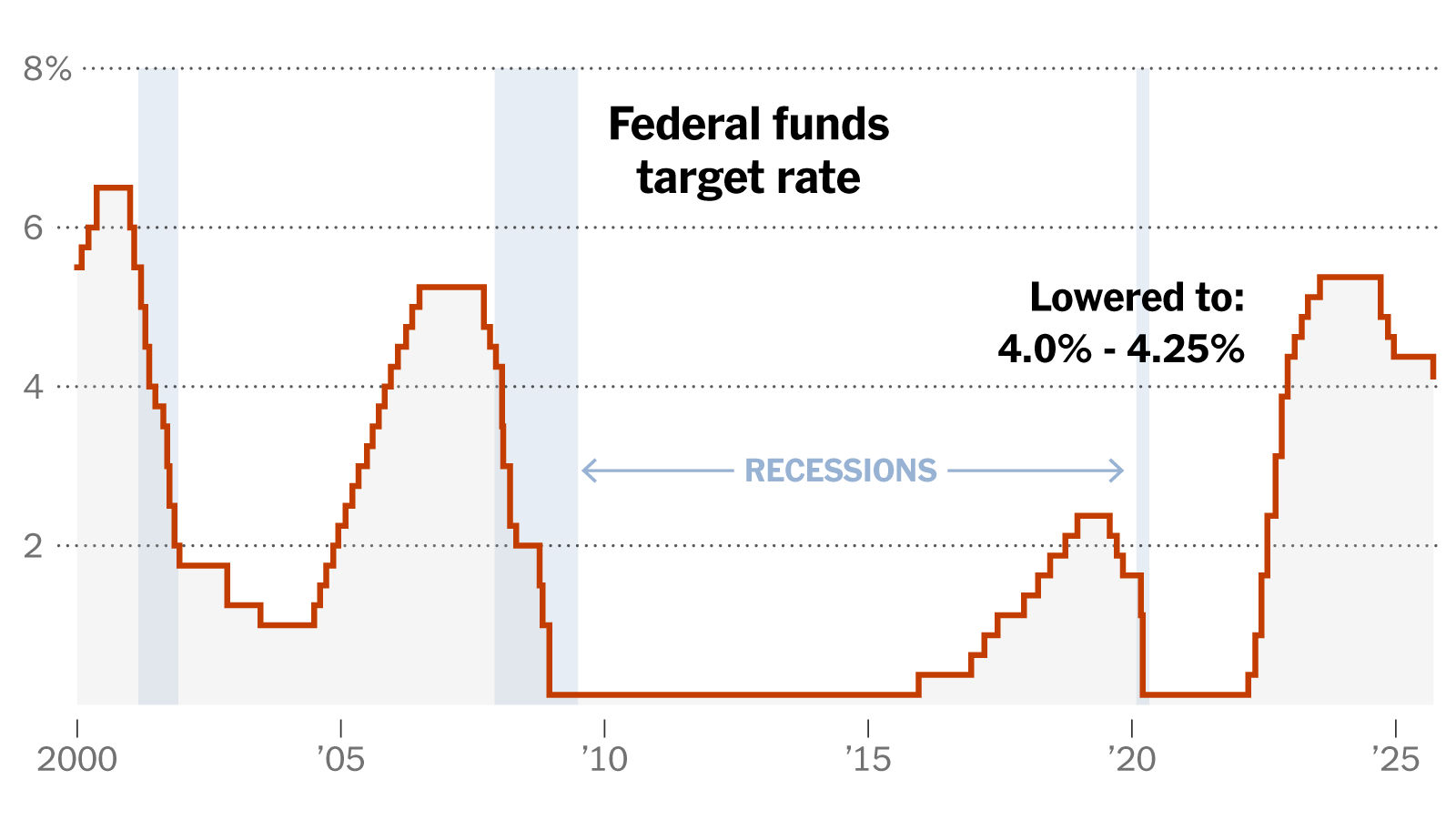

The U.S. Federal Reserve has announced its first interest rate cut of 2025, marking a pivotal shift in monetary policy as it attempts to balance the risks of a cooling labor market with persistent inflationary pressures. The highly anticipated decision, unveiled on Wednesday, has set the central bank’s benchmark policy rate in the 4%–4.25% range, following a quarter-point reduction.

This development has sparked a wave of reactions across global markets, especially in India, where equities rallied in response. Analysts and investors are now closely examining how the move will shape economic conditions, foreign capital inflows, and sector-specific opportunities.

Why the Fed Cut Rates

During a press conference, Fed Chair Jerome Powell explained the decision by pointing to a rapidly cooling labor market.

“The labor market is really cooling off,” Powell noted, adding that weaker job creation, rising unemployment, and slowing hiring dynamics have raised concerns about the sustainability of U.S. growth.

The U.S. economy has been showing signs of fatigue:

-

August jobs report: Just 22,000 jobs added, far below expectations.

-

Cumulative jobs in 2025 so far: 598,000 — a sharp decline compared with 1.4 million in the first eight months of 2024.

-

Unemployment rate: Rose to 4.3%, the highest since September 2017 (excluding the pandemic years).

Powell described the labor market as “unusual,” citing not only weaker hiring but also a shrinking pool of available workers due to Trump’s immigration crackdown.

At the same time, inflation has remained a thorn in the Fed’s side. Since April, when Trump’s sweeping “reciprocal” tariffs were announced, U.S. inflation has climbed from 2.3% to 2.9% by August, well above the Fed’s 2% target.

Divisions Within the Fed

The vote by the Fed’s rate-setting committee ended 11 to 1 in favor of the quarter-point cut. The lone dissenter, Governor Stephen Miran, advocated a deeper half-point cut.

Miran’s presence has already sparked controversy. Sworn in this week, he still retains his position as Chair of the White House’s Council of Economic Advisers, albeit on leave — a highly unusual arrangement for a central bank governor. The Trump administration has defended this dual role, with Treasury Secretary Scott Bessent calling it “transparent” rather than irregular.

Meanwhile, Trump’s influence over the Fed continues to grow. His administration has attempted to remove Lisa Cook, the first Black woman on the board of governors, over mortgage fraud allegations. Courts have ruled she cannot be ousted while suing the administration, leaving her position intact.

Trump has also been outspoken in his criticism of Powell, pressuring him to lower rates sooner and blasting the Fed board as “ashamed” of its work. Powell, however, reiterated the need for caution:

“We’ve seen much more challenging economic times, but from a policy standpoint … there are no risk-free paths.”

Inflation, Growth, and Market Reactions

The Fed hinted at two more cuts this year, though internal divisions remain — with seven of 12 officials preferring no further cuts in 2025. Markets, however, are already pricing in up to three-quarters of a percentage point in cuts by year-end.

Corporate earnings calls and interviews highlight the strain on consumers. McDonald’s CEO Chris Kempczinski described a “two-tier economy”: affluent households continue to spend freely, while middle- and lower-income groups feel mounting financial pressure.

Economists remain divided. Some, like Joseph Gagnon of the Peterson Institute, warn that inflation could worsen as tariff costs push businesses to raise prices. Others point out that stock markets remain near record highs — a rare backdrop for monetary easing.

Immediate Impact on Indian Markets

Indian markets quickly responded to the Fed’s dovish pivot.

-

Sensex: Jumped 447 points (0.5%) to 83,141.21.

-

Nifty: Rose 117 points (0.46%) to 25,448.95.

-

Nifty IT Index: Climbed 1.1%, benefiting from expectations of stronger global demand and cheaper borrowing costs.

According to Umeshkumar Mehta, CIO at SAMCO Mutual Fund, the move is welcome but should be viewed cautiously:

“This festivity should not be celebrated right away … the rate cut should not be seen as a structural move, and the Fed would need enough data before the hope for a low single-digit regime returns.”

Why Fed Rate Cuts Matter for India

Experts believe that lower U.S. yields make emerging markets like India more attractive for foreign portfolio investors (FPIs).

-

Puneet Singhania (Master Trust Group): Indian assets become relatively more appealing, particularly export-driven sectors and businesses dependent on overseas borrowings.

-

Dhiraj Relli (HDFC Securities): “The Federal Reserve rate cut will make emerging markets like India more attractive for yield-seeking investors.” He expects strong buying opportunities as India’s structural growth story remains intact, driven by demographics, consumption, and reforms.

Sectors Likely to Benefit

-

Banking, Financial Services, and Insurance (BFSI) – Lower global rates reduce borrowing costs and spur credit demand.

-

Information Technology (IT) – Export-driven firms may benefit from increased U.S. spending.

-

Metals & Industrials – Could gain from renewed global demand.

-

Domestic Consumption (FMCG, Retail, Durables) – Stronger rupee and foreign inflows may support consumer spending.

-

Real Estate & Automobiles – Sensitive to liquidity conditions, both stand to gain if inflows rise.

However, analysts caution about currency risks. A stronger rupee could squeeze margins for export-heavy sectors like textiles and engineering.

Key Drivers Behind Market Optimism

Six major factors have boosted Indian equities following the Fed’s move:

-

Fed signals 2 more cuts in 2025 – Strong potential for inflows into Indian markets.

-

Positive global cues – Asian indices traded higher; U.S. index futures gained.

-

Falling crude oil – Brent crude dipped to $67.86 per barrel, reducing India’s import burden.

-

Lower volatility – India VIX fell 2.76% to 9.96, suggesting calmer markets.

-

India–US trade talks – Ongoing negotiations signal progress on tariffs and bilateral trade.

-

IT sector rally – Stocks like Infosys, HCL Tech, and Tech Mahindra drove Nifty IT to fresh highs.

Technical Outlook for Nifty and Sensex

According to Anand James, Chief Market Strategist at Geojit Financial Services:

-

Nifty may test 25,400–25,600 levels in the near term.

-

A slip below 25,200 could open the door to 24,800.

Final Takeaway

The U.S. Fed’s first rate cut of 2025 is a watershed moment that underscores the balancing act between fighting inflation and supporting a fragile labor market. While the move has boosted global and Indian equities, risks remain — from tariff-driven inflation in the U.S. to currency-related pressures in India.

For Indian investors, the outlook is cautiously optimistic. Sectors like IT, BFSI, real estate, and autos are poised to benefit, while export-linked industries must tread carefully amid rupee fluctuations.

The bottom line: As Powell emphasized, there are no risk-free paths — but with multiple cuts hinted at, emerging markets like India could be entering a phase of renewed opportunity.

With inputs from agencies

Image Source: Multiple agencies

© Copyright 2025. All Rights Reserved. Powered by Vygr Media.