As cryptocurrencies continue their dynamic rise in India, 2025 has emerged as a pivotal year for digital asset investments. With regulatory frameworks becoming more defined and investor awareness at an all-time high, choosing a reliable, secure, and government-compliant crypto exchange is essential.

India's Financial Intelligence Unit (FIU), operating under the Ministry of Finance, has intensified scrutiny on crypto platforms, requiring them to comply with anti-money laundering (AML) laws, Know Your Customer (KYC) protocols, and secure transaction standards. Against this backdrop, several crypto exchanges have stood out for their transparency, technological robustness, and investor-first approach.

Why Choosing the Right Crypto Exchange Matters in 2025

Investing in cryptocurrencies is no longer a fringe activity. As the asset class matures, especially in a fast-evolving market like India, investors are increasingly demanding compliance, safety, transparency, and simplicity.

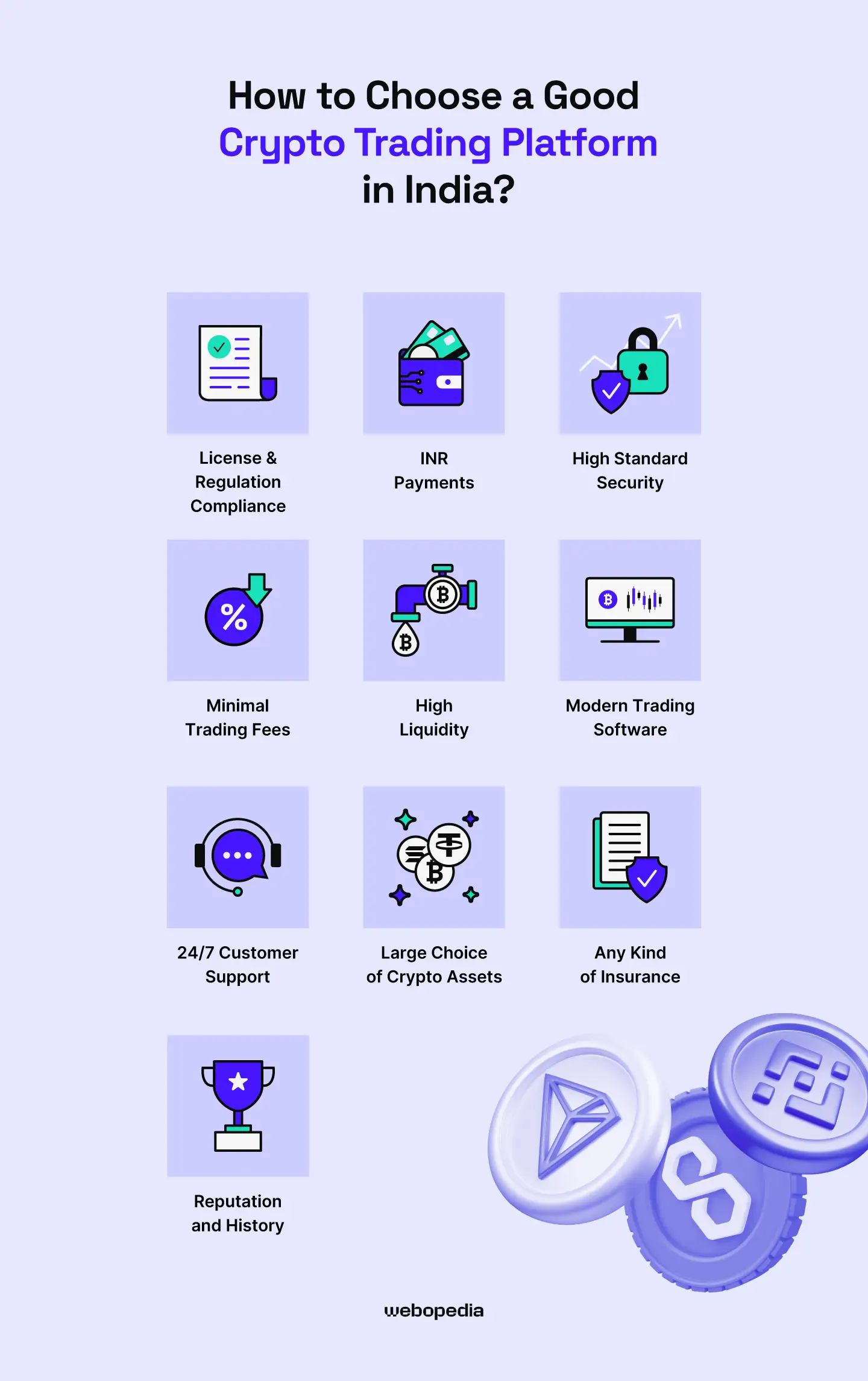

A credible crypto exchange must fulfil the following conditions:

-

FIU-India registration (under PMLA)

-

Robust KYC & AML measures

-

High-grade fund security and insurance

-

Easy INR transactions (via UPI, IMPS, or bank transfer)

-

Clear and transparent user policies

Let’s now look at the five most secure and user-trusted crypto exchanges that meet these standards in 2025.

1. Mudrex – Best Overall for Variety, Security, and User Experience

Mudrex is currently one of the most secure and feature-rich crypto investment platforms for Indian users. Founded in 2018 and backed by Y Combinator, the platform caters to both beginners and seasoned traders with a user-friendly app, transparent fees, and advanced investment tools.

Security & Compliance

-

FIU-India Registered: Fully compliant with Indian AML and KYC norms.

-

Cold Wallet Storage: Most assets are stored offline to prevent cyber threats.

-

Insurance Protection: Funds are insured, offering peace of mind against breaches.

-

Video KYC for Withdrawals: Adds a second layer of user verification.

-

AES-256 Encryption: Bank-grade protection for data and transactions.

Features

-

650+ Cryptocurrencies: Extensive selection of major and emerging tokens.

-

Coin Sets: Thematic baskets (e.g., AI Tracker, Ethereum Ecosystem) for diversified investment.

-

Futures and Spot Trading: Ideal for traders at every skill level.

-

Copy Trading & Trade Signals: Learn and trade like a pro.

-

Start with ₹500: Accessible to beginners.

Deposit Methods:

UPI, IMPS | KYC Required: Yes | Fee: 0.2% per transaction

Why Mudrex Stands Out: It blends institutional-grade security with investor-friendly features, educational tools, and low barriers to entry.

2. CoinDCX – Trusted Name with 500+ Coins and Insurance Protection

CoinDCX, launched in 2018, is one of India’s most prominent and widely used crypto exchanges. It offers a vast range of cryptocurrencies, along with beginner education and strong compliance credentials.

Security & Compliance

-

FIU-India Registered

-

Cold Storage & Data Encryption: Assets are stored securely offline.

-

Insurance Cover: User assets are protected against security breaches.

-

Regular Security Audits: Ensures platform safety and integrity.

Infact some traders prefer tools like QuantumX to do their trades better

Features

-

500+ Cryptocurrencies: Trade, stake, lend, or invest.

-

Margin & Futures Trading: Advanced trading options available.

-

DCX Learn: In-house education platform for crypto beginners.

-

Instant INR Transactions: Swift UPI deposits and withdrawals.

Deposit Methods:

UPI, IMPS, Bank Transfers | KYC Required: Yes

Why Choose CoinDCX: It offers a perfect mix of safety, education, and sophisticated trading tools for long-term investors and daily traders.

3. CoinSwitch – Most Beginner-Friendly with Systematic Investment Plans

CoinSwitch is known for its intuitive design and commitment to investor safety. It aggregates prices from various global exchanges, ensuring optimal rates and minimal slippage.

Security & Compliance

-

FIU-India Registered

-

ISO/IEC 27001:2022 Certified: Ensures robust information security practices.

-

KYC & AML Compliance: Quick verification for safe onboarding.

-

Enterprise-Grade Custody Providers: Crypto is safely held off-chain.

Features

-

320+ Cryptocurrencies

-

Systematic Investment Plans (SIPs): Invest in crypto just like mutual funds.

-

Advanced Tools (Pro version): For seasoned traders, including limit orders and analytics.

-

Start with ₹100: Extremely low entry barrier.

Deposit Methods:

UPI, Bank Transfers | KYC Required: Yes

Why Choose CoinSwitch: A secure, user-first platform with SIP options and ISO-certified systems—great for new investors seeking safety and simplicity.

4. ZebPay – Veteran Exchange with Strong Offline Security & Lending

Established in 2014, ZebPay is one of India’s oldest and most trusted crypto platforms. With over 5 million users, it continues to be a benchmark for security-first investing.

Security & Compliance

-

FIU-India Registered

-

98% Offline Storage: The vast majority of funds are stored cold.

-

Multi-Signature Wallets: Prevent unauthorised access with multiple approvals.

-

Routine Security Audits: Ensures continual compliance and system strength.

Features

-

100+ Cryptocurrencies

-

Crypto Lending & Staking: Earn passive income on idle assets.

-

Zero Deposit Fees: Makes it cheaper to enter the market.

Deposit Methods:

UPI, IMPS | KYC Required: Yes

Why Choose ZebPay: A legacy player with a conservative security model—ideal for risk-averse investors.

5. Unocoin – Indian-Centric Platform with Local Payment Convenience

Unocoin focuses specifically on Indian users, offering a localised and user-friendly interface with seamless INR deposit methods and referral programs.

Security & Compliance

-

FIU-India Registered

-

Secure Digital Wallets

-

Standard KYC & AML Protocols

Features

-

80+ Cryptocurrencies

-

INR-Friendly Platform: Accepts UPI and bank transfers.

-

Referral Rewards Program: Earn by inviting friends to the platform.

Deposit Methods:

UPI, Bank Transfers | KYC Required: Yes

Why Choose Unocoin: Tailored for Indian users who prefer a straightforward and localised crypto investing experience.

Honourable Mention: Paxful – Peer-to-Peer Flexibility with Escrow Security

While not based in India, Paxful is compliant with Indian norms and offers unmatched peer-to-peer trading flexibility.

Security & Compliance

-

Global KYC Standards

-

Escrow Service: Protects both buyer and seller during trades.

-

Supports 500+ Payment Methods: From PayPal to UPI.

Features

-

Ideal for BTC/USDT Trades

-

Zero Buyer Fees

-

Highly Accessible Mobile App

Why Consider Paxful: Best suited for users looking to buy or sell directly with others through a secure, escrow-based system.

Feature Comparison: At a Glance

|

Platform |

INR Deposit Methods |

KYC Required |

Key Security Features |

Unique Offering |

|---|---|---|---|---|

|

Mudrex |

UPI, IMPS |

Yes |

Video KYC, cold storage, insured funds, AES-256 |

Coin Sets, Copy Trading, Education Tools |

|

CoinDCX |

UPI, IMPS, Bank |

Yes |

Cold storage, data encryption, insurance, and regular audits |

DCX Learn, Margin/Futures Trading |

|

CoinSwitch |

UPI, Bank Transfer |

Yes |

ISO-certified, secure custody, liquidity aggregation |

SIPs, Pro Tools |

|

ZebPay |

UPI, IMPS |

Yes |

98% cold storage, multi-signature wallets, and audits |

Crypto Lending & Staking |

|

Unocoin |

UPI, Bank Transfer |

Yes |

Secure digital wallets, KYC, AML |

Indian-focused platform, Referral Rewards |

|

Paxful |

500+ payment options |

Yes |

Escrow system, global compliance |

Peer-to-peer flexibility, zero buyer fees |

Things to Check Before Choosing a Crypto Exchange

To ensure your crypto journey is safe and hassle-free in India, always evaluate platforms based on the following:

-

Regulatory Compliance: FIU-India registration is a must.

-

Security Infrastructure: Look for cold wallet storage, insurance, and regular audits.

-

Transparent Fee Structures: Avoid platforms with hidden costs.

-

User Education & Support: Opt for exchanges with robust learning resources and customer support.

-

Risk Assessment Tools: Crypto is volatile—ensure you understand and manage your risk tolerance.

Note to Investors

Cryptocurrency and NFTs remain unregulated in India. While trading is legal through FIU-compliant platforms, the market is inherently volatile. There is no regulatory recourse for losses, and investors must proceed with caution.

This article is intended solely for educational and informational purposes and does not constitute financial advice. Always consult a financial advisor before making investment decisions.

Frequently Asked Questions (FAQs)

Q1: Is it legal to trade cryptocurrencies in India in 2025?

Yes, it’s legal as long as you use FIU-registered platforms and complete KYC verification.

Q2: What’s the minimum amount needed to start?

You can start with as little as ₹100 on CoinSwitch or ₹500 on Mudrex—crypto has never been more accessible!

Q3: Are these platforms safe for storing funds?

Yes. All the listed platforms use strong encryption, offline wallets, and some even provide insurance (e.g., Mudrex, CoinDCX).

Q4: How do I complete identity verification?

Upload your Aadhaar, PAN, or other ID and a selfie. Platforms like Mudrex offer instant e-verification via India’s DigiLocker.

India’s crypto investment scene is growing rapidly, and 2025 offers exciting opportunities for those who tread wisely. Platforms like Mudrex, CoinDCX, CoinSwitch, ZebPay, and Unocoin are leading the charge by prioritising user safety, regulatory compliance, and feature-rich experiences.

Choose a platform that aligns with your investment goals, risk tolerance, and knowledge level, and always stay updated as crypto regulations evolve.

With inputs from agencies

Image Source: Multiple agencies

© Copyright 2025. All Rights Reserved Powered by Vygr Media.