Sugar.fit, a Diabetes management startup has successfully raised $11 million in its Series A funding round, with MassMutual Ventures leading the investment. The funding round also saw participation from existing investors, including Cure.fit, Tanglin Venture Partners, and Endiya Partners.

Breakdown of Funding and Post-Money Valuation

MassMutual Ventures took the lead in the funding round, contributing $7 million, followed by Cure.fit and Tanglin Venture Partners with investments of $1.5 million each. Endiya Partners also joined the round with an investment of $1 million. The post-money valuation of Sugar.fit is estimated to be around Rs 500 crore or $60 million. The company's value has experienced significant growth since its seed funding round, where it was valued at close to Rs 190 crore.

Strategic Utilization of Capital for Expansion and Innovation

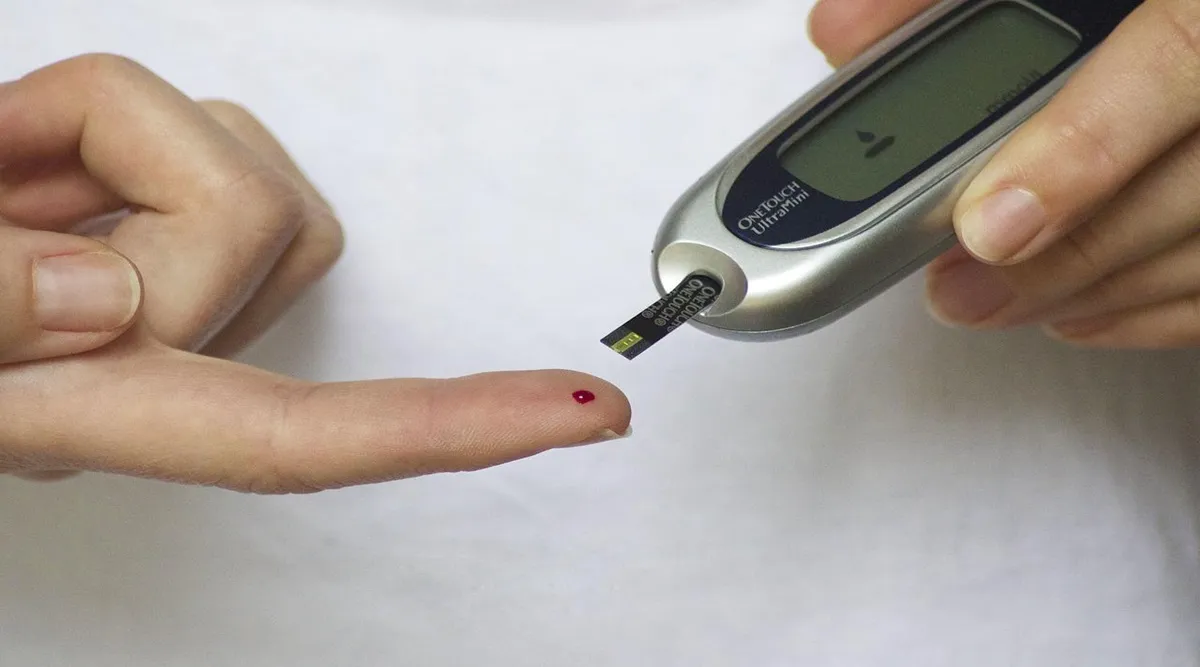

Sugar.fit plans to utilize the newly acquired capital to expand its product offerings, establish an offline presence, and accelerate research and development in the diabetes management sector. The Bengaluru-based startup, founded two years ago, aims to enhance its comprehensive diabetes care program by integrating various devices, including continuous glucose monitors and fitness trackers. The company also provides access to diabetes specialists and health coaches, allowing users to monitor the real-time impact of their lifestyle on glucose levels and receive personalized guidance in areas such as fitness, nutrition, and sleep.

Company Growth and Financial Performance

After a seed round that raised $10 million in September 2021, Sugar.fit has now secured a total of $21 million across two funding rounds. The company's scale witnessed a remarkable 6X increase during FY23, reaching Rs 14 crore from Rs 2.16 crore in FY22. However, Sugar.fit also experienced a significant rise in losses, exceeding 2X, totalling Rs 30.84 crore in FY23 compared to Rs 13.81 crore in FY22. Despite the challenges, the startup continues to strengthen its position in the diabetes management space with a focus on innovation and expansion.

© Copyright 2024. All Rights Reserved Powered by Vygr Media.