India’s edtech unicorn PhysicsWallah Ltd. (PW) has officially announced the details of its much-awaited initial public offering (IPO), setting the stage for one of the most closely watched listings in the education technology space this year. The offering marks a new chapter in the remarkable journey of a startup that began as a YouTube channel in 2016 and has now evolved into a $3.2 billion enterprise.

According to the red herring prospectus (RHP) released on Thursday, PhysicsWallah has pegged its valuation at ₹28,073 crore (approximately $3.2 billion) for its upcoming IPO. This represents a significant jump from the company’s $2.8 billion valuation in September 2024, signaling strong investor confidence despite an increasingly competitive edtech environment.

IPO Structure and Price Band

PhysicsWallah’s IPO comprises 31.93 crore shares, including a fresh issue of 28.44 crore shares and an offer for sale (OFS) of 3.49 crore shares. The company has set a price band of ₹103 to ₹109 per share, aiming to raise as much as ₹3,480 crore through the public issue.

Out of this total, ₹3,100 crore will come from the fresh issue, while the OFS component will account for ₹380 crore. Founders Alakh Pandey and Prateek Boob, the promoter-selling shareholders, are offloading stock worth ₹380 crore—down from the earlier planned ₹720 crore—indicating their continued confidence in the company’s long-term prospects.

PhysicsWallah’s Grey Market Premium (GMP) Indicates Positive Sentiment

Investor enthusiasm appears strong ahead of the IPO launch. As per data from Investorgain, the PhysicsWallah IPO Grey Market Premium (GMP) stood at ₹9 as of the time of reporting. This suggests that the stock could list at around ₹118 per share, implying an 8.26% premium over the upper end of the IPO price band (₹109).

However, experts caution that the GMP serves only as an indicator of investor sentiment and is not a guaranteed predictor of listing-day performance. The grey market, which operates unofficially and independently from formal exchanges, reflects the price traders are willing to pay for IPO-bound shares—but such premiums can fluctuate rapidly and are not always aligned with a company’s fundamentals.

Key Dates for the PhysicsWallah IPO

The PhysicsWallah IPO will open for subscription on Tuesday, November 11, 2025, and close on Thursday, November 14, 2025. The anchor investor bidding will take place one day prior to the issue opening—on Monday, November 10, 2025.

As per the tentative schedule in the RHP, the basis of share allotment will be finalized on Friday, November 14, 2025, and PhysicsWallah’s shares are expected to debut on the NSE and BSE on Tuesday, November 18, 2025.

IPO Lot Size and Investment Requirements

Retail investors can bid for a minimum of one lot comprising 137 shares. This means a retail participant would need to invest at least ₹14,933 at the upper end of the price band (₹109 per share) to apply for one lot. Further investments can be made in multiples of this lot size.

Allocation Breakdown

According to the red herring prospectus, PhysicsWallah has allocated:

-

Not less than 75% of the issue for Qualified Institutional Buyers (QIBs)

-

Not more than 15% for Retail Individual Investors (RIIs)

-

Not more than 10% for Non-Institutional Investors (NIIs)

This structure ensures that a significant portion of the issue is directed toward institutional investors, aligning with regulatory norms and boosting overall credibility.

Lead Managers and Registrar

The PhysicsWallah IPO is being managed by some of the top names in the financial sector. The book-running lead managers are Kotak Mahindra Capital Company, JP Morgan India, Goldman Sachs (India) Securities, and Axis Capital.

MUFG Intime India Pvt. Ltd. has been appointed as the registrar to the issue, responsible for handling share allotment, refunds, and investor correspondence.

Use of IPO Proceeds: Fueling Expansion and Technological Growth

PhysicsWallah intends to utilize the proceeds from the IPO to strengthen its presence in both online and offline education segments, scale its infrastructure, and enhance technology capabilities.

According to the RHP, the company plans to allocate:

-

₹460.5 crore for fit-outs of new offline and hybrid centres.

-

₹548.3 crore toward lease payments for existing identified centres.

-

₹47.2 crore for investments in its subsidiary Xylem Learning, including ₹31.6 crore for setting up new centres and ₹15.5 crore for lease payments and hostels.

-

₹33.7 crore for Utkarsh Classes & Edutech Ltd. to fund lease payments for its centres.

-

₹200.1 crore for expanding server and cloud infrastructure.

-

₹710 crore dedicated to marketing initiatives aimed at driving brand reach and customer acquisition.

-

₹26.5 crore to acquire an additional stake in Utkarsh Classes & Edutech Ltd.

Collectively, these investments reflect the company’s ambition to deepen its footprint in the blended learning space—combining the scale of online education with the credibility and discipline of offline learning environments.

Financial Performance: Revenues Rise, Losses Narrow

PhysicsWallah’s financial trajectory paints a picture of growth and operational discipline.

As per the company’s filings, revenue surged by 50.79% year-on-year to ₹3,039.09 crore in FY25, compared with the previous fiscal year. Meanwhile, net losses narrowed sharply to ₹243.26 crore in FY25, a significant improvement from the ₹1,131.13 crore loss recorded in FY24.

For the first quarter of FY26, the company reported a loss of ₹127.01 crore on revenue of ₹905.41 crore, indicating a steady march toward profitability amid expansion.

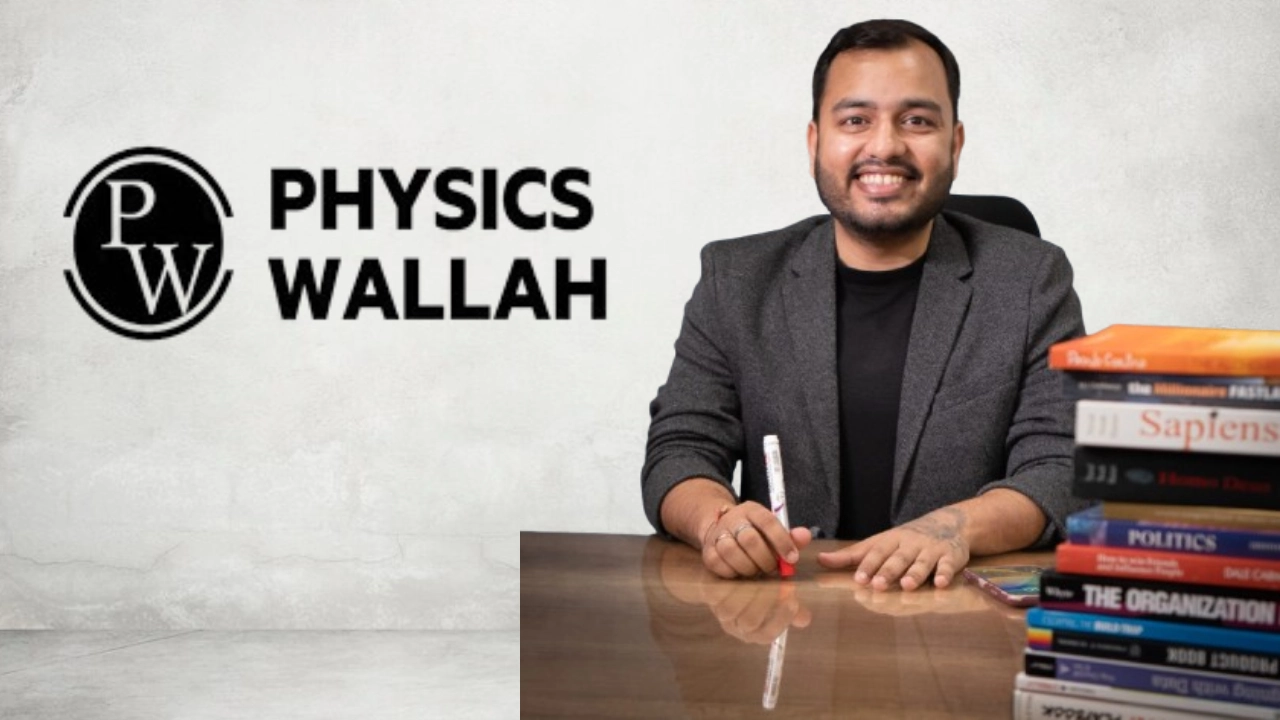

From YouTube Channel to $3.2 Billion Edtech Giant

Founded in 2016 by Alakh Pandey—popularly known as “Physics Wallah”—the company began as a free YouTube channel offering physics lessons to students preparing for competitive exams such as JEE and NEET. Pandey’s relatable teaching style and focus on affordability helped PhysicsWallah carve out a unique identity in a crowded edtech space.

While several edtech giants such as Byju’s, Unacademy, and Vedantu have struggled with mounting losses and layoffs in recent years, PhysicsWallah has managed to sustain growth and profitability at scale, largely due to its cost-effective learning model and hybrid expansion strategy.

As of July 15, 2025, the company’s flagship YouTube channel, “Physics Wallah – Alakh Pandey”, boasts 13.7 million subscribers, underscoring its massive reach and strong brand recall.

Core Offerings and Business Model

PhysicsWallah offers a broad suite of test preparation courses for competitive examinations, including engineering and medical entrance exams, as well as upskilling programs for various academic and professional fields.

The company delivers its content through multiple channels, encompassing:

-

Online platforms such as its website, mobile app, and social media channels.

-

Tech-enabled offline centres and hybrid learning hubs, which combine in-person tutoring with digital learning tools.

With this multi-channel approach, PhysicsWallah has emerged as one of India’s top five education companies by revenue, showcasing the growing acceptance of hybrid learning models among Indian students and parents.

Outlook: A Test for the Edtech Revival

The PhysicsWallah IPO is being closely watched by both retail and institutional investors as a potential bellwether for the Indian edtech industry, which has seen a period of consolidation following years of hypergrowth during the pandemic.

By balancing profitability, affordability, and expansion, PhysicsWallah aims to prove that sustainable growth in education technology is not only possible but also scalable.

If successful, this listing could revive investor confidence in the broader edtech sector—once seen as struggling under inflated valuations and uncertain business models.

Final Takeaway

With a price band of ₹103–₹109 per share, a ₹3,480-crore issue size, and a $3.2-billion valuation, PhysicsWallah’s IPO represents a milestone moment for the Indian startup ecosystem. The company’s prudent financial management, strong brand loyalty, and ambitious expansion plans position it well to capitalize on India’s booming education market.

As investors gear up for the November 11 opening, all eyes will be on whether PhysicsWallah’s public debut can replicate the same success story that started in a small YouTube classroom and is now poised to make history on Dalal Street.

With inputs from agencies

Image Source: Multiple agencies

© Copyright 2025. All Rights Reserved. Powered by Vygr Media.