Fabindia, India's largest apparel retail chain, scrapped its Initial Public Offering (IPO) plans on February 27 due to the current market conditions. The company had planned to raise upto 482 million rupees in the IPO.

“The decision to withdraw was taken as the current market conditions were not seen to be conducive for listing,” said Fabindia spokesperson.

The legacy ethnic wear maker was looking to issue fresh shares worth Rs 500 crore and sell 25.1 million existing shareholder’s stock via the IPO as reported by India.com. According to the company spokesperson, the new funds would go to repaying its debts.

Precarious and volatile market conditions have caused business to assess their plans for filing IPOs. Recently, e-commerce platform Snapdeal, D2C major boAt and Kerala-based jewellers, Joyalukkas have scrapped their IPO plans.

Market sentiments are dull with the Nifty 50 index falling by over 4% this year. The markets are under the pressure of constant rate hikes from the central banks in India as well as the US as they are trying to reduce inflation. RBI in its monetary policy meeting has increased the repo rate by 25 basis points to 6.50%.

The listed competitors of Fabindia are trading in the red lines. Shares of Aditya Birla Fashion and Retail Ltd are down by nearly 25% in the last six months while shares of Vedant Fashions Ltd, the parent of famed ethnic wear Manyavar are down by 8%.

Investor sentiment has been affected by the loss in valuations of new-age listed companies like Zomato, Nykaa, and Paytm which have lost over 50% of their value from their listing prices.

"Sentiment is weak now. Most of these companies are looking to raise money at higher valuations than is possible in the market right now, and there is no proper appetite," said Hemang Jani, equity strategist at Motilal Oswal Financial Services as reported by Moneycontrol.

The decision by Fabindia marks a setback for the Indian capital markets and is indicative of the current state of the markets. It also highlights the challenges that companies face when attempting to go public. The uncertainty in the Indian economy has made it difficult for companies to access capital from investors.

This development comes at a time when many companies have been struggling with their IPO plans due to volatile market conditions and a lack of investor confidence. It remains to be seen if Fabindia will try again in the future or opt for another form of financing.

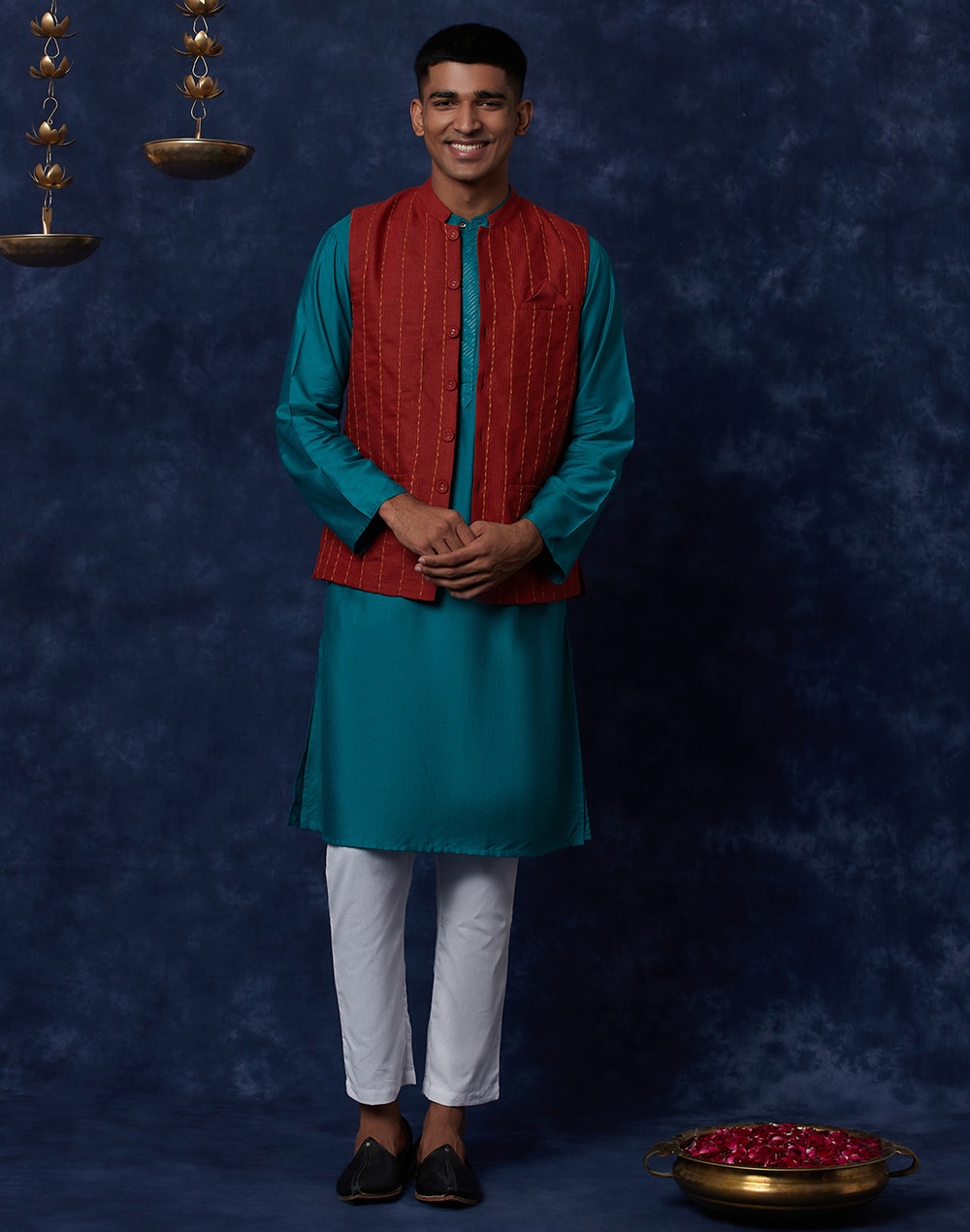

Fabindia is a leading Indian retail chain that specializes in home furnishings, apparel and organic foods. Founded in 1960, the company has grown to become one of the largest retailers in India with over 300 stores across the country. Fabindia offers a wide range of products ranging from traditional Indian clothing and home decor items to organic food products. The company also provides services such as custom tailoring and beauty treatments. Fabindia is committed to providing quality products at affordable prices while promoting traditional Indian artisanship and craftsmanship.

© Vygr Media Private Limited 2022. All Rights Reserved.