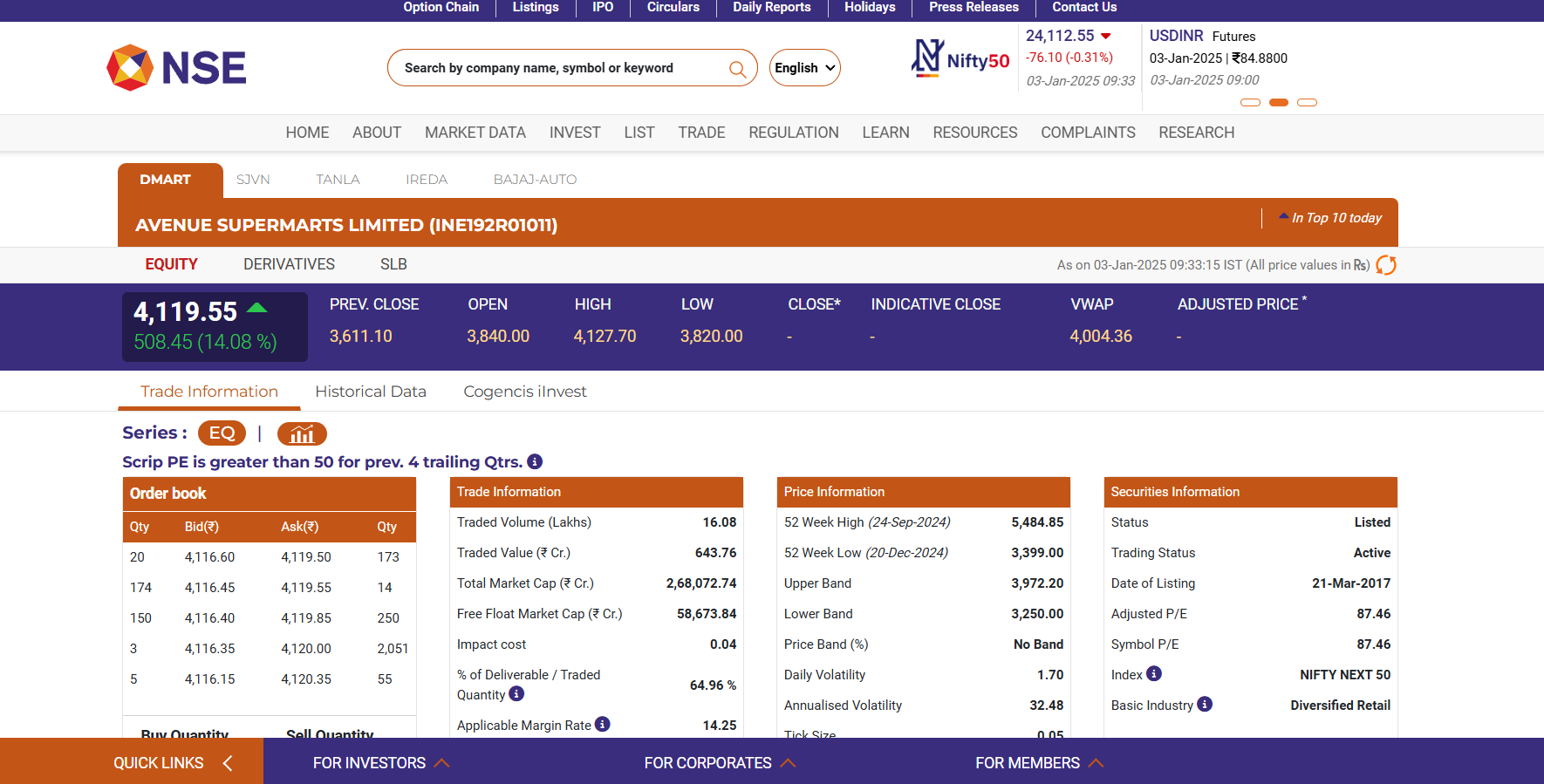

Avenue Supermarts, the parent company of the DMart retail chain, witnessed a significant rally in its stock prices, with shares soaring 15% on January 3, 2025, reaching an upper circuit of ₹4,160.4 per share on the BSE. This marked a sharp contrast to the overall market sentiment, as the BSE Sensex was down by 0.52%. The surge followed the release of an impressive Q3 FY25 business update, which highlighted robust growth and operational performance.

1. Revenue Growth

-

Avenue Supermarts reported a standalone revenue from operations of ₹15,565.23 crore for the quarter ending December 31, 2024, reflecting a 17.4% year-on-year (YoY) growth compared to ₹13,247.33 crore in the same quarter last year.

-

Over the past two years, the company has shown consistent revenue growth, with H1 FY25 like-for-like revenue increasing by 7.4% for stores operational for over two years.

2. Store Expansion

-

As of December 31, 2024, DMart operated 387 stores across India, adding 10 new outlets during Q3 FY25. This expansion underlines the company’s commitment to strengthening its nationwide presence.

3. Improved Efficiency

-

The annualized revenue per store increased by over 4% YoY to ₹16.3 crore, showcasing an improvement compared to the modest 1% growth reported in Q2 FY25.

-

The annualized revenue per square foot also rose by 3% YoY to ₹3,88,000, signaling enhanced operational efficiency.

Expert Recommendations on DMart Stock

Brokerage firm Motilal Oswal has retained its "Buy" rating for Avenue Supermarts, with a target price of ₹5,300 per share. The firm cited strong revenue growth, improved per-store metrics, and a solid operational framework as key factors for its bullish stance.

Avenue Supermarts' Q2 FY25 Snapshot

1. Financial Performance

-

Net Profit: The company recorded a 5.77% YoY rise in consolidated net profit, amounting to ₹659.58 crore, compared to ₹623.56 crore in the same period the previous year.

-

Revenue: Total revenue increased by 14.41% YoY to ₹14,444.5 crore, up from ₹12,624.37 crore.

-

EBITDA: The earnings before interest, taxes, depreciation, and amortization (EBITDA) surged 29.3% YoY to ₹1,093.8 crore.

2. Operational Insights

-

Six new stores were added in Q2, bringing the total store count to 377 as of September 30, 2024.

-

Total expenses for the quarter stood at ₹13,574.83 crore, marking a 14.94% increase YoY.

DMart's Presence and Market Trends

Promoted by Radhakishan Damani and family, DMart operates as a one-stop retail chain offering essential home and personal products. Its extensive presence spans multiple states, including Maharashtra, Gujarat, Andhra Pradesh, and Tamil Nadu.

Despite the recent surge, DMart's stock faced challenges over the past year, losing 8% of its value, while the BSE Sensex gained 12%. However, the company's robust Q3 performance could mark the beginning of a recovery.

Conclusion: A Promising Future

Avenue Supermarts' stellar Q3 FY25 performance underscores its resilience and growth potential in the competitive retail sector. With consistent revenue growth, store expansion, and expert-backed stock recommendations, DMart remains a key player in India's retail landscape. Investors eyeing long-term gains may find the current momentum and positive outlook a compelling opportunity to invest.

With inputs from agencies

Image Source: Multiple agencies

© Copyright 2024. All Rights Reserved Powered by Vygr Media.