August 2024 witnessed a significant shift in the stock market, particularly in the technology sector. Major tech firms faced substantial declines in their market values, driven by concerns over rising costs associated with artificial intelligence (AI) infrastructure and the increasing risk of a potential recession. These factors combined to create a vulnerable environment for tech-related stocks during market corrections, leading to notable impacts on several industry giants.

Image Source: The Hindu

-

Alphabet Inc.- Alphabet Inc. (GOOGL.O) experienced a 4.7% drop in its market value throughout August. This decline was primarily attributed to a slowdown in advertising revenue from YouTube, which raised concerns about the company's earnings potential. Additionally, Alphabet faced a significant legal setback when a U.S. court ruled that Google had violated antitrust laws. This ruling, coupled with emerging competition from OpenAI, which is developing an AI-based search engine prototype, further compounded the challenges for Alphabet, leading to a sharp decline in its stock performance.

-

Amazon.com Inc.- Amazon.com Inc. (AMZN.O) saw a 4.5% decrease in its market value during the same period. The decline was largely driven by a slowdown in online sales, which highlighted broader challenges within the e-commerce sector. As one of the largest online retailers globally, Amazon's performance is closely watched, and any indication of weakness in its core business can have significant repercussions on investor sentiment.

-

Tesla Inc.- Tesla Inc. also faced a tough month, with its market capitalization dropping by 7.7%. The decline followed weaker-than-expected second-quarter earnings, which disappointed investors. Moreover, Tesla faced additional pressure from geopolitical developments, particularly Canada's proposal of a 100% tariff on electric vehicles (EVs) manufactured in China. Since Tesla's Shanghai facility plays a crucial role in its global supply chain, this tariff could significantly impact the company's profitability, especially as it grapples with higher production costs in the United States.

-

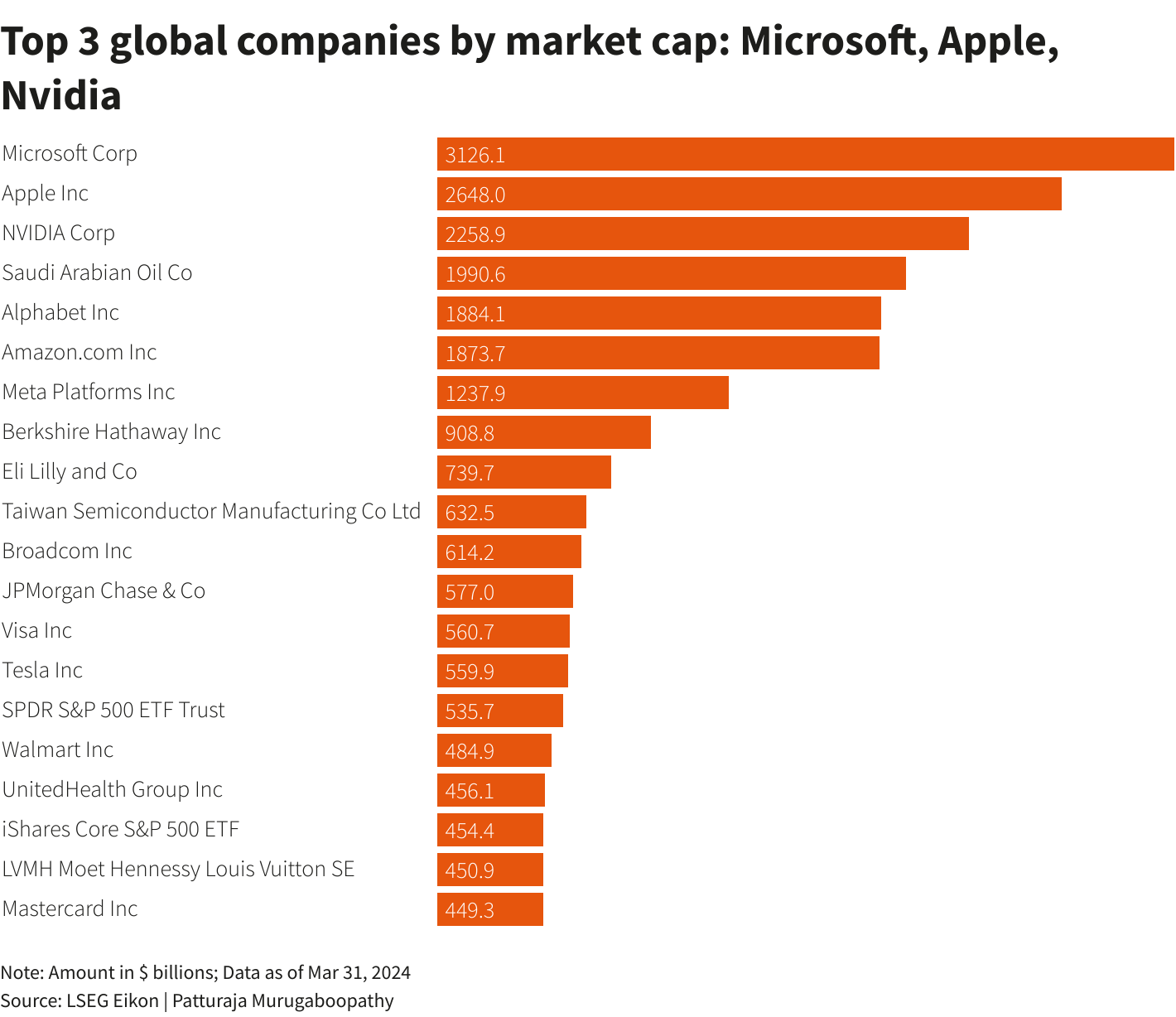

Nvidia Corp.- Nvidia Corp. (NVDA.O), a leader in AI chip manufacturing, also experienced a challenging August. The company's market value fell by 7.7% in the last week of the month, bringing its valuation to $2.92 trillion. The decline came after Nvidia's third-quarter gross margin forecasts fell short of market expectations, and its reported revenue only met estimates, rather than exceeding them. Investors had high hopes for Nvidia, given its dominant position in the AI chip market, so the relatively modest performance was met with disappointment.

Image Source: Longport

While the tech sector faced headwinds, other companies managed to thrive in August 2024, bucking the overall market trend.

-

Eli Lilly- Eli Lilly (LLY.N) emerged as a standout performer, with its market value surging by approximately 20%. The pharmaceutical company benefited from robust sales and the successful launch of a weight-loss drug, which has been shown to significantly reduce the risk of developing type 2 diabetes in overweight adults. This development not only boosted investor confidence in Eli Lilly's growth prospects but also positioned the company as a leader in the burgeoning market for diabetes prevention treatments.

-

Berkshire Hathaway- Berkshire Hathaway (BRKa.N), the conglomerate led by Warren Buffett, also had a milestone month, with its market value surpassing $1 trillion for the first time. This achievement reflects the strong investor confidence in Berkshire Hathaway, which is often viewed as a proxy for the U.S. economy due to its diverse portfolio of businesses spanning various industries. The company's performance in August underscores its resilience in the face of broader market challenges.

-

Meta Platforms Inc.- Meta Platforms Inc. (META.O) also saw significant gains in August, with its market value increasing by nearly 10%. The company's strong second-quarter revenue and optimistic forecasts for the July-September quarter were key drivers of this growth. Despite the rising costs associated with its AI investments, Meta's robust digital ad spending helped to offset these expenses, reinforcing investor confidence in the company's ability to navigate the evolving digital landscape.

Image Source: Longport

The stock market in August 2024 presented a mixed picture, with major tech firms like Alphabet, Amazon, Tesla, and Nvidia facing significant challenges due to rising AI infrastructure costs, legal hurdles, and geopolitical tensions. However, the success of companies like Eli Lilly, Berkshire Hathaway, and Meta Platforms highlights the resilience and adaptability of businesses outside the tech sector. As the market continues to evolve, these contrasting performances underscore the importance of diversification and strategic innovation in navigating uncertain economic environments.

With inputs from agencies

Image Source: Multiple agencies

© Copyright 2024. All Rights Reserved Powered by Vygr Media.