Hyundai Motor India is preparing to launch a significant Initial Public Offering (IPO), having submitted preliminary documents to the Securities and Exchange Board of India (SEBI). The company plans to raise nearly $3 billion, potentially setting a new record for India's largest IPO, surpassing the Life Insurance Corp. of India's $2.5 billion issue in 2022.

About Hyundai Motor India

Hyundai Motor Company ranks as the third-largest original equipment manufacturer (OEM) globally.

Renowned for producing four-wheeler passenger vehicles with cutting-edge technology and innovative features, Hyundai offers a diverse lineup including sedans, hatchbacks, sports-utility vehicles (SUVs), and battery electric vehicles (EVs).

The upcoming IPO aims to raise $3 billion, marking a significant event in India's financial landscape.

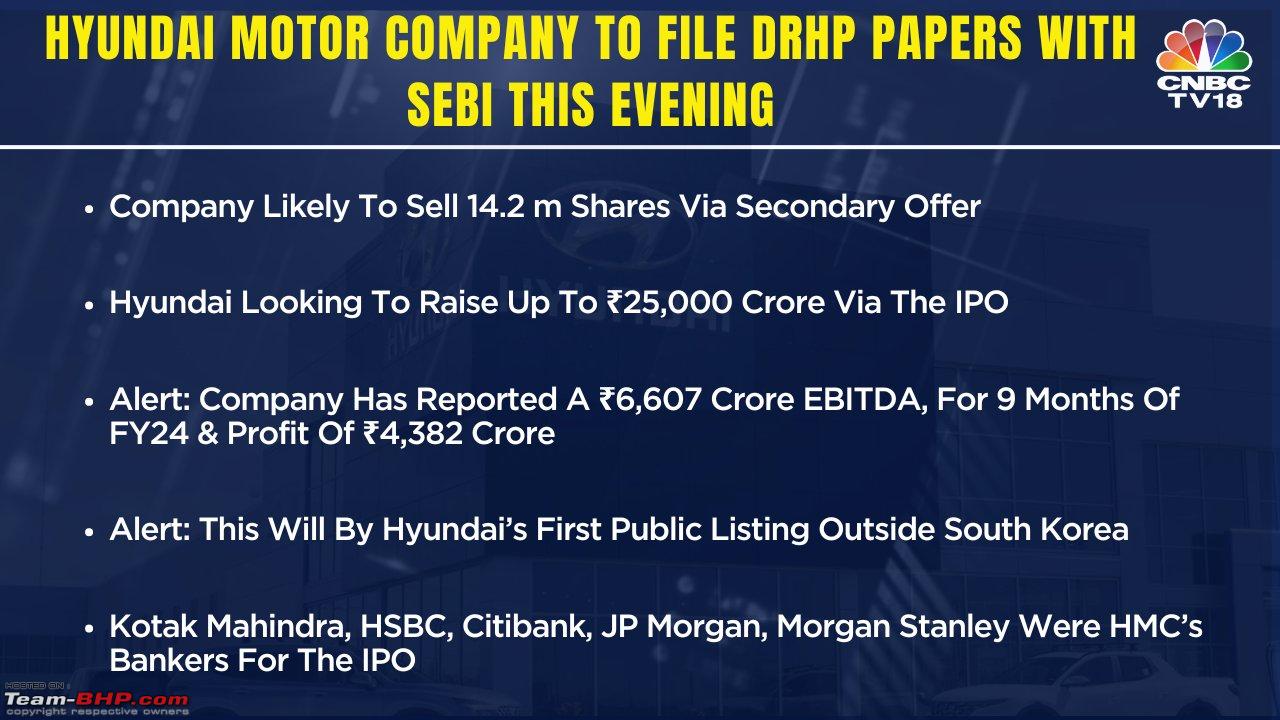

The draft red herring prospectus (DRHP) submitted to SEBI does not specify the exact amount to be raised.

Hyundai is in discussions with major investment banks such as JP Morgan, Morgan Stanley, Citi, and Bank of America to manage the IPO, although no formal agreements have been made yet.

Hyundai Motor India IPO Details

Hyundai Motor India’s IPO has been confirmed, though the exact size remains undisclosed. Bankers involved in the process suggest a target of $2.5 to $3 billion, which would value the company at $25-30 billion.

According to the DRHP, the IPO will be an offer for sale (OFS) of 142,194,700 equity shares by Hyundai Motor Company, with no new shares being issued. This represents 17.5% of the post-offer paid-up equity share capital, indicating a substantial public offering.

-

Company: Hyundai Motor Company

-

IPO Size: Approximately $3 billion

-

Valuation: Targeting around $30 billion for the Indian unit

-

Purpose: To expand operations in India, particularly in electric vehicles (EVs) and related infrastructure

-

Expected Market Impact: Likely to surpass Life Insurance Corporation’s $2.7 billion IPO in 2022, becoming India’s largest IPO.

Strategic Reasons for the IPO

Hyundai Motor Company has several strategic reasons for launching this IPO:

-

Expansion in India: The company aims to accelerate its growth in India, where it has been operating for 25 years and is the second-largest carmaker by sales. The funds raised will help Hyundai expand its market presence and potentially become the leading car manufacturer in India.

-

Reducing Dependency on Parent Company: By raising funds locally, Hyundai seeks to reduce its financial reliance on the parent company. This move is intended to enhance its financial independence and flexibility.

-

Competing with Local and Global Rivals: With increasing competition from local companies like Tata Motors and the anticipated entry of Tesla into the Indian market, Hyundai aims to strengthen its position, particularly in the EV sector.

Hyundai Motor files for India's biggest IPO worth $3 billion#hyundai #hyundaimotor #ipo #sebi #MarketUpdate #automobiles #latestnews #BreakingNews #trending@HyundaiIndia@SebiCoinCalls pic.twitter.com/b5EH0nzV5X— VYGR News (@Vygrofficial) June 17, 2024

Usage of IPO Proceeds

The proceeds from the IPO will be utilized to bolster Hyundai’s position in the dynamic Indian automotive market. The primary areas of focus include:

-

Electric Vehicle (EV) Development: Funds will be allocated to the development and launch of new electric vehicles to meet the growing demand for sustainable transportation. Hyundai aims to offer a range of electric cars catering to various market segments, from affordable to premium models.

-

Charging Infrastructure: Recognizing the need for robust charging infrastructure, Hyundai plans to invest in setting up comprehensive charging facilities across India, including urban and rural areas. They will also promote home charging solutions and fast charging technology.

-

Battery Pack Assembly Unit: To enhance vertical integration of its supply chain, Hyundai plans to establish a battery pack assembly unit in India. This will reduce dependency on imported batteries, leading to cost efficiencies and faster production cycles.

-

Expansion of Manufacturing Capacity: To meet the increasing demand for Hyundai vehicles in India, the company intends to expand its manufacturing capacity. This includes setting up new manufacturing plants or expanding existing ones. Hyundai has already acquired a plant from General Motors, which will be upgraded to boost production capacity.

Hyundai’s planned IPO for its Indian unit represents a strategic initiative to strengthen its market presence, achieve financial independence, and enhance its competitive edge in the automotive market. This significant IPO presents a promising investment opportunity for potential investors.

With inputs from agencies

Image Source: Multiple agencies

© Copyright 2024. All Rights Reserved Powered by Vygr Media.