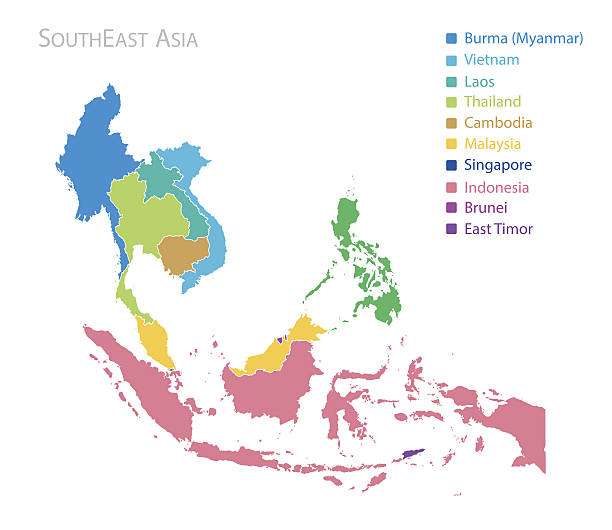

The Indian Cyber Crime Coordination Centre (I4C) has revealed some alarming information: over half of financial frauds that target Indians originate in Southeast Asia. The three nations in question are specifically Myanmar, Cambodia, and Laos. These countries act as hotspots for organised crime groups that take advantage of weaknesses in India's digital infrastructure.

Southeast Asian Involvement, 48% Stat

According to recent studies, 48% of cyber scams that target Indian nationals are planned and executed in Southeast Asia. These fraudulent schemes come in a variety of forms, from romance scams to investment scams, and they have collectively defrauded people and companies out of significant sums of money.

Chinese Connection and Web Applications

It's interesting to note that a large number of the online programmes used to carry out these scams are written in Chinese, suggesting a more complex relationship. The fact that Chinese entities are involved highlights how global cybercrime is and how international collaboration is essential to combating these dangers.

Indian Hotspots and Losses Quantum

Even though Southeast Asia is important, it's important to understand that India is home to a number of fraud centres. Previously regarded as the hubs of financial cybercrime in India, infamous areas like Jamtara and Mewat are now eclipsed by these global syndicates. The amount of money lost to scams with Southeast Asian origins is still significant nonetheless.

Recent Victims of Cybercrime

1. 'Digital Arrest' Scam in Noida: A Noida woman fell prey to a brand-new kind of cybercrime called 'Digital Arrest. Cybercriminals posing as law enforcement officials conned her out of Rs 11 lakh. The con artists forced her to transfer money in order to avoid being arrested, accusing her of engaging in illegal activity related to her Aadhaar card.

For more, read: Noida's First 'Digital Arrest': Woman Scammed Of Rs 11 Lakh

2. The Upsetting Cyber Fraud in Faridabad: In a related incident, a woman in her twenties was deceived out of Rs 2.5 lakh. Falsely accusing her of mailing passports and cards connected to her Aadhaar number to Cambodia for illegal activities, such as human trafficking, the thieves pretended to be customs inspectors.

For more, read:Cyber Fraud: Man Scammed Of 72 Lakhs Under The Guise Of A Job

3. Government Action Against Foreign Websites: The Ministry of Electronics and Information Technology (MeitY) has blocked more than 100 foreign websites in response to the growing trend of cybercrime. These websites targeted women, pensioners, and young people without jobs with promises of large profits for doing easy online chores. They were also involved in organised crime and part-time employment scams.

For more, read: Over 100 Overseas Websites Blocked By Government Upon Task Based Part-Time Job Fraud

Tackling Scam Centres: The Triumph of West Bengal

A remarkable development occurred when West Bengal police moved decisively to shut down one of the four "scam" centres that YouTuber Mark Rober had uncovered. After almost ten years of operation and over a thousand employees, MET Technologies in New Town was shut down, and fifteen "scammers" were taken into custody for defrauding victims in the US, UK, and Australia.

Prompt Police Intervention and Additional Advancements

The Kolkata Police's cyber unit raided MET Technologies' call centre in New Town on May 10, 2024, and took 15 people into custody on charges of defrauding customers from the US, UK, and Australia. During the raid, the authorities confiscated 300 hard drives, 13 laptops, and many cell phones, uncovering private information about the scam operations. It was also discovered that MET Technologies had a significant presence in both Kolkata and Pune, operating multiple branches.

Persistent Attempts and Additional Raids

Six more people were arrested at the same location by the police during other raids they performed as part of an ongoing attempt to stop these fraudulent activities. Collaboration with regional law enforcement organisations in the US, UK, and Australia made these arrests possible. Interestingly, the hunt for the scam's creator is still ongoing, demonstrating the determination of the authorities to apprehend all of the perpetrators.

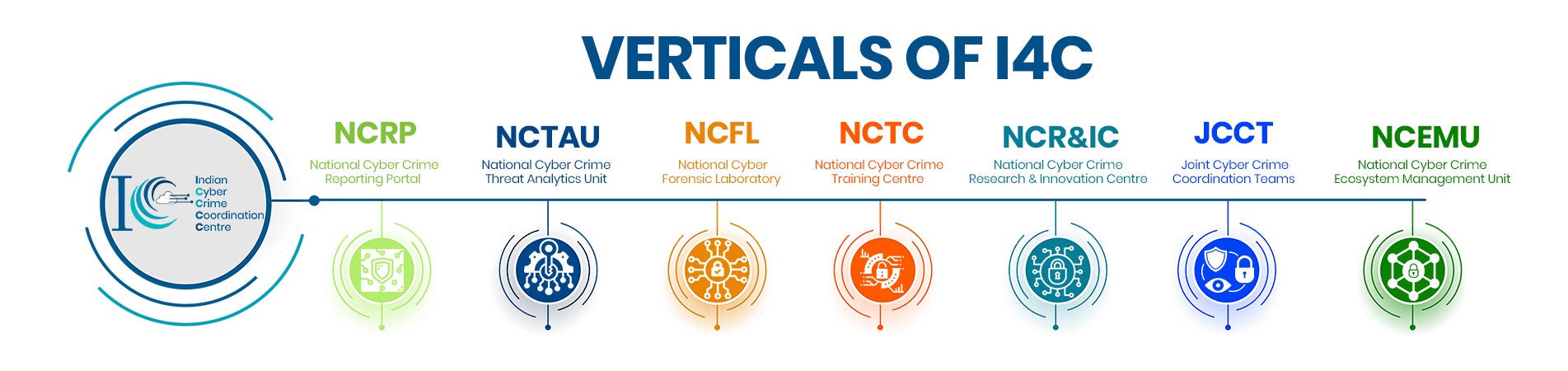

National and International Frameworks for Government Policies

Initiatives like the National Cyber Security Policy-2013 (NCSP-2013) demonstrate India's dedication to cybersecurity. The policy seeks to protect software, services, devices, and networks in addition to establishing a secure computer environment and promoting trust in electronic transactions. In order to effectively combat cybercrime, the Indian Cybercrime Collaboration Centre (I4C) also focuses on improving collaboration between law enforcement authorities and others.

The Causes and Statistics of the Increase in Financial Cybercrimes

The Changing Financial Crime Scene

With associated costs taken into account, financial crime and fraud have grown to be a trillion-dollar business, with institutions losing about three dollars for every dollar of fraud. This tendency can be attributed to multiple factors:

Automation and Digitization: As financial systems digitise and automate, vulnerabilities to fraud and financial crime increase. Criminals exploit these technologic national and international frameworks for government policies. India's National Cyber Security Policy-2013 and I4C aim to protect software, services, devices, and networks, promoting trust in electronic transactions and enhancing collaboration between law enforcement authorities.

Massive Transaction Volumes: The sheer growth in transaction volumes provides cybercriminals with more opportunities to exploit weaknesses in the system.

Global Integration: Financial systems are increasingly interconnected within countries and internationally, making them susceptible to cross-border cyber threats.

Recent Statistics on Financial Cybercrimes

India: Financial frauds accounted for over 75% of cyber crimes in India from January 2020 to June 2023. Nearly 50% of these cases were related to UPI (Unified Payments Interface) and internet banking.

Global Trends:

♦ Data breaches: Between 2019 and 2023, the number of data compromise incidents involving financial institutions increased by over 330%.

♦ Monetary Losses: The monetary damage caused by cybercrime in the United States reached a historical peak of $12.5 billion in 2023.

♦ Extreme Losses: Extreme losses from cyber incidents have more than quadrupled since 2017, totaling $2.5 billion.

♦ Ransomware: Financial institutions are among the main targets for ransomware attacks, threatening funding problems and solvency.

Cybersecurity Measures and Challenges

► Multi-Factor Authentication (MFA): Organizations deploy MFA systems to enhance security, but some users find them annoying or complicated.

► Third-Party Vendors: Financial firms increasingly rely on third-party IT service providers, which can improve resilience but also expose the industry to system-wide shocks.

Personal Experience: A Real-Time Scam Attempt

It was funny that while I was writing this article on financial cyber threats, I received a call from +918****** that seemed to be a scam attempt. The caller, a polite but unknown male, addressed me by my name and knew where I currently reside. After a few courtesy and awkward "namaste" and "hellos," he proceeded to tell me that "my father, Mr. such and such, has given me your number to send you the pending payment of Rs. 5000." This sounded suspicious from the very start. Before he could go into more irrelevant and useless details, I stopped him and asked him to hold on for a moment. Stupidly, he did.

I ran to my father in the next room, where he was about to fall asleep while reading his newspaper. I asked him if we knew some Mr. X from Jalandhar, to which he seemed baffled, confirming my suspicion. My father took the phone from me and just said hello. The tone on the other side completely changed; the reason for calling and the story all shifted. When my father asked who he was, the caller's name changed again, leaving us to giggle. In the end, Mr. X or whoever he was said the usual "oh, sorry, wrong number" and hung up.

Being aware of what a scam call or correspondence of any kind could look like, I knew something was off. It could have been that the call before me or the call after me made the mistake of trusting this person. He wasn't asking for money but saying he needed to send us money, which could be the hook for many. I cannot stress enough the importance of being self-aware. From the start of the dot-com era, everyone wanted online recognition, but now, the tables have turned in such a way that even if you think you are safe online, you never know.

Acquired knowledge and preventive actions

These incidents demonstrate the changing strategies used by cybercriminals and the significance of raising public awareness. To avoid falling for such scams, citizens are recommended to exercise caution, examine dubious digital transactions, and confirm the legitimacy of UPI app receivers.

In summary

Strong cybersecurity measures, international cooperation, and public awareness are critical as India continues its digital revolution. By working together, we can make the internet a safer place and make sure that those who commit cybercrimes are held accountable.

Inputs from multiple agencies

Media from multiple agencies

ⒸCopyright 2024. All Rights Reserved Powered by Vygr Media.