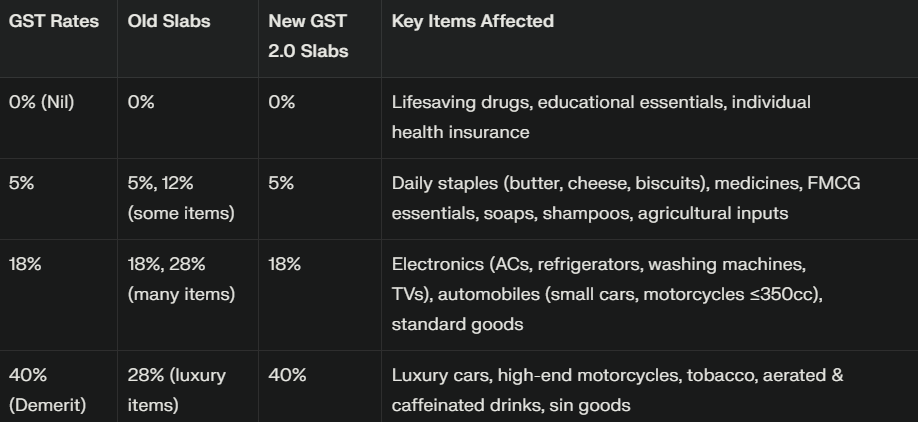

India's Goods and Services Tax (GST) system has entered a new phase known as GST 2.0, effective from September 22, 2025. This updated tax structure aims to simplify the GST slabs and bring relief to a wide range of goods, particularly essentials and household appliances. With GST rates rationalized into three clear categories—5% for essentials, 18% for standard goods, and 40% for luxury and sin items—consumers can expect noticeable changes in pricing across many daily-use products and appliances.

Simplified GST Slabs for Better Clarity

The GST Council has restructured the tax slabs, replacing the previous complex mix of 5%, 12%, 18%, and 28% rates with a streamlined three-slab system. The 5% slab covers essential goods like daily staples and medicines, which are now cheaper due to reduced tax rates. The 18% slab includes standard goods such as household appliances and most electronics, while the 40% slab is reserved for luxury goods like high-end motorcycles and sin items like tobacco and aerated beverages.

This simplification is designed to ease compliance for businesses and make pricing more transparent and understandable for consumers. It also aims to boost consumption by making essential and mid-range products more affordable, especially ahead of festive seasons.

Impact on Appliance Prices and Electronics

One of the most significant benefits of GST 2.0 is felt in the electronics and household appliance sectors. Items that were previously taxed at 28%, such as air conditioners, refrigerators, washing machines, dishwashers, and large-screen TVs, will now attract just an 18% GST. This change is expected to lower prices by roughly 8-9%, translating to savings of thousands of rupees for buyers.

For example, air conditioners and dishwashers may see price drops in the range of Rs 3,500 to Rs 4,500 per unit. Refrigerators and washing machines are also becoming more affordable, making it easier for the middle class to upgrade their homes with energy-efficient and modern appliances. This price shift is timely, coinciding with major festivals when consumers are more likely to make big purchases.

However, not all electronics experienced tax cuts. Mobile phones and laptops remain in the 18% slab, meaning their prices will not see a direct GST-related reduction. Buyers will still need to rely on sales and seasonal discounts for price relief on these items.

Daily Staples and Essentials—Cheaper Than Before

GST 2.0 is also a boon for everyday consumers because it reduces taxes on a large range of common staples and FMCG goods. Approximately 99% of products previously taxed at 12% have now moved to the 5% slab. This includes items like butter, cheese, confectionery, savory snacks, biscuits, ice cream, soaps, toothpaste, and shampoos.

Leading FMCG companies have already started passing on these savings to consumers by reducing prices. This means grocery shopping bills for families will be lighter, empowering consumers, especially in rural and semi-urban areas, where economic pressures are often higher.

The reduction in GST rates on medicines and medical devices—now at 5%—could also improve access to healthcare by lowering costs of essential medicines and diagnostic kits.

What Does GST 2.0 Mean for Consumers and the Economy?

GST 2.0 represents a careful balance between consumer relief and fiscal sustainability. By reducing tax rates on essentials and household items, the government aims to increase disposable income for millions of families, encouraging consumption. This is crucial after a period marked by inflation and economic uncertainties that dampened consumer spending.

The timing of these changes, close to major festivals, has the potential to rejuvenate demand in sectors like electronics, FMCG, and automobiles, leading to broader economic growth. Retailers and manufacturers are likely to benefit from increased sales volumes, which may also incentivize businesses to pass on benefits quickly.

On the other hand, luxury and sin goods remain heavily taxed at 40%, signaling a continued governmental goal to discourage unhealthy or non-essential consumption while maintaining robust revenue collection.

Overall, GST 2.0 aims to make the tax system simpler and fairer while giving ordinary consumers more purchasing power. For many households, this means that the items they use daily—whether it’s their monthly groceries or an air conditioner for the summer—will become more affordable, helping improve living standards without compromising the government’s fiscal responsibilities.

What Consumers Should Look Out For

-

Expect your monthly grocery bills to reflect lower prices on essentials like dairy, snacks, and household items.

-

Appliances such as ACs, refrigerators, and washing machines will now be more affordable, ideal timing for festival shopping.

-

Keep in mind that phones and laptops have no tax cut, so discounts will depend on market promotions rather than GST changes.

-

Pharmacies and medical stores will offer medicines and medical devices at lower rates due to the reduced tax slab.

In conclusion, GST 2.0 brings welcome clarity and relief for everyday consumers, while aiming to keep taxation balanced for the economy. This well-planned tax reform could lead to positive ripple effects across households and industries, supporting India's continued growth and consumer confidence in the years ahead.

With inputs from agencies

Image Source: Multiple agencies

© Copyright 2025. All Rights Reserved. Powered by Vygr Media.