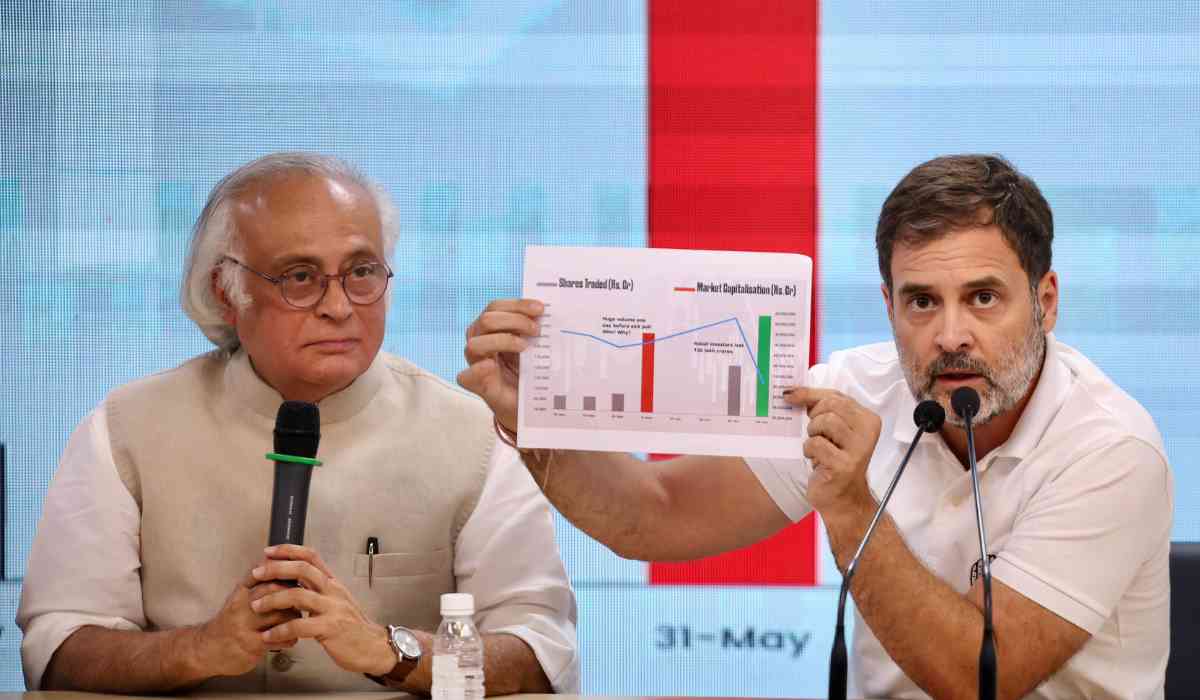

Congress leader Rahul Gandhi, during a press conference on Thursday, accused Prime Minister Narendra Modi and Home Minister Amit Shah of being directly involved in what he termed the "biggest stock market scam" in Indian history. Gandhi claimed that this scam resulted in retail investors losing Rs 30 lakh crore. He demanded a Joint Parliamentary Committee (JPC) probe into the alleged scam, emphasizing the need for accountability and transparency from the highest echelons of the government.

Unprecedented Comments on Stock Markets

Gandhi during the press conference stated,

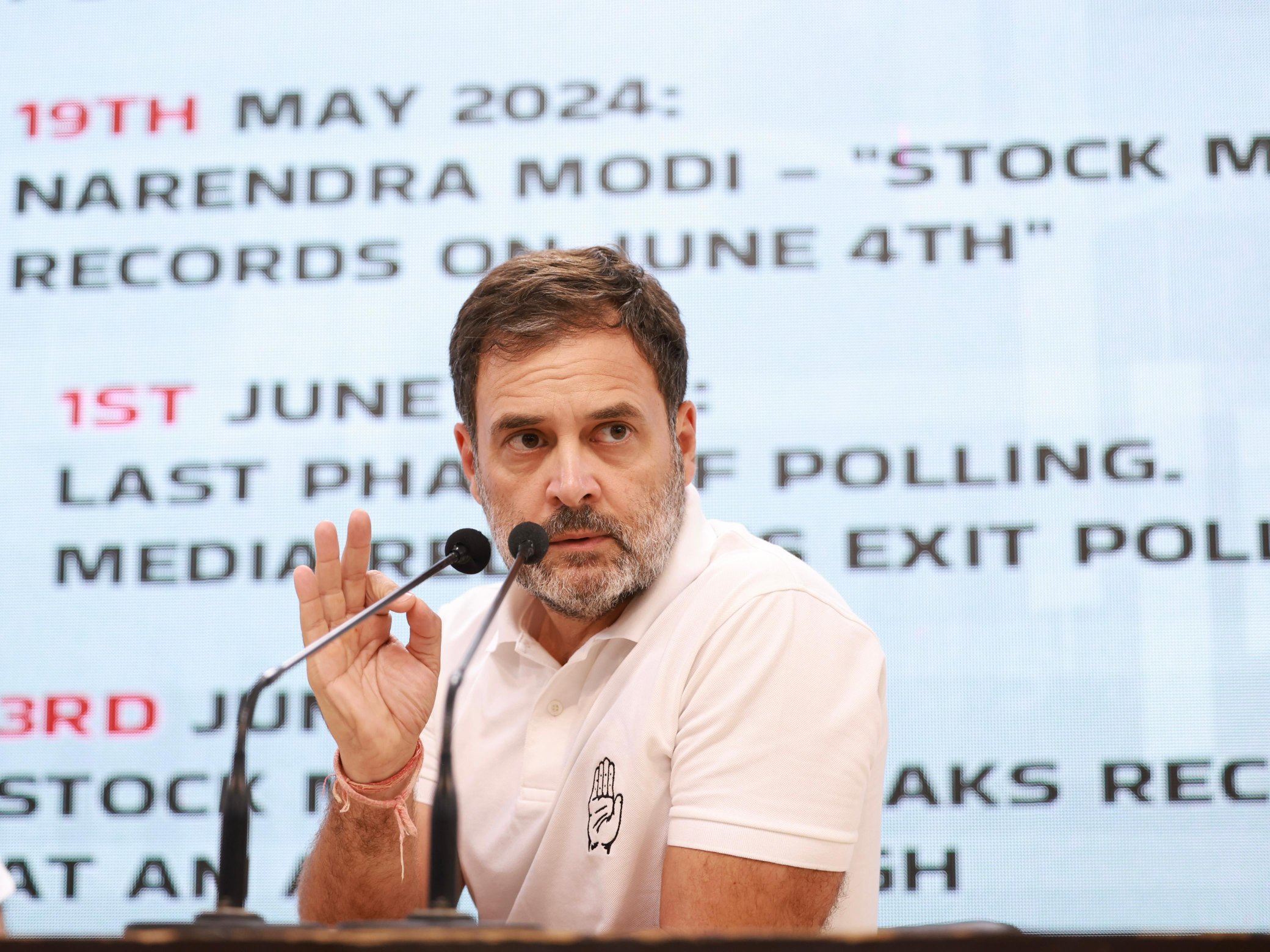

“For the first time we noted that during the elections, the Prime Minister, the Union Home Minister and the Finance Minister commented on the stock market. The Prime Minister said that the stock market is rising rapidly. The Union Home Minister said that on June 4 the stock market will be on the rise and you all should invest and similar was said by the Finance Minister…Amit Shah says buy shares before June 4, 19 May PM Modi says the stock market will break records on June 4…”

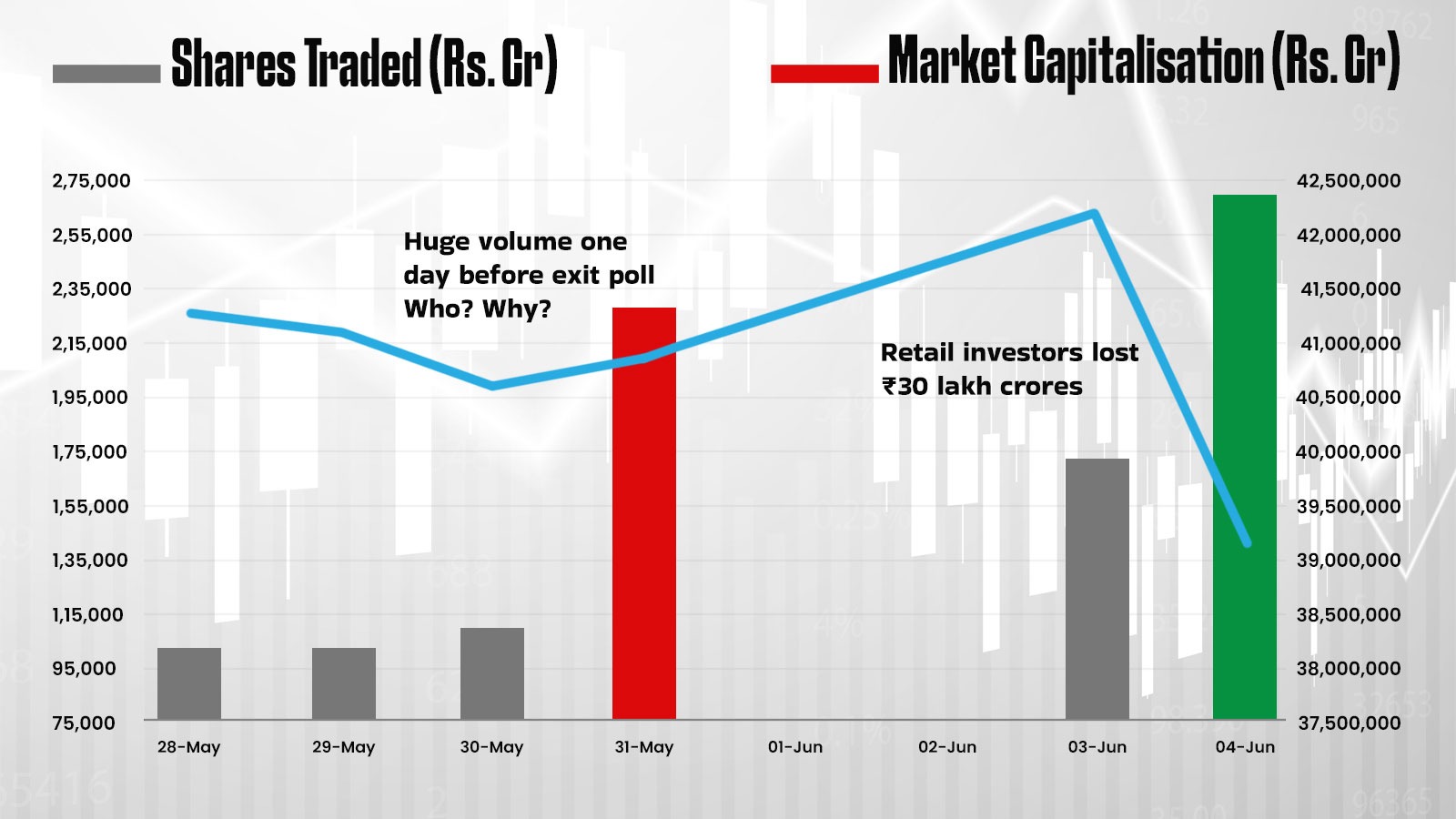

He highlighted that Prime Minister Modi, Home Minister Shah, and Finance Minister Nirmala Sitharaman made unusual comments about the stock market ahead of the Lok Sabha elections. He argued that such remarks from high-ranking officials were unprecedented and suspicious. According to Gandhi, the stock markets experienced a significant rise following the release of "fake" exit polls, only to crash dramatically on June 4th, the day votes were counted.

Questions Raised by Rahul Gandhi

During the press conference, Gandhi posed several pointed questions to the government:

1. Why did the Prime Minister and Home Minister provide specific investment advice to retail investors?; citing PM Modi’s interview given to NDTV on May 19th, 2024 stating;

Source: NDTV

2. Why were both interviews conducted at the same media house owned by a business group under SEBI investigation?

3. What is the connection between the BJP, fake exit pollsters, and foreign investors who profited from the market movements?

Gandhi emphasized that this issue was broader than the Adani group controversy and directly implicated the Prime Minister and Home Minister. He stressed that the unusual activity and advice provided by these leaders had never occurred before, suggesting a deliberate attempt to manipulate the market.

The Market Crash on June 4th

- Election Results and Market Reaction

The Indian stock market experienced a massive selloff on June 4th, coinciding with the vote counting for the Lok Sabha elections. Contrary to the exit polls, which had predicted a landslide victory for the BJP, the actual vote-counting trends showed a much closer contest. The Bharatiya Janata Party (BJP) appeared to be falling short of a clear majority, raising concerns about political stability and the future of economic reforms under a potentially weakened government.

Nirmala Sitaraman statement

Source: CNBC-News18

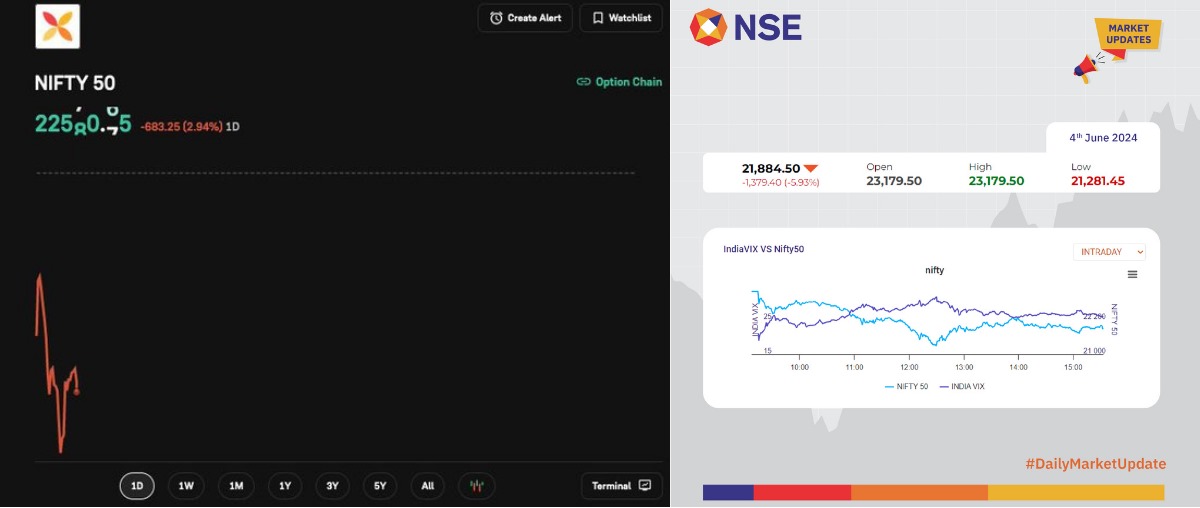

- Market Indices Plunge

India’s benchmark indices, the Sensex and the Nifty 50, both closed down by nearly 6%. The Sensex, which tracks 30 large companies, opened at 76,285.78 against its previous close of 76,468.78 and dropped by 8.2% to an intraday low of 70,234.43. It finally closed with a significant loss of 4,390 points, or 5.74%, at 72,079.05. Similarly, the Nifty 50 opened at 23,179.50 against its previous close of 23,263.90 and fell 8.5% to hit an intraday low of 21,281.45, closing at 21,884.50, down by 5.93%.

This was the biggest single-day percentage fall for the Nifty 50 in over four years, with losses comparable to those seen during the early stages of the COVID-19 pandemic in 2020.

Sensex on June 4th, 2024

- Broader Market Impact

The crash extended beyond the large-cap indices, affecting mid and small-cap stocks as well. The BSE Midcap index ended the day with a loss of 8.07%, having fallen as much as 12% during the session. The BSE Smallcap index plunged over 10% intraday, closing with a loss of 6.79%. The volatility index, India VIX, surged by 24%, indicating heightened market nervousness.

Amit Shah Statement’s was given on May 13th, 2024 to NDTV "Stock market crashes should not be linked with elections, but even if such a rumour has been spread, I suggest that you buy (shares) before 4 June. It will shoot up." - wound up to be contradicted by the markets.

- Financial Losses

The market capitalization of BSE-listed firms dropped dramatically from nearly ₹426 lakh crore to approximately ₹395 lakh crore, wiping out nearly ₹31 lakh crore in investor wealth. This significant loss was felt across various sectors and stocks, with nearly 300 stocks hitting fresh 52-week lows. Major losers included Bajaj Finserv, HDFC Life, IDFC First Bank, LTIMindtree, SBI Card, and Zee Entertainment.

- Sectoral Performance

Among the sectoral indices, Nifty PSU Bank was the worst hit, losing 15.14%, followed by Nifty Oil & Gas (down 11.80%) and Nifty Metal (down 10.63%). The Nifty Bank index fell by 7.95%, while the Financial Services index declined by 7.86%. In contrast, the Nifty FMCG index bucked the trend, closing 0.95% higher, with stocks like Hindustan Unilever, Britannia, and Nestle posting gains.

Source: NDTV

Analysis and Implications

► Political Uncertainty

The unexpected election results contributed to the market turmoil. Investors had anticipated a strong mandate for the BJP, which was expected to ensure political stability and facilitate bold economic reforms. The actual vote count, however, suggested a more fragmented mandate, leading to fears of policy paralysis and a less aggressive reform agenda. This uncertainty led to a broad-based selloff as investors reassessed their risk exposure.

► Allegations of Market Manipulation

Rahul Gandhi’s allegations added another layer of complexity to the situation. His claims of market manipulation by top government officials, coupled with the unusual market movements following the exit polls, raised serious questions about the integrity of the market and the role of political influence in financial decisions.

If substantiated, these allegations could lead to significant political and financial repercussions, including potential regulatory actions and further market volatility.

► Investor Sentiment

The market crash on June 4th highlighted the fragility of investor sentiment in the face of political and economic uncertainties. The significant losses across sectors and market segments underscored the interconnectedness of political events and market performance. The surge in the volatility index reflected heightened anxiety among investors, who might become more cautious in the near term, potentially leading to reduced market liquidity and further volatility.

► Regulatory and Policy ResponsesEarly trends are in, and it’s looking quite different from the what the exit polls predicted.

#LokSabhaElectionsResult #ElectionsResults pic.twitter.com/WdqhPfvMUu— VYGR News (@Vygrofficial) June 4, 2024

In response to the market crash and the allegations of manipulation, regulatory bodies like SEBI (Securities and Exchange Board of India) may need to intensify their scrutiny of market activities and political disclosures. Enhanced transparency and stricter enforcement of regulations could help restore investor confidence. Additionally, the government may need to address these allegations comprehensively to prevent further erosion of trust in the financial markets.

► Economic Outlook

The broader economic implications of the market crash could be significant. A sustained downturn in the stock market could affect capital formation, investment sentiment, and overall economic growth. Policymakers might need to implement measures to stabilize the market, such as liquidity support or investor protection mechanisms. Ensuring a smooth political transition and clear communication of economic policies will be crucial to mitigate the adverse effects on the economy.

Conclusion

The events of June 4th marked a tumultuous day for the Indian stock market, driven by unexpected election results and allegations of high-level market manipulation. Rahul Gandhi’s accusations against Prime Minister Modi, Home Minister Amit Shah, and Finance Minister Sitharaman have added a political dimension to the financial turmoil, raising questions about the integrity of the market and the influence of political leaders on financial decisions.

The market crash serves as a stark reminder of the interconnectedness of politics and finance, highlighting the importance of political stability and transparent governance for the health of financial markets. Moving forward, both political and financial leaders must work together to rebuild trust and foster a stable environment conducive to economic growth and prosperity.

Inputs by Agencies

Image Source: X(Multiple Agencies)

Ⓒ Copyright 2024. All Rights Reserved Powered by Vygr Media.