- Rainmatter's Investment in Water Recycling and Nutrition: Zerodha's venture capital firm, Rainmatter, has invested in two startups: Boson Whitewater, focused on water recycling, and TruNativ, a nutrition-focused brand.

- Addressing Water Scarcity: Boson Whitewater aims to solve water scarcity issues by treating excess wastewater from sewage treatment plants.

- Direct-to-Consumer Nutrition Products: TruNativ offers nutritional supplements like protein powder, fiber, and sweeteners directly to consumers.

- Rainmatter's Investment Strategy: Rainmatter invests in startups across various sectors and is committed to providing long-term patient capital.

- Focus on India and the World: Rainmatter supports startups building for India and the world with a long-term mindset.

- Geospatial Data for Problem Solving: GalaxEye, another Rainmatter investment, uses geospatial data to address issues like early warning for climate-related disasters.

Dinesh Pai, Chief of Rainmatter (Image Source - The Economic Times)

Rainmatter, the venture capital firm of brokerage platform Zerodha, has invested Rs 10 crore in water recycling startup Boson Whitewater. Boson Whitewater treats excess wastewater from sewage treatment plants and converts it into potable water for cities facing severe water scarcity, such as Bengaluru.

TruNativ: Nutritional Supplements

Rainmatter also invested Rs 10 crore in TruNativ, a direct-to-consumer brand of nutritional products like protein powder, fiber supplements, and sweeteners. These are available on the company website and other online portals.

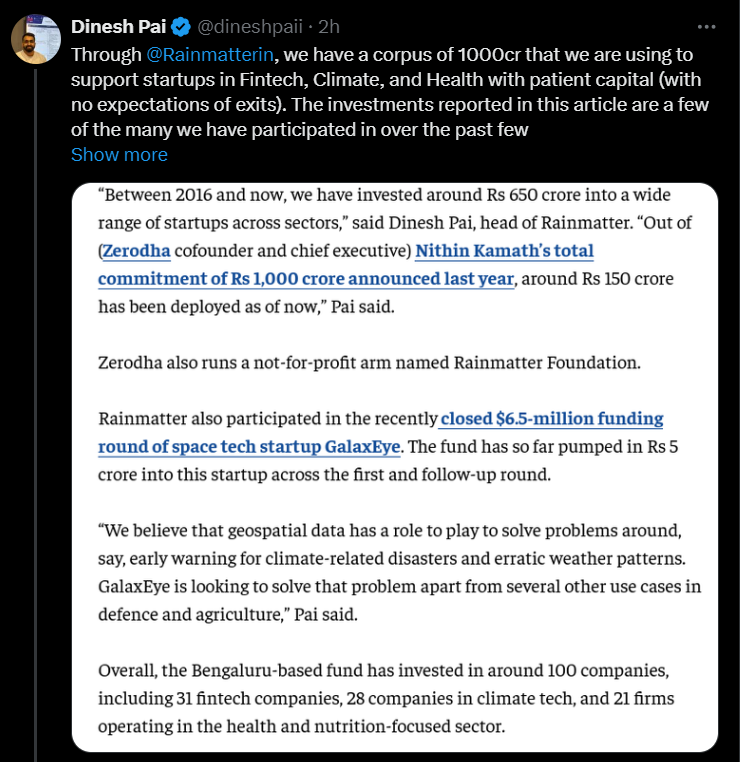

Image source - Dinesh Pai, X

Investment Strategy of Rainmatter

Rainmatter invests in startups across the Fintech, Clean Energy, Climate Tech, and Healthtech sectors. It has so far invested Rs 30 crore in over two months in several companies including follow-on rounds in health startup Devil's Circuit, climate-focused startup GreenWorms, and Fintech startup Actlogica.

Dinesh Pai, chief of Rainmatter said they have invested close to Rs 650 crore in startups since 2016. Nithin Kamath, co-founder of Zerodha has committed Rs 1,000 crore to Rainmatter, and about Rs 150 crore has been deployed so far.

GalaxEye Raises Funding From Rainmatter

It recently also participated in the $6.5-million funding round of GalaxEye, a space tech startup. The fund has invested Rs 5 crore in this startup across the first and follow-up rounds. GalaxEye leverages geospatial data to offer solutions for challenges such as early warning for climate-related disasters and erratic weather conditions.

( Talk -show about the investment strategy) Image source - Dinesh Pai, X

Rainmatter's Investment Strategy

Rainmatter is in complete belief that to build such a breed of Indian startups for the long term, they need more patient capital. They do not believe in exits after a certain period and would hence be long-term supporters of startup building for India and the rest of the world.

Overall, Rainmatter has so far invested in about 100 firms, including 31 fintech firms, 28 firms in climate technology, and 21 firms operating in the health and nutrition-focused verticals.

Inputs by Agencies

Image Source: Multiple Agencies

Ⓒ Copyright 2024. All Rights Reserved Powered by Vygr Media.