-

Listing Date and Exchanges: Shree Tirupati Balajee Agro Trading Company Ltd. shares are debuting today, September 12, on BSE and NSE.

-

Strong Grey Market Premium (GMP): The shares have a grey market premium of ₹22, suggesting an expected listing price of around ₹105, which is a 27% premium over the IPO price of ₹83.

-

Analyst Expectations: Analysts anticipate a strong debut, with shares likely to list at a 20% to 30% premium. They recommend holding the stock for medium to long-term gains.

-

Financial Performance: The company has shown consistent growth, with revenue rising from ₹444.2 crore in FY22 to ₹539.7 crore in FY24, and improving EBITDA margins from 7% to 11%.

-

Subscription Details: The IPO was heavily oversubscribed, with 124.74 times overall demand, showing strong interest from all investor categories.

-

Segment and Trading Rules: Shares will trade in the Trade-for-Trade segment for 10 days and participate in the Special Pre-open Session on listing day.

-

Expert Advice: Analysts recommend holding the stock due to attractive pricing and market potential but advise consulting certified experts for investment decisions.

Image Source - X

The Shree Tirupati Balajee Agro Trading Company Ltd. IPO will likely hit the stock market today, September 12, on both BSE and NSE. After attracting good investor interest, the company's shares are likely to trade with a premium.

IPO Overview and Listing Details

Shree Tirupati Balajee IPO, which opened for subscription on September 5, closed on September 9. Allotments were finalized on September 10 and the shares will be listed in the 'T' group on BSE. The stock will trade in the Trade-for-Trade segment for the first 10 days and participate in the Special Pre-open Session (SPOS).

Grey Market Premium (GMP) and Expected Listing Price

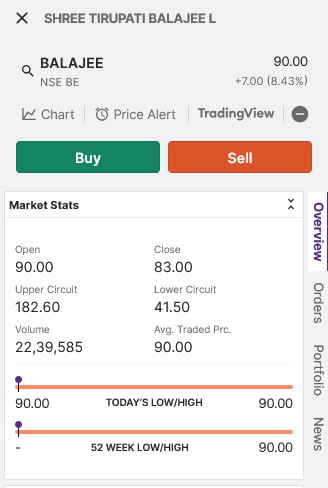

Trends on the grey market indicate shares of Shree Tirupati Balajee trading with a premium of ₹22 over the issue price. This would imply a listing price of around ₹105 per share, a 27% increase over the IPO price of ₹83. Shares might list with gains between 20% and 30%, according to analysts.

Image Source - X

Financial Performance and Analyst Insights

Shree Tirupati Balajee has managed to carve a niche in the FIBC and Industrial Packaging market. Despite all market challenges, the company has shown stable financial growth. Revenue grew at a CAGR of 10.2%, rising from ₹444.2 crore in FY22 to ₹539.7 crore in FY24 with improving EBITDA margins from 7% to 11%. Analysts say they hold the stock with a view of medium to long-term gains.

IPO Subscription and Issue Details

The ₹78-83 per share-priced IPO mobilized ₹169.65 crore, which includes a fresh issue of shares worth ₹122.43 crores and an offer for sale aggregating ₹47.23 crores. The IPO was subscribed 124.74 times overall, with strong demand from all investor categories.

Recommendation by Experts

Analysts are bullish on the market debut of Shree Tirupati Balajee, recommending a 'hold' on the company, citing its attractive valuation with a future growth potential. Investors are advised to consult certified experts before making any investment decisions.

Inputs by mint

Image Source: Multiple Agencies

Ⓒ Copyright 2024. All Rights Reserved Powered by Vygr Media.