Raymond Ltd., a historic Indian conglomerate with nearly a century of operations, is embarking on a significant restructuring journey. This initiative aims to separate its diverse business interests into distinct entities, enhancing shareholder value and positioning the company for future growth. The planned restructuring involves listing Raymond's apparel and real estate units by the end of 2025, while retaining its engineering and auto components division.

_3.jpg_1725364185.webp)

The Rationale Behind the Restructuring

Raymond’s Chairman, Gautam Hari Singhania, has articulated that the restructuring is a strategic move to address the "subdued valuations" experienced due to the conglomerate's varied business portfolio. By dismantling its conglomerate structure, Raymond intends to unlock value within its separate units and provide shareholders with more focused investment opportunities.

“The aim is to dismantle Raymond’s conglomerate structure, which led to the subdued valuations for its businesses,” Singhania explained. This restructuring will result in three distinct listed entities: Raymond Lifestyle, the real estate unit, and the parent company retaining its engineering and auto components operations.

Details of the Restructuring Plan

-

Raymond Lifestyle Listing

-

Date and Structure: Raymond Lifestyle is set to start trading in Mumbai on Thursday. For every five shares held in Raymond Ltd., investors will receive four shares of Raymond Lifestyle.

-

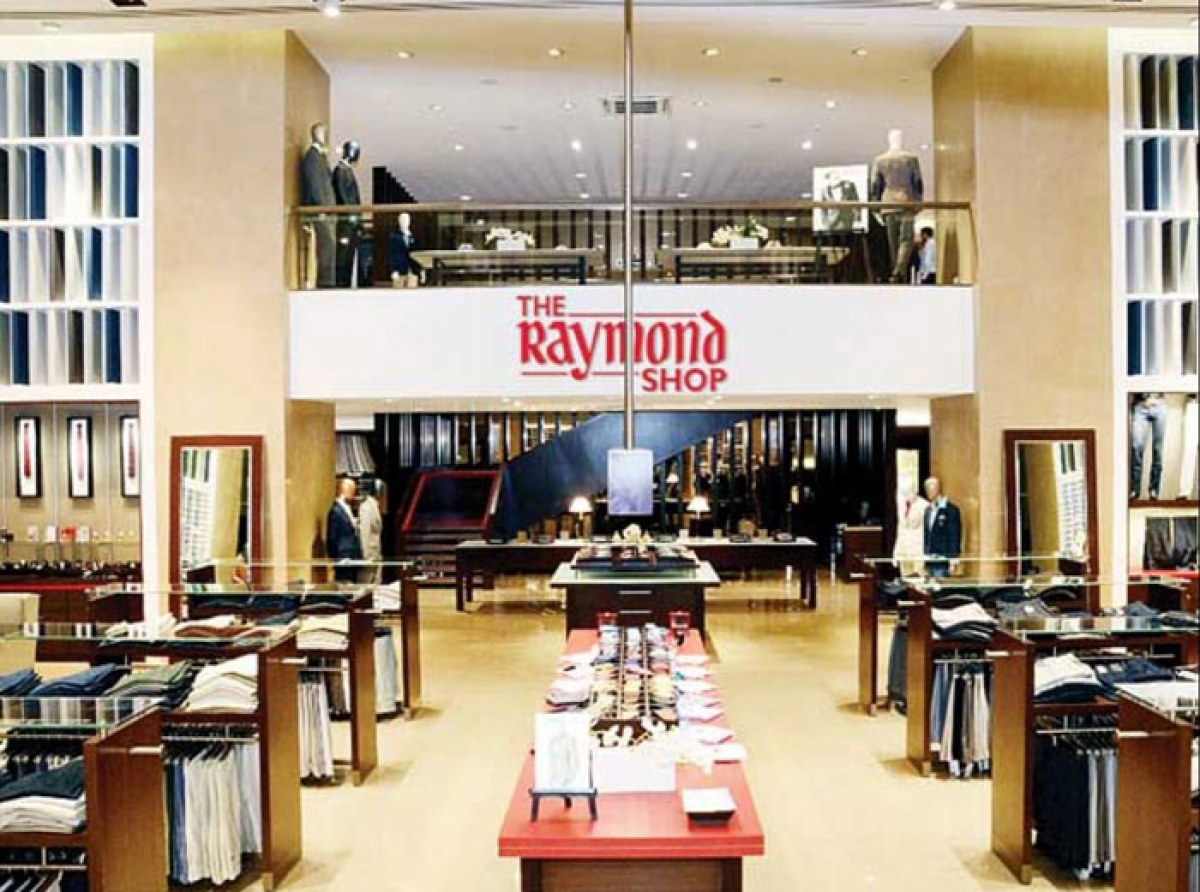

Business Focus: Raymond Lifestyle specializes in premium menswear, including high-end suits and wedding wear. The unit is targeting significant expansion within the Rs 750 billion ($8.9 billion) menswear market in India.

-

Growth Strategy: The unit plans to double its EBITDA and open 900 new stores by 2028. Currently, Raymond Lifestyle operates 1,518 stores in India and 48 stores overseas.

-

-

Real Estate Unit Listing

-

Timeline: The real estate unit is expected to be listed by the end of 2025.

-

Strategic Importance: This move aims to give the real estate division the autonomy it needs to thrive, separate from the conglomerate’s other interests.

-

-

Parent Company Focus

-

Retained Operations: The parent company will keep its engineering and auto components businesses. This focused approach will allow these segments to concentrate on their core operations without the complexities of a diversified conglomerate structure.

-

Addressing Past Challenges

Raymond has faced challenges in recent years, including a significant drop in its share value following Chairman Singhania’s public and contentious separation from his wife. This personal issue led to investor uncertainty and a dip in market value. However, Singhania is optimistic about moving past these issues. “Corporate governance issues are a matter of the past,” he stated. “We’re forging ahead, and the future is all about expanding and focusing on what Raymond does best.”

Market Outlook and Future Plans

Raymond's shares have rebounded impressively, surging by 89% this year, reflecting renewed investor confidence. The company aims to leverage its extensive experience and market presence to capture the growing middle class in India, estimated at 400 million.

For Raymond Lifestyle, the focus will be on expanding its presence in the lucrative wedding and menswear market. With competitors like Vedant Fashions and Aditya Birla Fashion and Retail, Raymond Lifestyle is positioning itself to capture a significant share of the market through strategic growth and increased store presence.

Raymond Ltd.'s restructuring represents a transformative phase in its long history. By separating its diverse business interests into distinct entities, the conglomerate aims to enhance shareholder value and provide clearer investment opportunities. With ambitious plans for growth and a renewed focus on its core areas, Raymond is set to embark on a new chapter, aiming to leverage its legacy and position itself strongly for future success.

With inputs from agencies

Image Source: Multiple agencies

© Copyright 2024. All Rights Reserved Powered by Vygr Media.