The initial public offering (IPO) of Emcure Pharmaceuticals Ltd., backed by Bain Capital, has generated significant attention in the market. This IPO, which opened for subscription on July 3, 2024, saw an enthusiastic response from investors, resulting in full subscription on the very first day. With a price band set between Rs 960 and Rs 1,008 per share, the IPO is poised to raise substantial funds for the company and its stakeholders.

Emcure Pharmaceuticals IPO Details

IPO Subscription Status:

With bids for 1,80,25,840 shares against the 1,37,03,538 shares on offer, the IPO achieved a 1.32-fold subscription rate. Retail individual investors (RIIs) subscribed 1.39 times, while non-institutional investors demonstrated strong interest by subscribing 2.70 times their allocated quota. Qualified institutional buyers (QIBs) subscribed to 7% of their reserved portion.

Offer Composition:

The IPO comprises a fresh issuance of equity shares worth Rs 800 crore and an offer for sale (OFS) of 1.14 crore equity shares, amounting to Rs 1,152 crore at the upper end of the price band. Promoter Satish Mehta and BC Investments IV Ltd., an affiliate of Bain Capital, are among the key sellers in the OFS.

Use of Proceeds:

Proceeds from the fresh issue will be used to pay down debt and for general corporate purposes. Emcure Pharmaceuticals has already raised Rs 583 crore from anchor investors.

Namita Thapar's Remarkable Return

Namita Thapar, Executive Director of Emcure Pharmaceuticals, is set to gain significantly from the IPO. Thapar stands to earn approximately Rs 127.87 crore from the sale of 12.68 lakh shares through the OFS, reflecting a 293-fold return on her initial investment. Thapar had acquired her shares at a weighted average price of Rs 3.44 per share. With the IPO price band set between Rs 960 and Rs 1,008 per share, her investment has appreciated remarkably.

Company Overview

Pune-based Emcure Pharmaceuticals is engaged in developing, manufacturing, and globally marketing a broad range of pharmaceutical products across several major therapeutic areas. The company's diverse portfolio and strong market presence have contributed to its robust performance and investor confidence.

Key participants in the IPO

Promoters and significant shareholders participating in the OFS include:

- Satish Ramanlal Mehta

- Sunil Rajanikant Mehta

- Samit Satish Mehta

- BC Investments IV Ltd.

- Pushpa Rajnikant Mehta

- Bhavana, Satish Mehta

- Kamini Sunil Mehta

- Arunkumar Purshotamlal Khanna

- Berjis Minoo Desai

- Sonali Sanjay Mehta

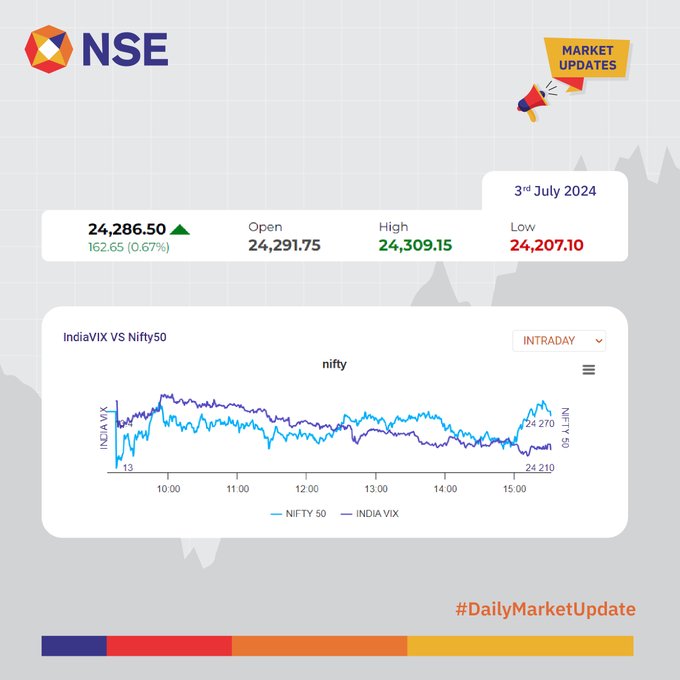

Market performance today

On July 3, 2024, Indian equity indices closed higher, with the Sensex gaining 545.35 points to reach 79,986.80 and the Nifty rising 162.70 points to end at 24,286.50. The market saw buying interest across most sectors, except media. The banking sector, particularly BankNifty, was a top performer, closing at 53,089.25, up by 1.77%.

Key Market Highlights:

⇒ The companies with the biggest gains were HDFC Bank, Axis Bank, Kotak Mahindra Bank, Adani Ports, and Tata Consumer Products.

⇒ Titan Company, Tata Motors, Reliance Industries, TCS, and Hindalco Industries were the biggest losers.

⇒ Sector Performance: The media sector underperformed, while gains of 1% to 2% were recorded in the power, capital goods, banking, and metals sectors.

⇒ The midcap and smallcap indexes experienced a nearly 1% increase.

_1720016147.png)

Conclusion

The successful subscription of Emcure Pharmaceuticals' IPO on its first day, coupled with Namita Thapar's impressive return on investment, highlights the strong market confidence in the company. As the IPO remains open for subscription until July 5, it continues to attract substantial interest from investors. The overall positive market performance further underscores the bullish sentiment in the current economic landscape.

Inputs from Multiple Agencies

Media from multiple sources

Ⓒ Copyright 2024. All Rights Reserved Powered by Vygr Media.