Apple’s pursuit of a more resilient and diversified global supply chain has reached a new milestone, with reports suggesting the tech giant is in discussions to onboard Bharat Forge, a flagship company of the Kalyani Group, as one of its suppliers in India. Should these talks materialise into a formal partnership, Bharat Forge would join an elite group of Indian companies, including the Tata Group, Motherson Group, and Aequs, that are contributing to Apple’s manufacturing ecosystem. This move is emblematic of Apple’s strategic endeavour to bolster local value addition in India while reducing its dependence on China. Since the introduction of India’s Production Linked Incentive (PLI) scheme in 2020, Apple has significantly expanded its supplier network in the country. Over this period, the company has achieved an impressive increase in local value addition, rising from an initial 5-8% to approximately 20% by 2024 across various iPhone models.

The potential collaboration with Bharat Forge, a prominent player in industries ranging from automotive and aerospace to defence and energy, underscores the growing role of Indian manufacturers in the global supply chains of high-technology products. Apple’s decision to engage with Bharat Forge is also indicative of its broader ambition to tap into the capabilities of India’s industrial sector, which has demonstrated resilience, scalability, and innovation in recent years. Furthermore, Apple’s supplier ecosystem in India already includes significant contributions from both domestic and international players. Notable suppliers such as Foxconn, Tata Group, Sunwoda, and Aequs are integral to the production of iPhones and their components. With Bharat Forge’s inclusion, the collaboration could set a precedent for other Indian manufacturers to align with global technology giants, thereby accelerating India’s journey towards becoming a manufacturing hub of international repute.

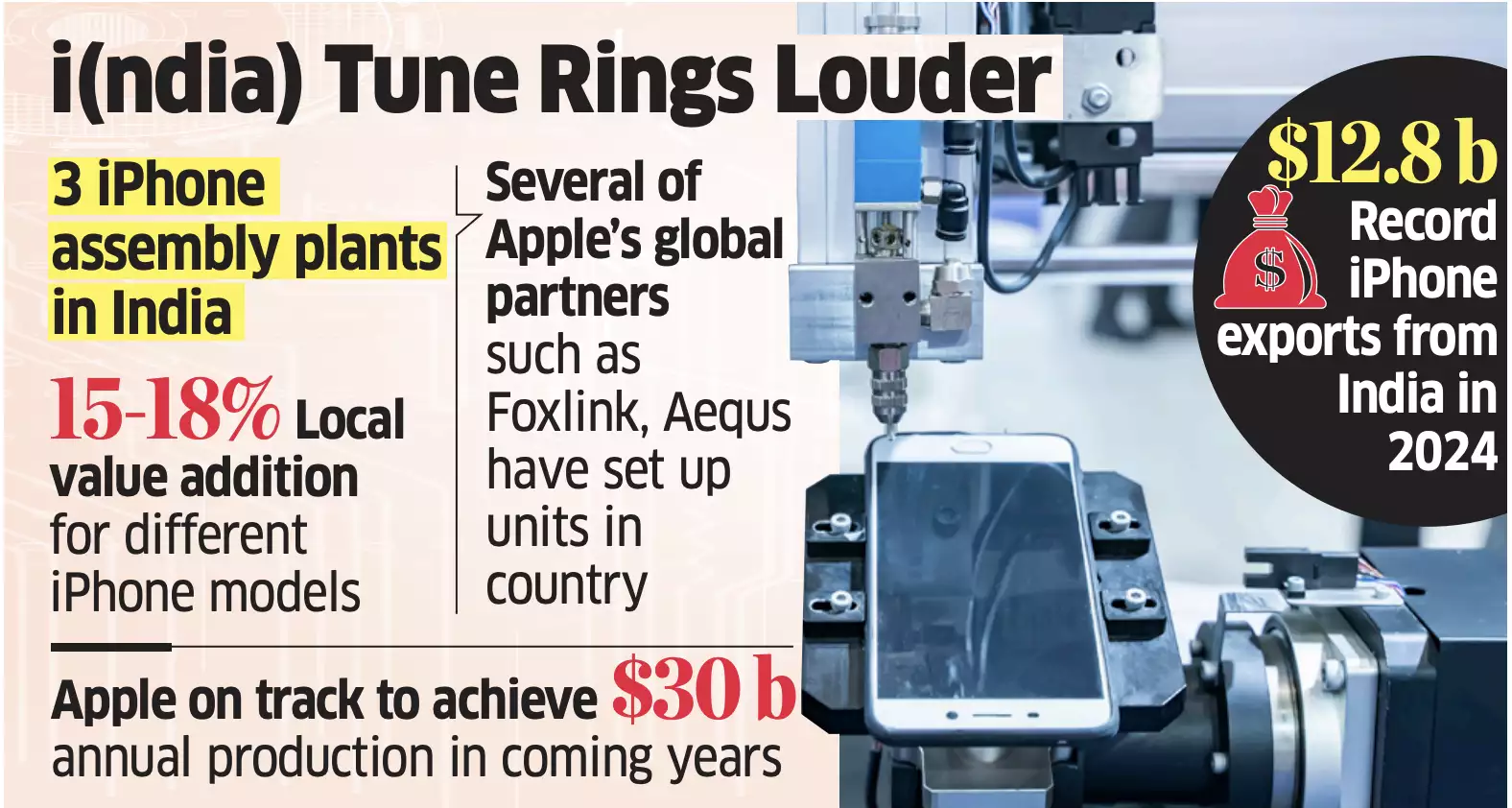

As Apple continues to achieve remarkable milestones, including the production of $17.5 billion worth of iPhones and record exports valued at $12.8 billion in 2024, its growing reliance on Indian suppliers reflects the country’s strategic importance in the global tech manufacturing landscape. This development not only underscores India’s rising stature in the world of advanced manufacturing but also aligns with the government’s vision of fostering local production capabilities to enhance economic growth and technological advancement.

China’s Resistance to India’s Apple Manufacturing Surge: An Overview

India’s strides in electronics manufacturing, particularly through the “Make in India” initiative, have drawn international attention. However, these advances appear to have alarmed China, which has reportedly begun adopting measures to impede India’s progress in this domain. Among the key achievements of India’s manufacturing sector is its burgeoning Apple production, a standout feature of the country’s push towards self-reliance in high-tech industries.

China’s Strategy to Stall India’s Growth

India’s reliance on China for intermediate goods, such as high-tech machinery essential for manufacturing electronics, has created a vulnerability that Beijing now seems to be exploiting. Industry sources reveal that China has significantly curtailed the supply of critical capital equipment to Indian manufacturers. This move impacts not only the electronics sector but also industries like solar panels and electric vehicles (EVs), where Chinese dominance in the supply of machinery is pronounced. China’s actions are seen as an attempt to stifle the expansion plans of major global players such as Apple supplier Foxconn, EV manufacturer BYD, and laptop giant Lenovo, all of which have been bolstering their presence in India. Delays in the transfer of machinery and rising costs for manufacturers are threatening to derail India’s progress in developing a robust domestic manufacturing ecosystem.

The “China Plus One” Conundrum

The “China Plus One” strategy, where Western manufacturers diversify their supply chains to reduce reliance on China, has been a cornerstone of India’s manufacturing growth. The Indian government’s Production Linked Incentive (PLI) scheme has been pivotal in attracting global manufacturers, including Apple and its suppliers, to set up operations in India. However, Beijing’s restrictive policies on equipment exports and the recall of Chinese workers from Indian factories have created hurdles for companies like Foxconn. Reports suggest that Foxconn’s Chinese staff were recently instructed to cancel travel to India, and those already stationed in Indian factories have been asked to return to China. To mitigate these disruptions, Foxconn has begun deploying Taiwanese employees to fill the gap left by its mainland Chinese workforce.

India’s Apple Success Story

Apple’s expansion in India is a significant triumph for the “Make in India” initiative. Foxconn’s facilities in Tamil Nadu and Karnataka have not only scaled up production of older iPhone models but are now poised to manufacture newer ones. In 2024, Apple achieved record-breaking iPhone exports worth $12.8 billion, representing a 42% year-on-year growth. Local production surged to $17.5 billion, marking a 46% increase compared to the previous year. The company’s success is underpinned by an increase in local value addition, which has risen from 5-8% in 2020 to approximately 15-20% in 2024. With continued growth, Apple is expected to achieve $30 billion in annual production in the coming years, potentially increasing India’s share in the global iPhone production ecosystem to over 26%.

Challenges and Opportunities for India

While India’s Apple manufacturing success has rattled China, challenges remain. The country’s reliance on Chinese machinery highlights the need for a stronger domestic ecosystem for high-tech manufacturing. The Indian government has introduced a $3 billion component incentive scheme to support this transition, with potential subsidies for capital equipment to offset the impact of China’s restrictions. Simultaneously, India has pressured Chinese companies operating locally to comply with stringent regulations. Measures such as requiring Indian nationals on company boards and enforcing residency rules for directors are part of a broader strategy to “Indianise” foreign businesses.

The Road Ahead

India’s journey towards self-reliance in high-tech manufacturing will take time, but the current momentum suggests significant progress is achievable. While China’s actions may create short-term obstacles, they are unlikely to halt India’s manufacturing ambitions. Experts argue that India’s success with Apple production could pave the way for investments in critical sectors like semiconductors, further reducing its dependence on Chinese imports. The geopolitical backdrop adds complexity to this rivalry. As the US-China trade war intensifies and companies look to de-risk from China, India stands to benefit. However, the Indian government must remain vigilant and proactive, leveraging international partnerships and policy support to sustain its manufacturing growth and counteract China’s protectionist measures.

China’s attempts to slow India’s manufacturing ascent highlight the growing importance of India in global supply chains. Despite the challenges, India’s Apple success story serves as a testament to its potential as a manufacturing powerhouse. With strategic planning and continued government support, India can not only overcome its current dependencies but also emerge as a global leader in high-tech manufacturing.

With inputs from agencies

Image Source: Multiple agencies

© Copyright 2024. All Rights Reserved Powered by Vygr Media.