-

Aditya Birla Capital plans to integrate Aditya Birla Finance Ltd. to avoid RBI's public listing requirement.

-

Aditya Birla Finance, a wholly-owned subsidiary, is among 15 upper-layer non-bank lenders mandated to go public by September 2025.

-

The merger aims to streamline organizational structure, enhance business collaboration, reduce regulatory complexity, and transform Aditya Birla Capital into a robust operating non-banking financial company.

Aditya Birla Capital recently announced its decision to integrate Aditya Birla Finance Ltd. into its operations, a move aimed at helping its unlisted subsidiary avoid the Reserve Bank of India's (RBI) requirement for public listing.

Background of the Merger

Aditya Birla Finance, a wholly-owned subsidiary, is among the 15 upper-layer non-bank lenders mandated by the RBI to go public by September 2025. However, as Aditya Birla Capital is already listed, merging with its listed parent company exempts the subsidiary from separate listing requirements. The planned merger is intended to streamline organizational structure, enhance business and operational collaboration, reduce regulatory complexity, and transform Aditya Birla Capital from a holding company into a robust operating non-banking financial company (NBFC).

Current Status and Future Steps

Aditya Birla Capital has revealed that the merger is pending regulatory and other necessary approvals. Following the transaction, Aditya Birla Finance will be wound up but its assets will be appropriately divided.

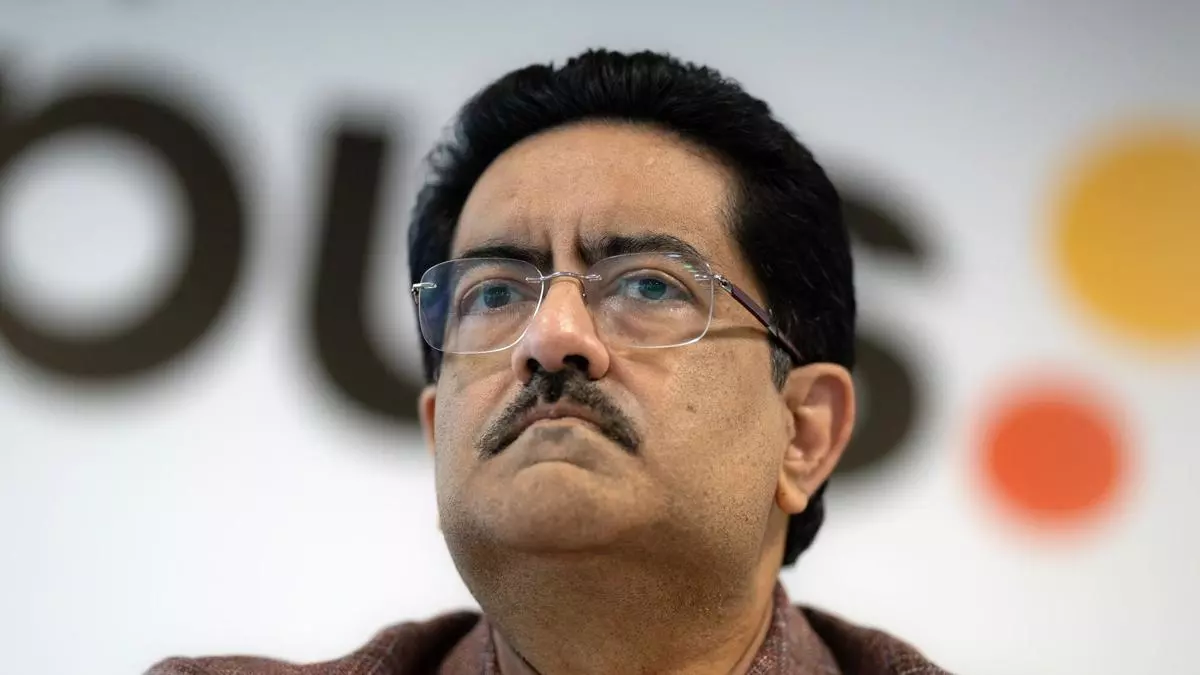

Kumar Mangalam Birla, chairman of the Aditya Birla Group, said in a statement that “the proposed amalgamation will create a strong capital base for Aditya Birla Capital to grow its business and participate in India’s growth story, successfully fulfilling its commitment to empowering the financial aspirations of millions of Indians.”

Strategic Implications

The decision to merge Aditya Birla Capital and Aditya Birla Finance stems from strategic considerations aimed at maximizing company resources, improving operational efficiency, and fostering synergies. Consolidating financial services under a single entity enables the group to offer customers comprehensive solutions, streamline processes, eliminate redundancies, and leverage collective expertise.

According to Birla, the financial services industry is the foundation of India’s economic success. “Our financial services division has strategically grown to become a vital source of growth for the Aditya Birla Group,” he claimed.

Market Response and Investor Outlook

The announcement of the merger has generated significant interest in the market, with investors closely monitoring developments. The consolidation of two key businesses within the Aditya Birla Group is expected to enhance competitiveness, boost financial performance, and strengthen market positioning. Investors perceive this move as a positive indication of the company's commitment to growth and innovation.

Potential Stakeholder Benefits

Stakeholders stand to gain in various ways from this integration. Customers can anticipate a broader range of tailored financial products and services. Employees may benefit from opportunities for skill development and career advancement within a larger, more integrated organization. Shareholders could see increased value creation resulting from efficiencies realized post-merger.

Image Source: Multiple agencies

© Copyright 2024. All Rights Reserved Powered by Vygr Media.