India’s bold military response under Operation Sindoor, following the Pahalgam terror attack that claimed 26 civilian lives, triggered immediate reactions across financial markets—both domestically and abroad. From fluctuations in currency to tremors in equity indices, the ripple effect of escalating geopolitical tensions was swift. However, historical data and market sentiment suggest that short-term volatility may not necessarily translate into long-term instability.

Operation Sindoor: India’s Decisive Military Response

On Wednesday, May 7, the Indian Armed Forces executed precision missile strikes on nine terrorist targets across Pakistan and Pakistan-Occupied Kashmir (PoK). This high-impact operation targeted key terror strongholds including:

-

Jaish-e-Mohammad’s base in Bahawalpur

-

Lashkar-e-Taiba’s camp in Muridke

A statement issued at 1:44 am by the Ministry of Defence emphasized that these were measured, non-escalatory response to the April 22 Pahalgam terror attack, targeting only terrorist infrastructure—not Pakistani military assets—reflecting strategic restraint while affirming India's zero-tolerance stance on terrorism. Indian officials clarified that no Pakistani military assets were targeted during the operation, underscoring the country’s intent to avoid full-scale escalation.

Immediate Financial Market Reaction: Rupee Slides, Oil Rises, and Domestic Indices Stay Steady

Rupee Declines Sharply

Following the early morning strikes, the Indian rupee depreciated by 31 paise, hitting 84.66 against the US dollar in early trade. At the interbank foreign exchange, the rupee opened at 84.65 before slipping further.

-

On the previous day (Tuesday), the rupee had already shown signs of weakness, settling 5 paise lower at 84.35.

-

Forex experts attributed the dip to investor nervousness, speculative dollar buying, and potential exits by foreign investors.

“There could be some dollar buying by speculators and panicky importers, but we think the Reserve Bank of India (RBI) will be present to stop any major slide of the rupee,” said Anil Kumar Bhansali, Head of Treasury at Finrex Treasury Advisors LLP.

He added that while Foreign Institutional Investors (FIIs) might sell off some equities, most would likely wait for clarity on whether the conflict would escalate further.

Dollar and Oil Prices

-

The US Dollar Index, which measures the greenback against six major currencies, climbed 0.30% to 99.53.

-

Brent crude, the global oil benchmark, rose by 0.68% to USD 62.57 per barrel, reflecting concerns over regional stability.

Diverging Equity Market Reactions: Calm in India, Panic in Pakistan

Indian Markets Show Resilience

Despite elevated tensions, Indian stock markets remained relatively stable:

-

Sensex declined by 107.74 points (0.13%) to 80,533.33

-

Nifty fell 24.35 points (0.10%) to 24,355.25

Defence sector stocks surged:

-

HAL, BDL, and BEL saw gains of over 1%, as investors bet on increased defence procurement and strategic clarity post-Operation Sindoor.

However, some early-week anxiety was visible:

-

The Nifty had dropped nearly 100 points on Tuesday amid disappointing earnings and market jitters.

-

Public Sector Unit (PSU) banks, particularly Bank of Baroda, were in focus after posting results that contributed to a ₹60,000 crore erosion in market capitalization.

Despite the subdued domestic reaction, FIIs remained net buyers, pumping in Rs 3,794.52 crore on Tuesday, according to exchange data.

Pakistani Markets Plunge

In stark contrast, Pakistani stock markets experienced a sharp decline.

Across the border, the Karachi Stock Exchange bore the brunt of panic:

-

The SE100 index plunged by 5% immediately following news of the Indian strikes.

-

Investors in Pakistan responded with widespread selling, fearing military escalation and economic instability.

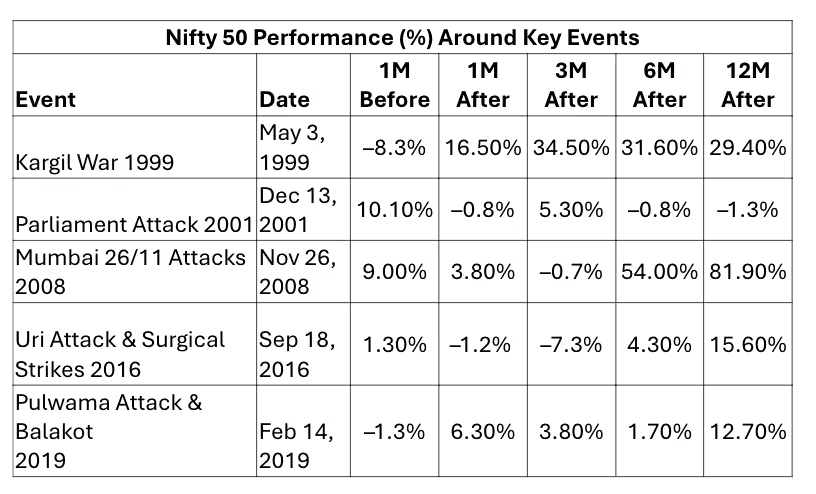

Will the Indian Market Fall? History Suggests Otherwise

Analysts and investors are evaluating the long-term implications of Operation Sindoor on India’s economy. Historical data paints a picture of resilience and quick recovery following similar India-Pakistan confrontations.

Past Military Events & Nifty Performance:

|

Event |

1-Month Return |

12-Month Return |

|---|---|---|

|

Kargil War (1999) |

+16.5% (1 month) |

+29.4% |

|

26/11 Mumbai Attacks (2008) |

+54% (6 months) |

+81.9% |

|

Uri Surgical Strikes (2016) |

-1.2% (1 month) |

+15.6% |

|

Balakot Airstrike (2019) |

+6.3% (1 month) |

+12.7% |

|

Parliament Attack (2001) |

Negative returns |

Continued drop |

The only significant deviation from this trend occurred after the 2001 Parliament attack, which led to an extended military standoff and corresponding investor anxiety.

According to Finavenue, even in high-tension scenarios, markets usually rebound strongly once the initial shock fades.

“Historical data suggests that the Indian stock market has generally responded with resilience to serious geopolitical events,” said Abhishek Jaiswal, Fund Manager at Finavenue.

He added:

“The likelihood of a full-scale war remains low. As long as such escalation is avoided, India’s economic growth trajectory is unlikely to face any major setbacks.”

Investor Sentiment: Cautious Optimism Amid Rising Tensions

Analysts agree that while initial market reactions are often cautious, strategic decisiveness by the government tends to reassure investors over time.

Key Insights:

-

FII Activity: On Tuesday, FIIs were net buyers of Indian equities worth ₹3,794.52 crore, showing continued confidence.

-

PSU Bank Pressure: Broader markets were already under some strain due to disappointing quarterly results, especially from Bank of Baroda, which led to a ₹60,000 crore loss in market capitalization.

-

Market Volatility: Traders expect the RBI to play an active role in managing forex volatility and preventing runaway losses.

Operation Sindoor Sends a Strong Message, But Markets Stay Rational

Operation Sindoor underscores India’s strategic decisiveness and resolve in countering cross-border terrorism. While the market has responded with initial caution, the broader economic narrative remains intact. India’s stock market, rupee, and investor sentiment have historically demonstrated the ability to absorb such shocks—and often emerge stronger.

As long as diplomatic restraint and clear communication continue alongside national security assurance, India’s economic engine is unlikely to stall. Investors, policymakers, and market watchers now await the next steps in this unfolding geopolitical chapter, with cautious optimism and historical insight.

With inputs from agencies

Image Source: Multiple agencies

© Copyright 2025. All Rights Reserved Powered by Vygr Media.