The Reserve Bank of India (RBI) has decided to keep its key lending rate, the repo rate, steady at 5.5% in its latest policy announcement in August 2025. Along with this, it maintained a neutral policy stance and confirmed its GDP growth forecast for the current fiscal year at 6.5% despite ongoing economic uncertainties and global trade issues, including tariff threats from the United States.

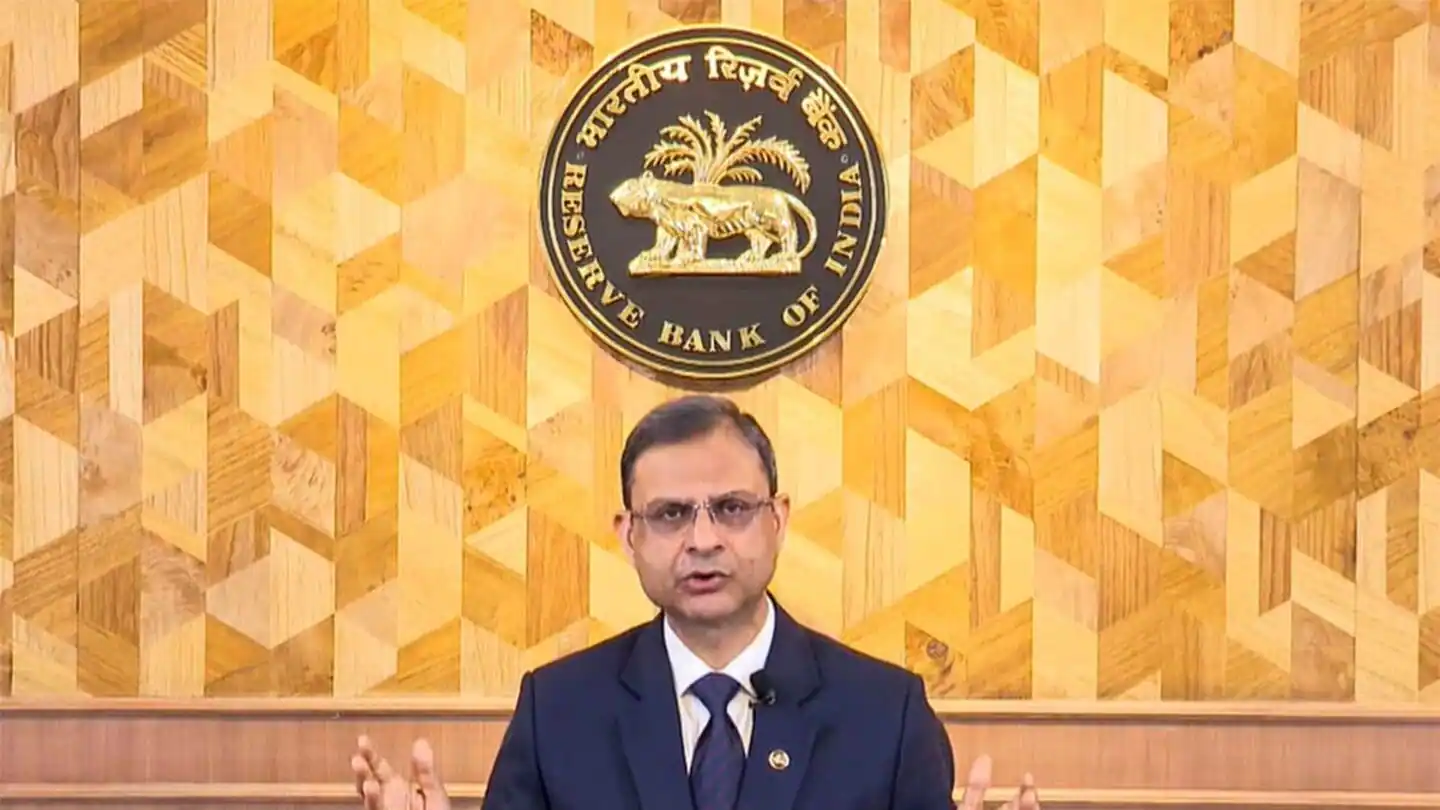

The decision to hold the repo rate stable comes after three consecutive rate cuts earlier this year that collectively brought the rate down by 100 basis points from February. The RBI Governor, Sanjay Malhotra, emphasized that this pause in rate changes allows the central bank to closely monitor the ongoing impact of earlier rate cuts and inflation trends before taking further steps. The neutral stance signals that future policy moves will depend on evolving inflation and growth data.

The projected GDP growth of 6.5% reflects confidence in India's economic resilience. This growth outlook comes as a rebuttal to concerns raised by some external critics, including jibes about India’s economic prospects in the context of US tariffs on Indian goods. The RBI believes that despite these global headwinds, India’s economy is supported by robust rural demand, strong government capital spending, and improving investment sentiment. Quarterly GDP projections for 2025-26 stand at around 6.5% for Q1, increasing slightly to 6.7% in Q2, 6.6% in Q3, and 6.3% in Q4.

Inflation data also plays a crucial role in the RBI’s decision. Headline inflation fell to a historic low of 2.1% in June, mainly due to decreasing food prices like vegetables and pulses, though the central bank expects inflation to rise moderately toward the end of the fiscal year. Core inflation has remained steady around 4%, and the RBI revised its inflation forecast for FY26 downward to about 3.1%, indicating price stability amid global trade tensions.

Experts view this policy as cautious but pragmatic. By keeping the rate unchanged, borrowers can expect stable loan repayments, which is positive for consumers and businesses alike. It also provides the banking system time to fully transmit earlier rate cuts to the economy, supporting sectors like housing and real estate, especially affordable segments.

At the same time, the RBI continues to watch global developments carefully, as ongoing geopolitical tensions, trade tariff disputes, and volatile capital flows could present risks to growth. The central bank has also planned to implement a phased cut in the cash reserve ratio (CRR) from September to enhance liquidity and encourage credit growth.

In summary, the RBI’s current stance balances optimism about India’s economic potential with caution about external risks. Maintaining the repo rate at 5.5% while projecting steady GDP growth of 6.5% demonstrates the central bank’s commitment to nurturing domestic economic growth amid a complex global environment, avoiding abrupt moves that might unsettle the economy while keeping an eye on inflation and financial stability. This approach reflects careful management aimed at sustaining growth momentum without compromising price stability.

This measured policy response also implies that the RBI is navigating between supporting the economy’s expansion and remaining prepared for global uncertainties—none of which have yet forced it to reconsider the growth outlook, reflecting an underlying confidence in India’s economic fundamentals.

With inputs from agencies

Image Source: Multiple agencies

© Copyright 2025. All Rights Reserved. Powered by Vygr Media.