In a much-anticipated move aimed at cushioning India’s economy against global headwinds, the Reserve Bank of India’s (RBI) Monetary Policy Committee (MPC) announced a 25 basis point (bps) cut in the repo rate, bringing it down from 6.25% to 6%. This marks the second successive rate cut of 2025 and reflects a clear shift in the central bank’s monetary stance—from neutral to accommodative.

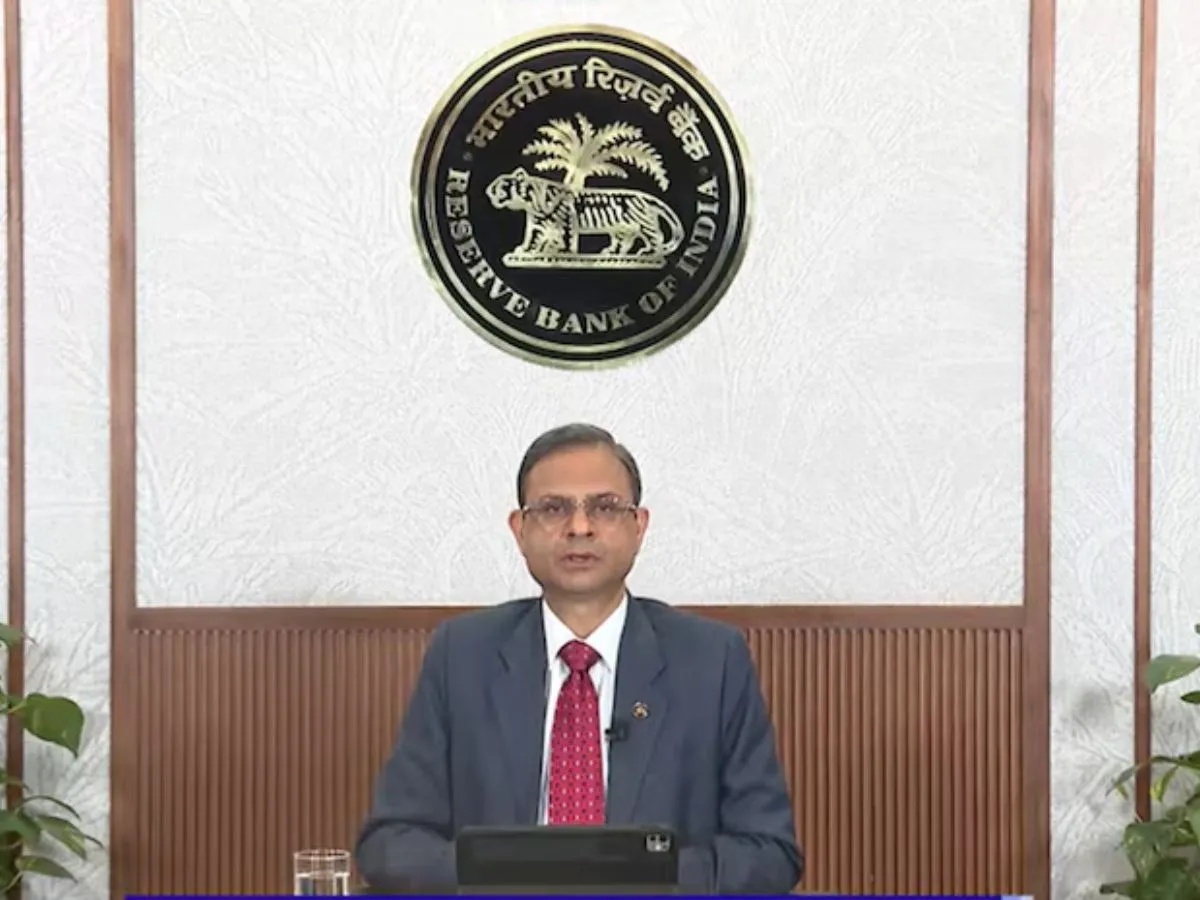

The decision was announced by RBI Governor Sanjay Malhotra following the three-day MPC meeting held from April 7–9, 2025. This comes in the backdrop of softening inflation, slowing domestic growth, and escalating global trade tensions, particularly due to aggressive tariff measures by the US and China.

Key Takeaways from RBI’s April 2025 MPC Meeting

-

Repo Rate: Cut by 25 bps to 6%

-

Policy Stance: Shifted from neutral to accommodative

-

Next MPC Meetings: Scheduled for June, August, October, December, and February

-

Standing Deposit Facility (SDF): Adjusted to 5.75%

-

Marginal Standing Facility (MSF) & Bank Rate: 6.25%

-

CPI Inflation Forecast for FY26: Revised to 4% (from 4.2%)

-

Real GDP Growth Forecast for FY26: Lowered to 6.5% (from 6.7%)

-

Liquidity: Surplus of over ₹1.5 lakh crore in April after tapering deficits earlier in the year

Why the Rate Cut Matters: EMIs, Fixed Deposits & Lending Rates

For borrowers, especially those servicing home, auto, or personal loans, the rate cut could bring relief through lower EMIs. However, this will depend on whether banks pass on the benefits of the repo rate cut.

“If banks do pass on the benefits of the last two rates cuts, it will be a boost to homebuyers, particularly for those eyeing affordable housing,” said Anuj Puri, Chairman of ANAROCK Group.

Despite the RBI’s dovish pivot, banks have been slow to reduce lending rates due to elevated funding costs and rising non-performing assets. Fixed deposit investors, meanwhile, may need to act fast, as FD rates are likely to decline in the wake of the easing cycle.

Impact on Borrowers and Investors

For Loan Borrowers:

-

EMIs on personal, home, and auto loans may come down—if banks transmit the rate cut.

-

However, lenders remain cautious due to:

-

High funding costs

-

Thin margins

-

Rising bad loans

-

Anuj Puri of ANAROCK Group noted, “If banks pass on the benefits, it would especially help affordable housing buyers. But borrowers should be realistic—relief may be partial and slow.”

For Fixed Deposit Investors:

-

Interest rates on FDs are likely to drop further.

-

Experts advise locking in high rates now or exploring alternative investment options.

Agricultural Outlook: Wheat Boost Eases Food Price Pressures

The second advance estimates show record wheat production and higher yields in key pulses. This improvement is expected to anchor food inflation and support the RBI’s positive inflation trajectory.

Global Headwinds: Tariffs and Trade Frictions Fuel Market Anxiety

The RBI flagged serious concerns about the intensifying global tariff war. US President Donald Trump's announcement of a 104% tariff on Chinese imports and a 26% reciprocal tariff on Indian goods—effective April 9—has shaken global markets. These measures are expected to:

-

Hurt net exports.

-

Add to uncertainty, dampening business and consumer confidence.

-

Slow down commodity and crude oil prices, potentially lowering import bills but also pointing to weak global demand.

RBI Governor Sanjay Malhotra warned:

“Higher tariffs shall have a negative impact on net exports. There are several known and unknown implications… FY26 has begun on an anxious note for the global economy.”

Governor Malhotra remarked, “FY26 has begun on an anxious note,” but assured that India’s growth path, though vulnerable, is still on track.

Trade frictions, especially involving large economies like the U.S. and China, are expected to dampen global demand and commodity prices, thereby impacting India’s export performance and overall growth trajectory.

Revised Economic Outlook: Slower Growth, Softer Inflation

GDP Projections for FY26:

Overall FY26 GDP Growth Estimate: 6.5%

|

Quarter |

Previous |

Revised |

|---|---|---|

|

Q1 |

6.7% |

6.5% |

|

Q2 |

7.0% |

6.7% |

|

Q3 |

6.5% |

6.6% |

|

Q4 |

6.5% |

6.3% |

|

Full FY |

6.7% |

6.5% |

CPI Inflation Projections for FY26:

Overall FY26 Inflation Estimate: 4%

|

Quarter |

Previous |

Revised |

|---|---|---|

|

Q1 |

4.5% |

3.6% |

|

Q2 |

4.0% |

3.9% |

|

Q3 |

3.8% |

3.8% |

|

Q4 |

4.2% |

4.4% |

|

Full FY |

4.2% |

4.0% |

RBI projects a "decisively positive" food inflation outlook, driven by improved Rabi crop estimates, including record wheat production and increased pulses output, which are expected to lower food prices sustainably.

Economic Rationale: Balancing Growth and Stability

Governor Malhotra emphasized that the MPC's decision was based on a “detailed assessment of evolving macroeconomic and financial conditions.” He pointed to several positive trends such as:

-

Revival in Manufacturing: Green shoots emerging in production.

-

Improved Urban Consumption: Aided by discretionary spending.

-

Resilient Investment Sentiment: Business expectations remain optimistic.

However, these positives were balanced by considerable risks, especially from the international front.

Additional Policy Measures and Structural Announcements

Alongside monetary easing, Governor Malhotra announced six significant regulatory and developmental initiatives:

-

Securitisation of Stressed Assets: Market-based mechanism beyond the ARC model under SARFAESI Act.

-

Expanded Co-Lending Framework: Applicable to all regulated entities and loan types.

-

Revised Gold Loan Guidelines: To be updated.

-

Partial Credit Enhancement: To be updated.

-

NPCI Autonomy in UPI Limits: NPCI empowered to revise limits for person-to-merchant UPI transactions beyond the current ₹2 lakh cap.

-

Neutral, On-Tap Regulatory Sandbox: For broader innovation testing across sectors.

Financial Markets React: Caution Dominates

Despite the widely expected rate cut, markets opened weak on April 9:

-

Nifty 50: Dropped below the 22,400 mark

-

Sensex: Fell over 400 points at open

-

Sectors Worst Hit: IT, pharma, and metals due to global exposure

-

Nifty FMCG: Only sectoral index in the green

Investor sentiment was further dented by the growing unpredictability in global markets, particularly around the US-China tariff conflict.

Expert Reactions: Encouraging, But More Easing May Be Needed

-

Umeshkumar Mehta, CIO, SAMCO Mutual Fund:

“An accommodative stance ensures buoyant credit growth. However, global pressures—especially from US bond yields—may limit benefits.”

-

Upasna Bhardwaj, Chief Economist, Kotak Mahindra Bank:

“We expect additional cuts of 75–100 bps this year depending on global developments.”

-

Radhika Rao, Executive Director, DBS Bank:

“The dovish tone and liquidity support reflect comfort with inflation and provide room for growth-supportive policies.”

Accommodative, but Cautious

The RBI’s latest policy decision reflects a delicate balancing act—stimulating growth while staying alert to both global shocks and domestic imbalances. While the dovish stance and rate cuts signal a pro-growth orientation, further actions will likely depend on how the tariff war, inflation trends, and banking sector transmission play out.

As the world grapples with economic fragmentation, the RBI appears poised to act with agility—ready to cut deeper if needed, but equally focused on maintaining macroeconomic stability.

With inputs from agencies

Image Source: Multiple agencies

© Copyright 2025. All Rights Reserved Powered by Vygr Media.