Bajaj Housing Finance Ltd. Sparkled on its first day as an Indian stock market entrant as shares rose as much as 136%. The home-loan unit of India's largest shadow lender was priced at the initial public offering at 70 rupees and rose to 165 rupees, the biggest IPO debut this year, and one of the strongest first-day gains for an offering that raised more than $500 million.

An IPO for the Record Books

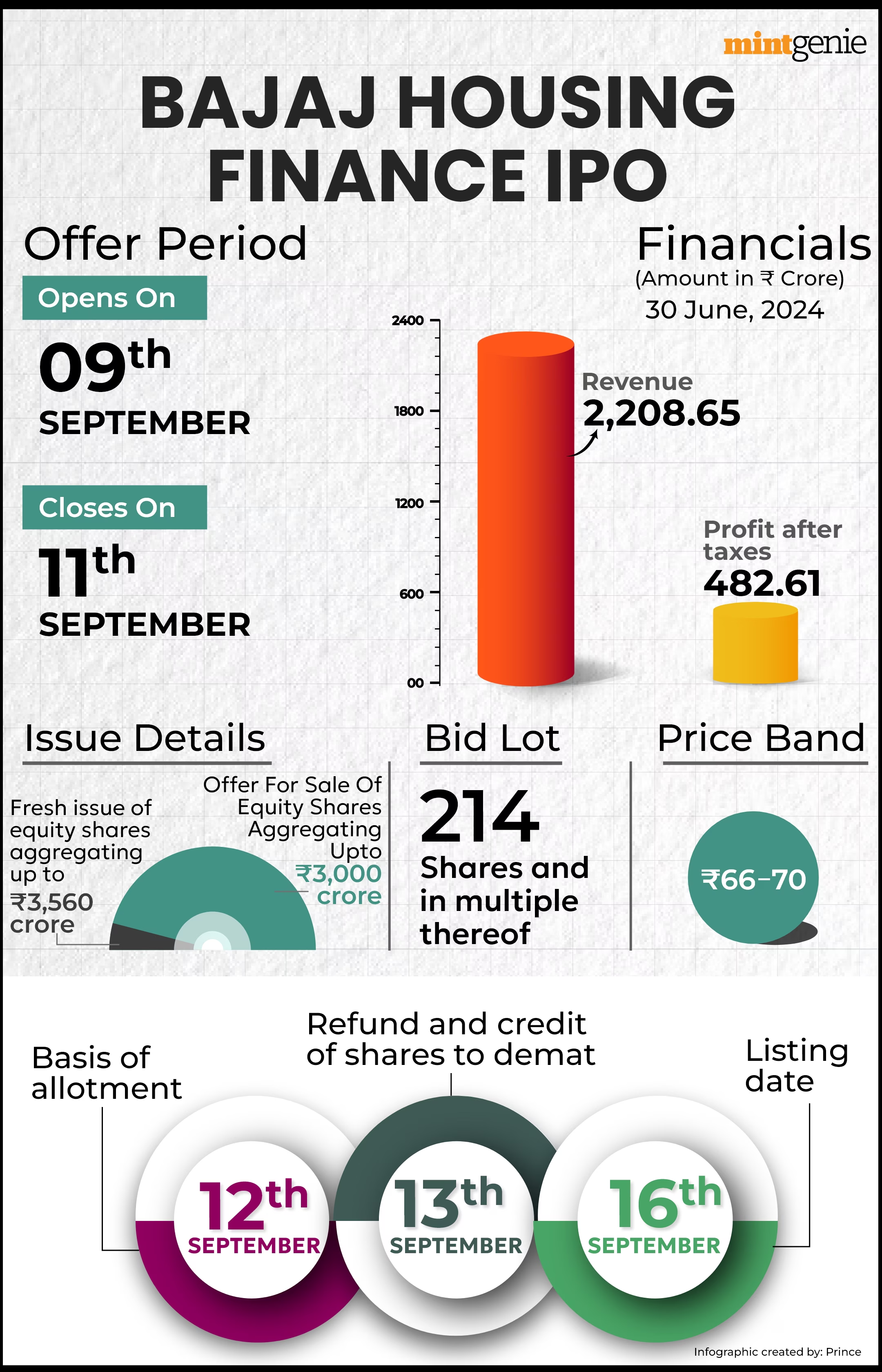

Bajaj Housing Finance raised its IPO and garnered a whopping $781 million (65.6 billion rupees) from the issue, aside from witnessing an unprecedented demand for the issue. Bids were coming in excess of $39 billion. Add to that the fact that the surge in demand has mainly been driven by retail investors, who have been actively on the lookout for IPO investments given soaring valuations in other parts of the market. This segment has some valuation comfort versus other parts of the market that remain overheated," said Pranav Bhavsar, co-founder of Trudence Capital Advisors Pvt. "Domestic investors are looking for IPO investments; the market is flushed with liquidity." India's booming IPO market has fueled the rush to invest in new listings, with companies raising $8.6 billion so far this year, surpassing the amount raised by them in each of the past two years.

Strong Brand and Market Performance

The success of the IPO of Bajaj Housing Finance is closely associated with the strong credibility of its parent company, Bajaj Finance, as the latter has delivered fantastic returns to investors. Bajaj Finance forms part of one of India's oldest conglomerates and operates on a strong platform in all kinds of financial service segments, which include asset management. Its shares have given an average annual return of 40% during the last decade, hence doubling more than the NSE Nifty 50 Index's performance. This might have provided the company with low-cost funds since its parent has strong support; hence, Bajaj Housing Finance enjoys a competitive advantage in terms of funding. Sharekhan, a brokerage firm, said Bajaj Housing has now been performing well for five successive years with a compounded annual growth rate of about 29% and a good growth prospect.

Bajaj Housing Finance is one in a stream of successful IPOs in India this year. Ola Electric Mobility Ltd., which had raised more than $730 million, and Brainbees Solutions Ltd., a baby-products retailer, had raised around $500 million. Shares in both companies trade over 35% above their issue prices, mirroring the bullish trend seen in Bajaj Housing's debut.

More Major IPOs on the Horizon

The IPO market in India has been hot and likely will stay that way till year-end with a few major listings in the pipeline. Hyundai Motor Co, for instance, is said to seek to raise up to $3.5 billion from the listing of its Indian unit in the coming months. Likewise, LG Electronics Inc of South Korea has reportedly started preparing for an IPO of its Indian business, which could raise as much as $1.5 billion. As the year continues, investors keep a close eye on large listings; the strength in issues like Bajaj Housing Finance signals healthy demand in India's IPO market.

Inputs by Agencies

Image Source: Multiple Agencies

Ⓒ Copyright 2024. All Rights Reserved Powered by Vygr Media.