IAN Alpha Fund, a venture capital pool with a strong corpus of Rs 1,000 crore (approximately $119 million), recently completed its first financial close, successfully securing Rs 355 crore in investments. As the second fund in the IAN Group's series, the initial closure slightly surpassed the target corpus set for IAN Fund I. Notable contributors to the Alpha Fund include SIDBI (Small Industries Development Bank of India), SRI Fund, and investors associated with IAN Fund I.

This fund, which operates under the regulatory supervision of SEBI as an AIF Category II entity, is strategically positioned to support investments in a wide range of sectors. The main focus is on clean tech, health tech/bio, fintech, deep tech, space tech, agri-tech, cybersecurity, hardware, and other emerging areas. The goal of IAN Alpha Fund is to use its resources to foster the growth of more than 500 startups, with the ambitious objective of creating 5,000,000 jobs by 2030. The overall mission also includes nurturing ecosystems and promoting significant economic growth, as stated in a comprehensive press release by IAN.

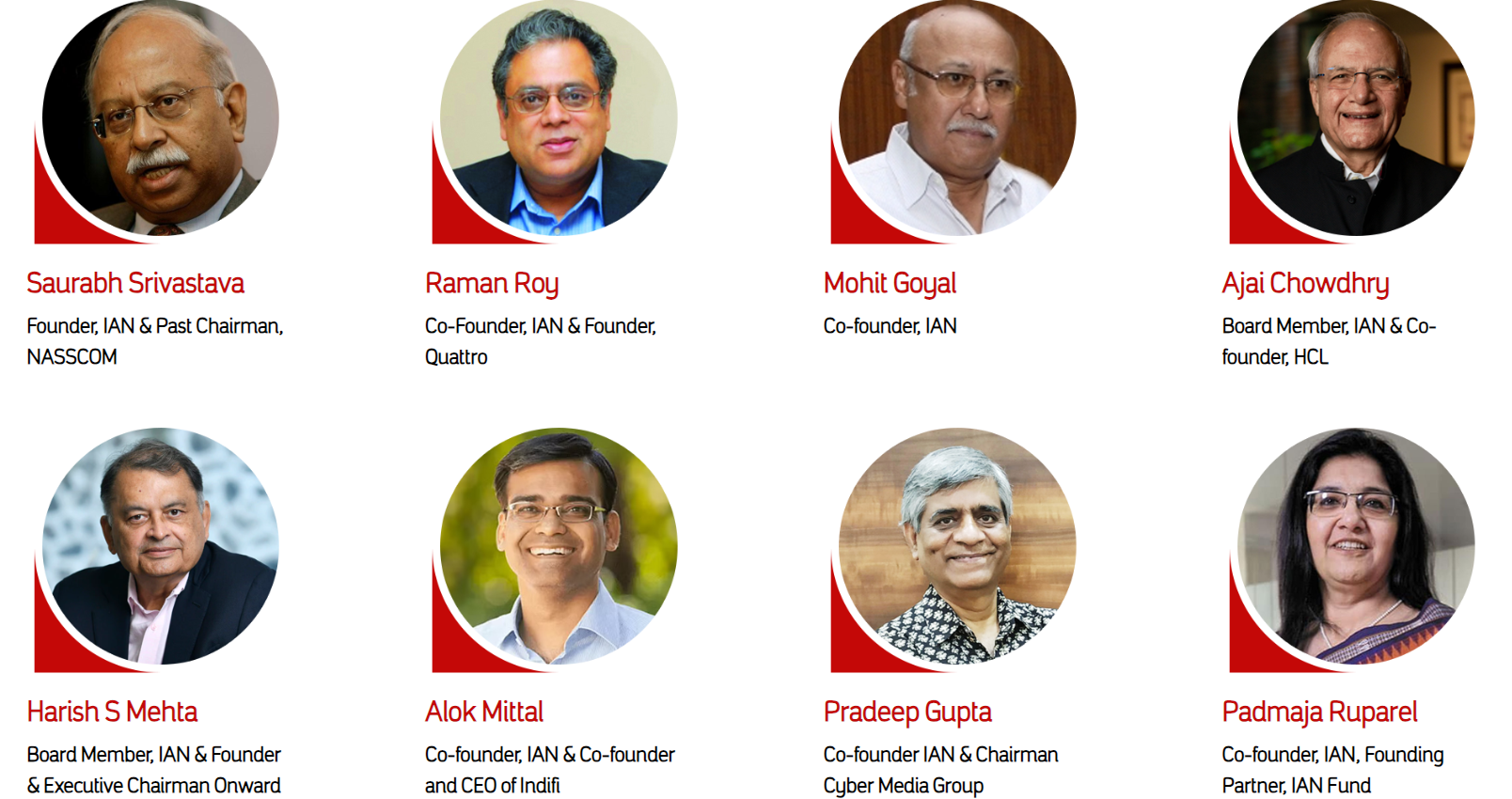

IAN BOARD PC: IAN WEBSITE

The Alpha Fund is pleased to announce its achievements, having already invested a significant amount of Rs 900 crore in over 250 startups. Currently, the fund is valued at over $9 billion (roughly Rs 75,000 crore). As part of the broader IAN Group, which includes the IAN Angel Group, BioAngels, and IAN Fund I, the platform serves as a catalyst for seed and early-stage investments. Entrepreneurs from 19 sectors in India and 7 other countries have successfully raised capital ranging from Rs 50 lakhs to Rs 50 crore through our platform. The investors associated with IAN not only provide crucial financial support but also offer mentorship and global market access to the innovative startups they work with.

In summary, IAN Alpha Fund emerges as an influential player in the venture capital landscape, with the potential to guide the growth trajectory of numerous startups, while making a substantial contribution to job creation and economic vitality by 2030.

Ⓒ Copyright 2023. All Rights Reserved Powered by Vygr Media.